Travis Texas Agreement: Adding a Silent Partner to Existing Partnership In the world of business, partnerships are a common way to combine resources, skills, and expertise to successfully run a venture. However, as businesses grow, it often becomes necessary to seek additional resources and capital to fuel expansion. This is where the Travis Texas Agreement, specifically designed for adding a silent partner to an existing partnership, comes into play. A Travis Texas Agreement Adding Silent Partner to Existing Partnership is a legally binding contract that outlines the terms and conditions for admitting a silent partner into an established business partnership. While a silent partner may not play an active management role, they often contribute capital, industry knowledge, or extensive networks, bringing tremendous value to the partnership. This agreement serves multiple purposes. Firstly, it defines the role and responsibilities of the silent partner within the partnership. Unlike active partners, the silent partner does not participate in the daily operations of the business but still reaps the financial rewards and shares in the profits. Secondly, it outlines the specific rights and privileges granted to the silent partner, such as the ability to attend meetings, receive financial reports, or access certain company assets. It ensures that the silent partner has a voice in certain key decisions while not interfering with the active partners' management authority. Moreover, the agreement covers the financial aspect of the partnership, addressing the investment amount and any subsequent contributions made by the silent partner. It outlines the profit-sharing structure, including how profits and losses will be distributed among the partners. Furthermore, it may detail any restrictions on the silent partner's liability, ensuring their limited involvement shields them from personal liability for the partnership's obligations. It is essential to note that there can be variations of the Travis Texas Agreement Adding Silent Partner to Existing Partnership to suit different situations. Here are a few types: 1. Capital Investment Agreement: This type of agreement focuses primarily on detailing the financial investment that the silent partner will be making into the partnership. It specifies the amount, mode, and timing of the investment, ensuring transparency between all partners. 2. Limited Liability Agreement: In this variation, the emphasis lies on formally restricting the silent partner's personal liability for any debts or legal obligations incurred by the partnership. It provides added protection for the silent partner, ensuring their investment is safeguarded. 3. Exit Strategy Agreement: This type of agreement is designed to outline the exit provisions for the silent partner. It covers scenarios such as a buyout, dissolution of the partnership, or the silent partner choosing to sell their stake. It helps ensure a smooth transition and clear expectations when the partnership dynamics change. In conclusion, the Travis Texas Agreement Adding Silent Partner to Existing Partnership is a crucial legal document that formalizes the inclusion of a silent partner into an already existing partnership. By clearly defining roles, responsibilities, and the financial aspects of the partnership, this agreement establishes a strong foundation for effective collaboration and growth.

Travis Texas Agreement Adding Silent Partner to Existing Partnership

Description

How to fill out Travis Texas Agreement Adding Silent Partner To Existing Partnership?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Travis Agreement Adding Silent Partner to Existing Partnership, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Travis Agreement Adding Silent Partner to Existing Partnership from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Travis Agreement Adding Silent Partner to Existing Partnership:

