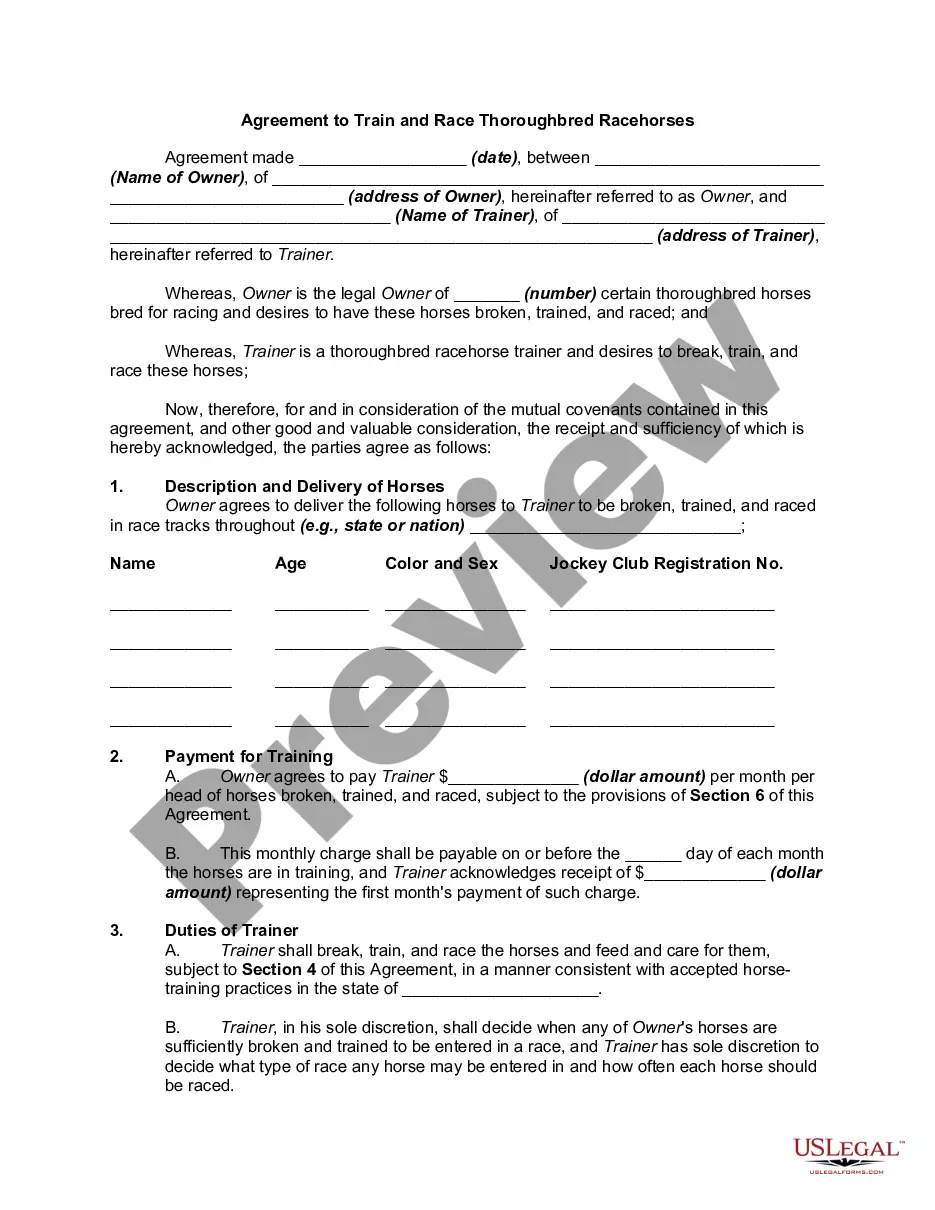

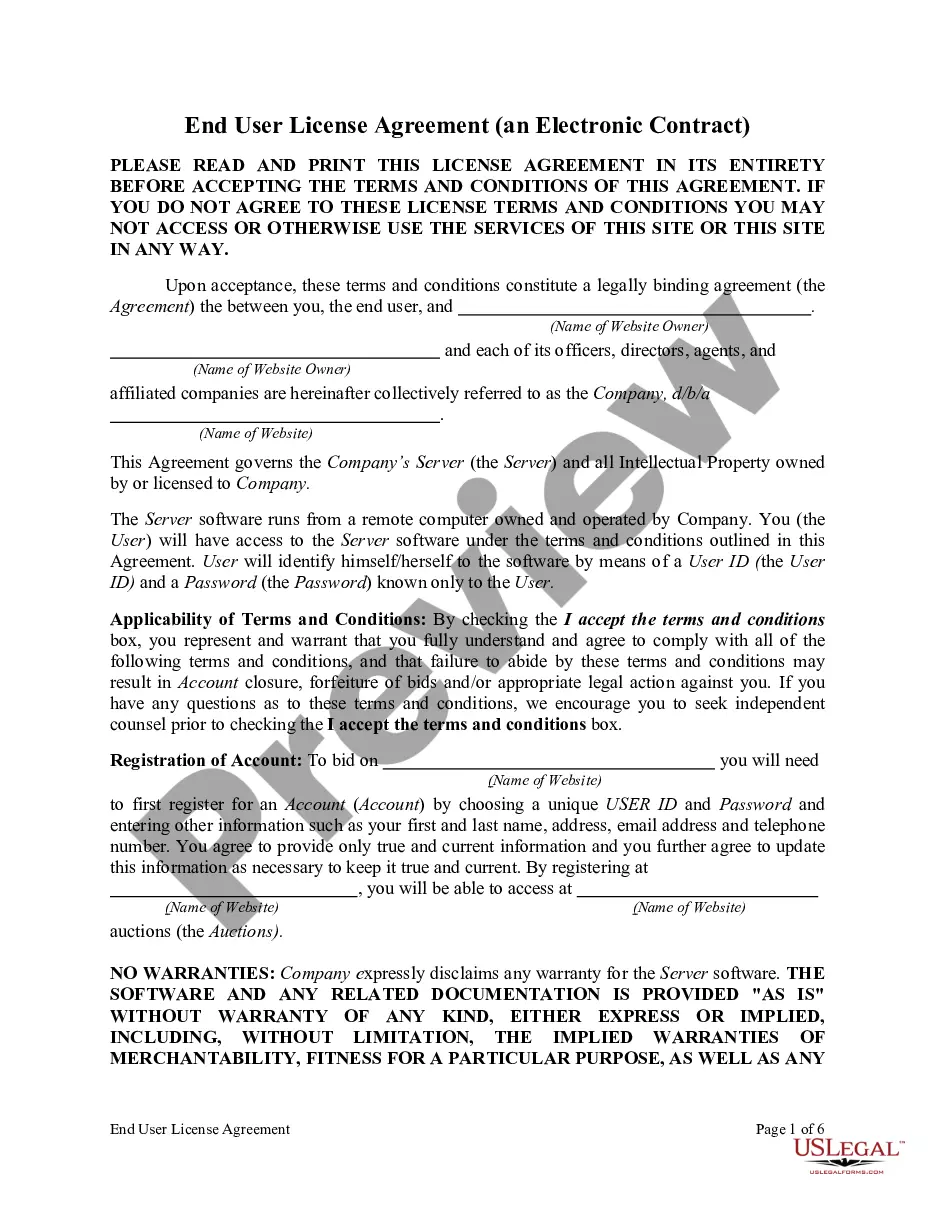

The Miami-Dade Florida Exchange Addendum to Contract — Tax Free Exchange Section 1031 is a legal document designed to facilitate tax-free exchanges of property in Miami-Dade County, Florida. This addendum is specifically tailored to comply with the requirements of Section 1031 of the Internal Revenue Code, which allows for the deferral of capital gains tax when certain conditions are met. This addendum is essential for parties involved in real estate transactions within Miami-Dade County who wish to take advantage of the tax benefits offered by Section 1031. By incorporating this addendum into the contract, buyers and sellers can establish their intent to conduct a tax-free exchange and outline the specific terms and conditions that must be met. There are different types of Miami-Dade Florida Exchange Addendum to Contract — Tax Free Exchange Section 1031, depending on the specific circumstances of the transaction. Some common variations include: 1. Simultaneous Exchange: This type of exchange refers to a situation where the relinquished property (property being sold) and the replacement property (property being acquired) are exchanged concurrently. Both properties are transferred on the same day. 2. Delayed Exchange: Also known as a "Starker exchange," a delayed exchange allows the taxpayer to sell the relinquished property and subsequently acquire the replacement property within a specified time frame. These exchanges typically involve the use of a qualified intermediary to facilitate the transfer and hold the proceeds from the sale of the relinquished property until the purchase of the replacement property is completed. 