A Tarrant Texas Consulting Agreement — Assist Company Obtain Loan is a legally binding contract between a consulting firm or professional and a company in Tarrant, Texas, aiming to help the company secure a loan. This agreement outlines the terms and conditions of the consulting services provided by the consultant to assist the company in obtaining the desired loan. The consultant's primary objective is to lend their expertise and industry knowledge to guide the company through the loan acquisition process. They act as advisors, strategists, and facilitators, navigating the complexities of borrowing funds to meet the company's financial needs. By collaborating closely with the company, the consultant develops a tailored plan to maximize the chances of loan approval. In this consulting agreement, various key aspects are typically covered, including but not limited to: 1. Scope of Services: This section clearly defines the specific consulting services the consultant will offer to assist the company in obtaining a loan. It may involve conducting a financial analysis, identifying suitable lenders, preparing loan application materials, and developing a compelling business case. 2. Deliverables: The agreement specifies the deliverables the consultant is expected to provide throughout the duration of the engagement. These may include comprehensive loan application packages, financial projections, credit analysis reports, and any other necessary documentation for loan approval. 3. Project Timeline: A well-defined timeline sets expectations for both the company and the consultant, outlining key milestones and deadlines. It ensures that the loan acquisition process remains on track and avoids unnecessary delays. 4. Compensation: This section elucidates the financial arrangement between the company and the consultant. It outlines the consultant's fees, payment terms, and any possible additional expenses related to the loan acquisition process. The compensation structure may vary depending on the complexity and duration of the consulting services required. 5. Confidentiality: Given the sensitivity of financial information involved in loan applications, the agreement includes provisions to ensure the confidentiality of the company’s data shared with the consultant. This safeguards the company's proprietary information and trade secrets, preventing unauthorized access or disclosure. 6. Termination: The agreement typically includes provisions detailing the circumstances under which either party can terminate the consulting engagement. It may also outline the notice period required and any associated penalties for early termination. Additionally, there might be different types of Tarrant Texas Consulting Agreements — Assist Company Obtain Loan, depending on the specific nature of the consulting services: 1. General Consulting Agreement: This is a comprehensive agreement covering a myriad of consulting services related to loan acquisition, encompassing various aspects like financial analysis, lender identification, and loan application support. 2. Financial Consulting Agreement: This type of agreement focuses specifically on financial advisory services to assist the company in obtaining a loan. It may involve assessing the company's financial health, restructuring existing debt, or identifying alternative financing options. 3. Credit Analysis Consulting Agreement: This agreement concentrates on providing a detailed analysis of the company's creditworthiness, determining its ability to secure a loan. The consultant reviews the financial statements, credit history, and overall financial position to guide the company through any necessary improvements required for loan approval. In conclusion, a Tarrant Texas Consulting Agreement — Assist Company Obtain Loan is a specialized contractual arrangement between a consulting firm and a local company, aiming to provide expert guidance and assistance throughout the loan acquisition process. The agreement ensures that both parties understand their roles and responsibilities, facilitating a successful loan application.

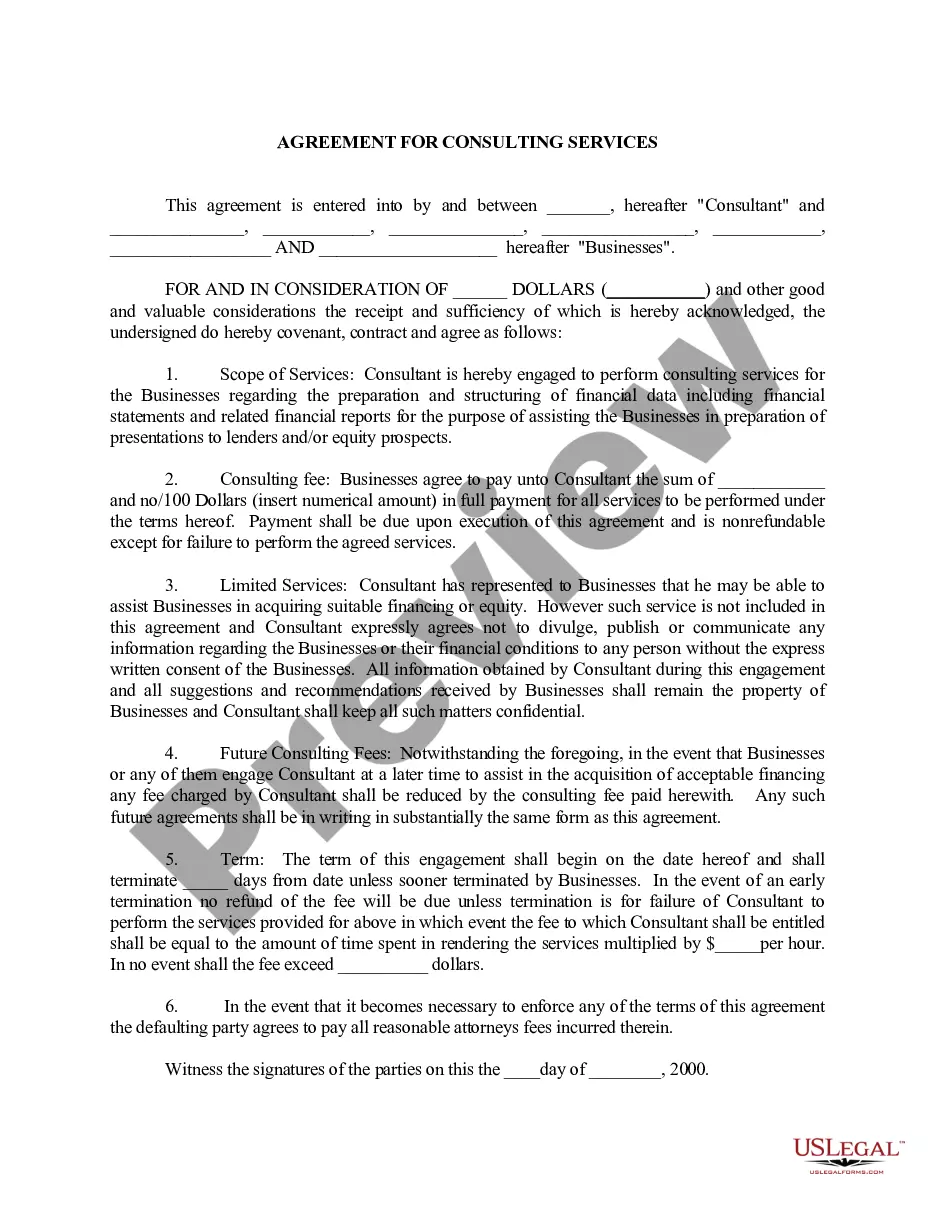

Tarrant Texas Consulting Agreement - Assist Company Obtain Loan

Description

How to fill out Tarrant Texas Consulting Agreement - Assist Company Obtain Loan?

Whether you plan to open your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Tarrant Consulting Agreement - Assist Company Obtain Loan is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to get the Tarrant Consulting Agreement - Assist Company Obtain Loan. Follow the instructions below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Tarrant Consulting Agreement - Assist Company Obtain Loan in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!