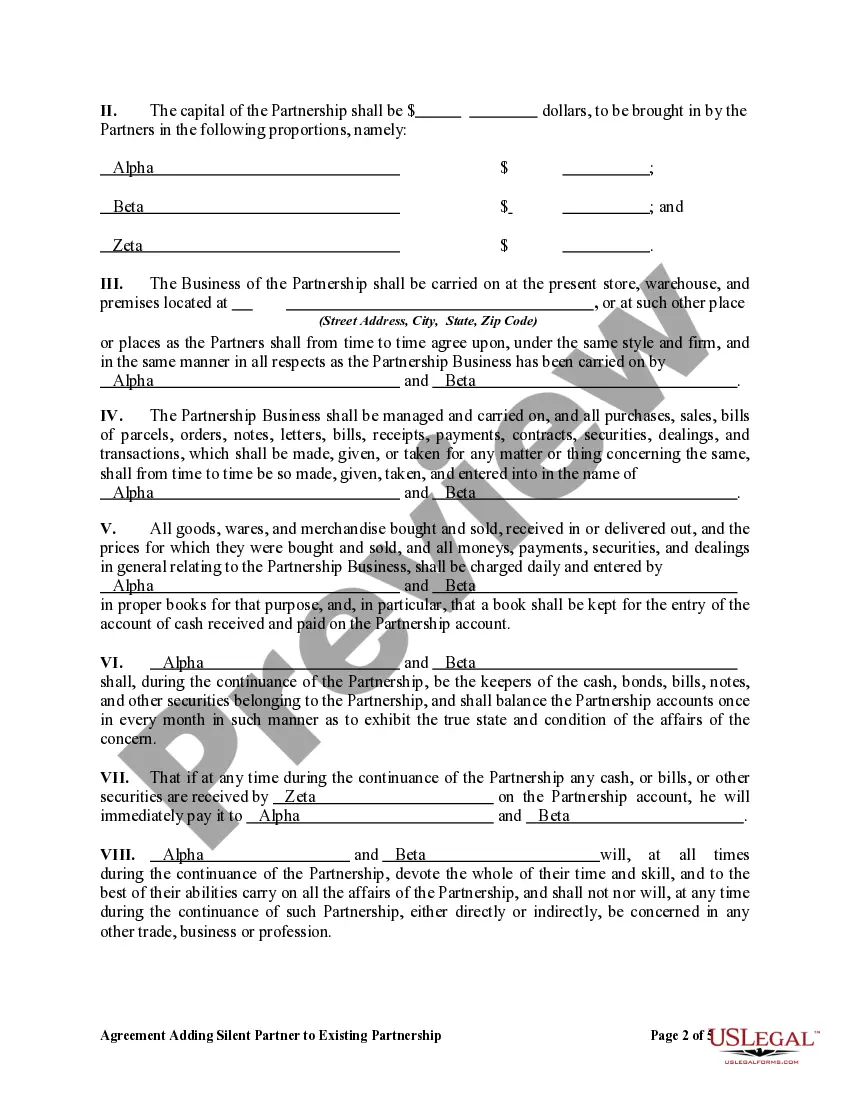

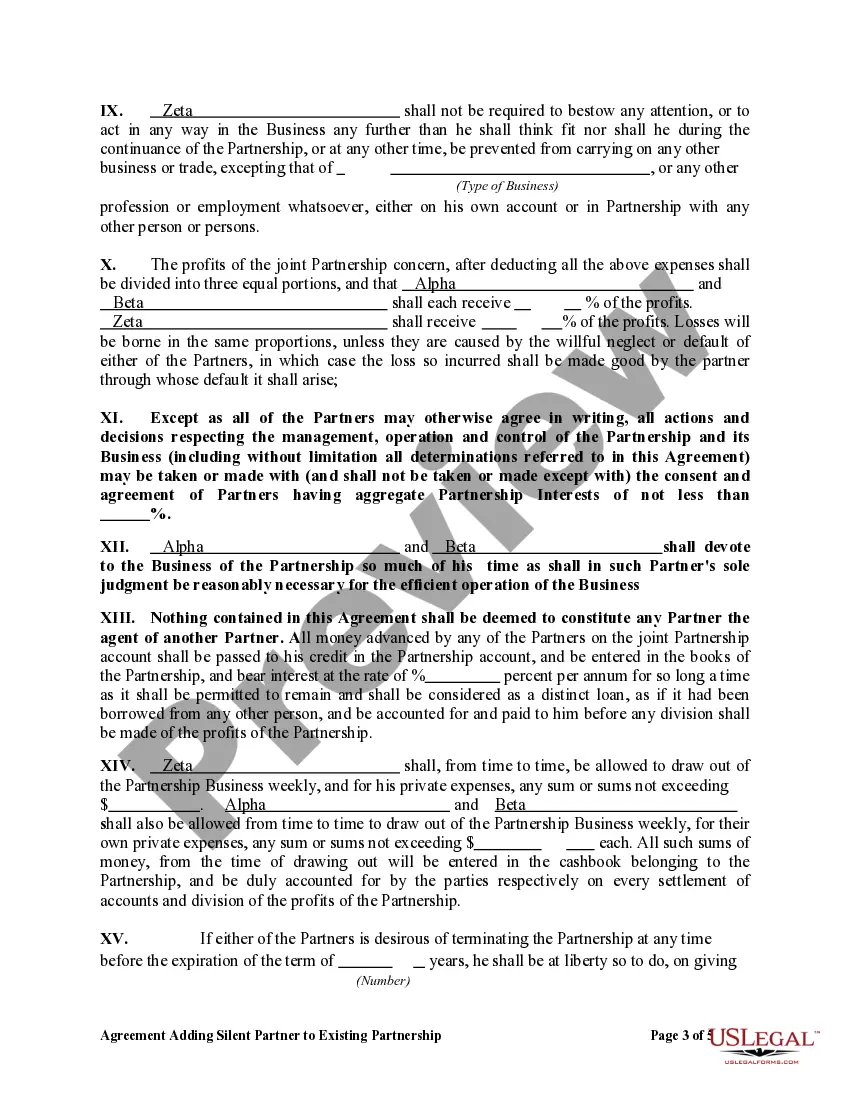

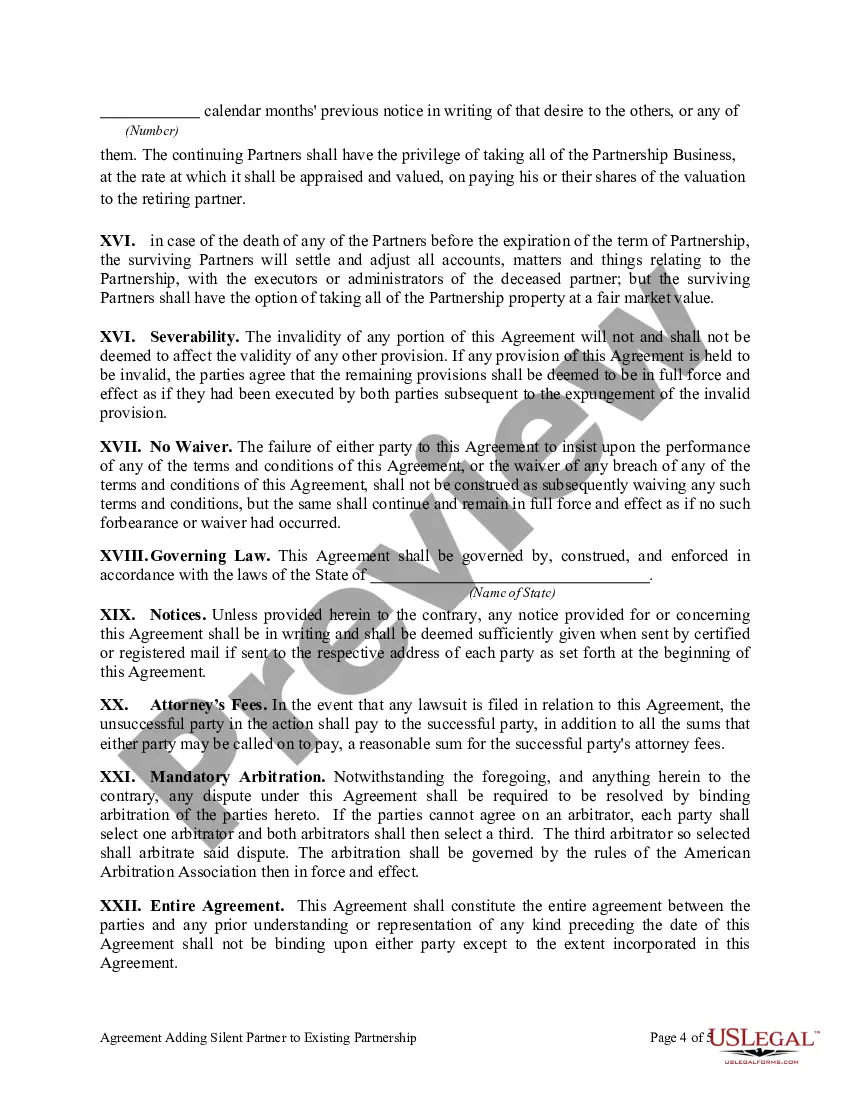