3. Reverse Exchange: In a reverse exchange, the taxpayer acquires the replacement property before selling the relinquished property. This type of exchange requires careful planning and coordination to comply with Section 1031 regulations. 4. Construction or Improvement Exchange: This type of exchange allows for the use of exchange proceeds to build or improve replacement property within a specified time frame. The exchange funds are used to cover construction costs, and the property is completed to meet the requirements of Section 1031. Regardless of the specific type of exchange, the Miami-Dade Florida Exchange Addendum to Contract — Tax Free Exchange Section 1031 serves as a crucial legal instrument to ensure compliance with the tax regulations and protect the interests of all parties involved in the transaction. It provides a clear framework for conducting a tax-free exchange while outlining the necessary steps, timelines, and responsibilities.

1031 Exchange Miami

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-00472F

Format:

Word;

Rich Text

Instant download

Description

This form is used when there is a tax free exchange proposed for buyer or seller.

The Miami-Dade Florida Exchange Addendum to Contract — Tax Free Exchange Section 1031 is a legal document designed to facilitate tax-free exchanges of property in Miami-Dade County, Florida. This addendum is specifically tailored to comply with the requirements of Section 1031 of the Internal Revenue Code, which allows for the deferral of capital gains tax when certain conditions are met. This addendum is essential for parties involved in real estate transactions within Miami-Dade County who wish to take advantage of the tax benefits offered by Section 1031. By incorporating this addendum into the contract, buyers and sellers can establish their intent to conduct a tax-free exchange and outline the specific terms and conditions that must be met. There are different