Collin Texas Exchange Addendum to Contract — Tax Free Exchange Section 1031: A detailed explanation The Collin Texas Exchange Addendum to Contract — Tax Free Exchange Section 1031 is a legally-binding document that outlines the terms and conditions of a tax-free exchange in the Collin County area of Texas. This addendum is specifically designed for individuals or entities looking to defer their capital gains taxes by using Section 1031 of the Internal Revenue Code. Under Section 1031, taxpayers are allowed to exchange one investment property for another, without recognizing any immediate capital gains or losses. The Collin Texas Exchange Addendum ensures that both parties involved in the exchange understand and agree to the terms and requirements of this tax-deferral strategy. This addendum typically contains information pertaining to the parties involved in the exchange, including their legal names, contact details, and respective roles (seller, buyer, intermediary, etc.). It also includes a thorough description of the properties being exchanged, their addresses, legal descriptions, and any encumbrances or liens attached to them. The addendum then outlines the specific requirements and deadlines that must be met in order for the exchange to be considered a tax-free transaction. For example, it typically stipulates that the buyer must identify the replacement property(IES) within 45 days of the original property's sale, and complete the exchange within 180 days. To ensure compliance with Section 1031, the addendum often requires the involvement of a qualified intermediary or accommodate who will hold the funds from the sale of the relinquished property and facilitate the purchase of the replacement property(IES) on behalf of the taxpayer. This intermediary acts as a neutral third party and assists in ensuring the transaction meets IRS guidelines. It is worth noting that while the Collin Texas Exchange Addendum specifically caters to the requirements in Collin County, Texas, there can be variations or additional clauses based on individual circumstances or the preferences of the parties involved. Some variations may include provisions related to personal property exchanges or reverse exchanges, where the taxpayer acquires the replacement property before selling the relinquished property. In summary, the Collin Texas Exchange Addendum to Contract — Tax Free Exchange Section 1031 is a crucial document for individuals or entities engaging in tax-free exchanges of investment properties in Collin County, Texas. It provides a comprehensive framework for executing a successful 1031 exchange, minimizing tax liabilities, and promoting the long-term growth of real estate portfolios.

Collin Texas Exchange Addendum to Contract - Tax Free Exchange Section 1031

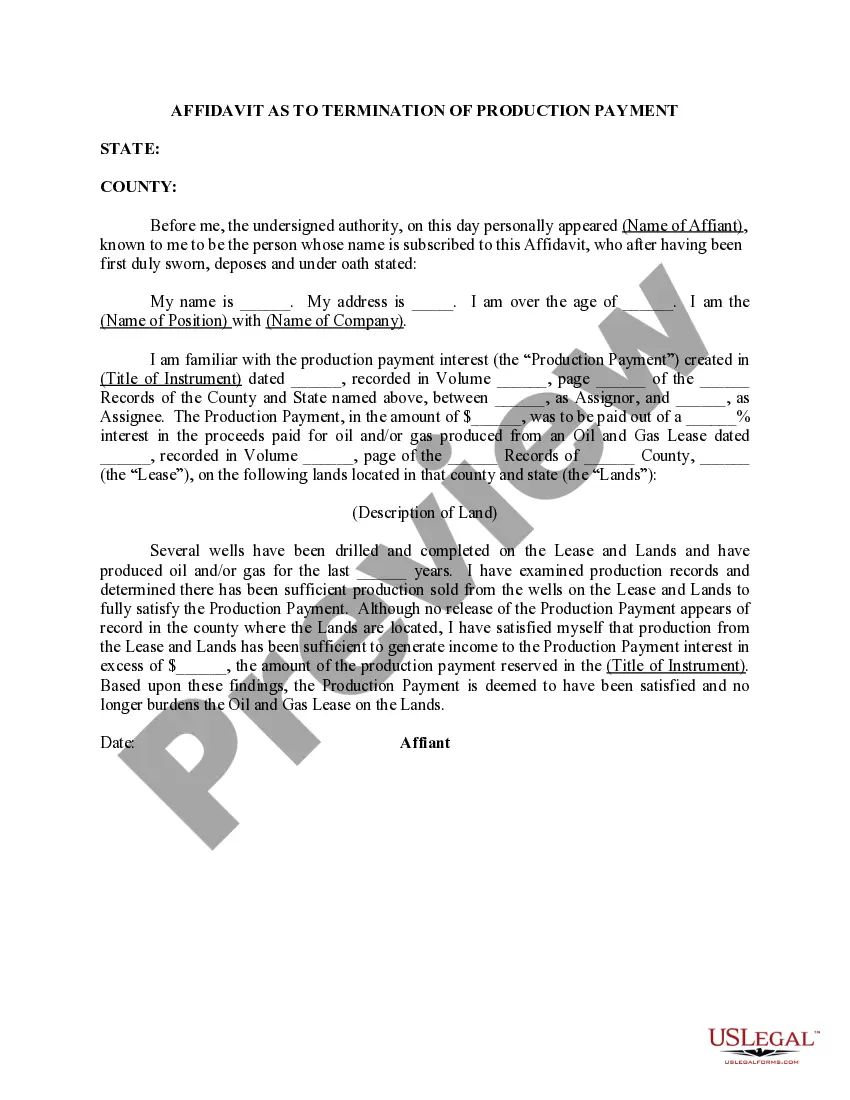

Description

How to fill out Collin Texas Exchange Addendum To Contract - Tax Free Exchange Section 1031?

How much time does it typically take you to draw up a legal document? Because every state has its laws and regulations for every life situation, locating a Collin Exchange Addendum to Contract - Tax Free Exchange Section 1031 suiting all local requirements can be exhausting, and ordering it from a professional attorney is often costly. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. In addition to the Collin Exchange Addendum to Contract - Tax Free Exchange Section 1031, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Experts verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can retain the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Collin Exchange Addendum to Contract - Tax Free Exchange Section 1031:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Collin Exchange Addendum to Contract - Tax Free Exchange Section 1031.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!