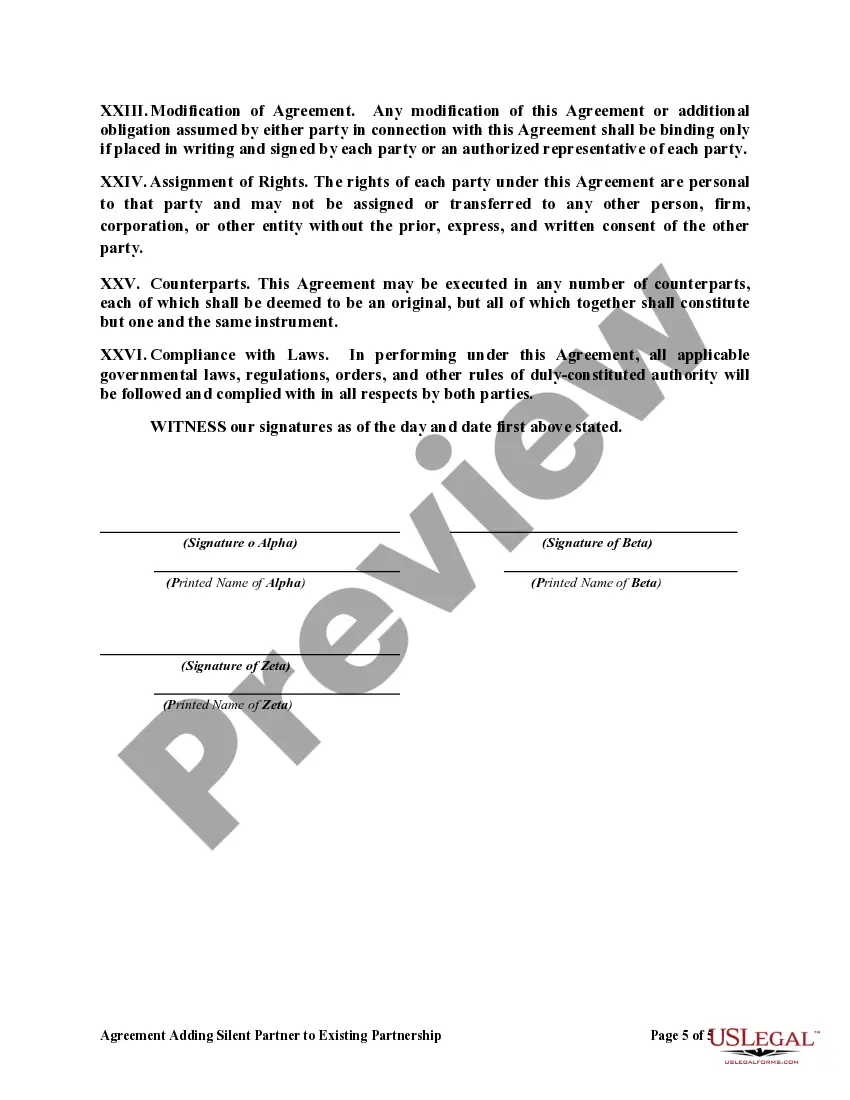

- Take a look at the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!