types of Miami-Dade Florida Exchange Addendum to Contract — Tax Free Exchange Section 1031, depending on the specific circumstances of the transaction. Some common variations include: 1. Simultaneous Exchange: This type of exchange refers to a situation where the relinquished property (property being sold) and the replacement property (property being acquired) are exchanged concurrently. Both properties are transferred on the same day. 2. Delayed Exchange: Also known as a "Starker exchange," a delayed exchange allows the taxpayer to sell the relinquished property and subsequently acquire the replacement property within a specified time frame. These exchanges typically involve the use of a qualified intermediary to facilitate the transfer and hold the proceeds from the sale of the relinquished property until the purchase of the replacement property is completed. 3. Reverse Exchange: In a reverse exchange, the taxpayer acquires the replacement property before selling the relinquished property. This type of exchange requires careful planning and coordination to comply with Section 1031 regulations. 4. Construction or Improvement Exchange: This type of exchange allows for the use of exchange proceeds to build or improve replacement property within a specified time frame. The exchange funds are used to cover construction costs, and the property is completed to meet the requirements of Section 1031. Regardless of the specific type of exchange, the Miami-Dade Florida Exchange Addendum to Contract — Tax Free Exchange Section 1031 serves as a crucial legal instrument to ensure compliance with the tax regulations and protect the interests of all parties involved in the transaction. It provides a clear framework for conducting a tax-free exchange while outlining the necessary steps, timelines, and responsibilities.

Free preview