San Jose California Exchange Addendum to Contract — Tax-Free Exchange Section 1031: A Detailed Description The San Jose California Exchange Addendum to Contract — Tax-Free Exchange Section 1031 is a legally binding document that outlines the terms and conditions for a tax-free exchange under Section 1031 of the Internal Revenue Code. This addendum is specifically tailored for properties located in San Jose, California. When individuals or businesses own investment properties, they often seek ways to defer capital gains taxes when selling one property and acquiring another. The Tax-Free Exchange Section 1031 allows property owners to exchange one investment property for another, deferring the capital gains taxes that would typically be incurred during the sale. This San Jose California Exchange Addendum serves as an additional attachment to the primary purchase contract and specifically addresses the tax-free exchange process. It ensures that all parties involved are fully aware of the requirements and conditions associated with a tax-free exchange. Key Elements of the San Jose California Exchange Addendum to Contract — Tax-Free Exchange Section 1031: 1. Identification of Exchange Properties: The addendum requires the identification of the property being sold (relinquished property) and the property being acquired (replacement property). It is essential to provide accurate descriptions of both properties to ensure compliance with IRS regulations. 2. Time Constraints: The addendum sets strict timelines for identifying and closing on the replacement property. The identification period usually spans 45 days from the date of the relinquished property's sale, and the closing must occur within 180 days. 3. Qualified Intermediary: To execute a successful tax-free exchange, a qualified intermediary (QI) must be engaged. The addendum specifies the role and responsibilities of the QI, who acts as a third-party facilitator and ensures compliance with IRS regulations throughout the exchange process. 4. Escrow Instructions: The addendum outlines the specific instructions for the handling of funds during the exchange, including depositing the proceeds from the sale of the relinquished property into an escrow account managed by the QI. 5. Seller's Disclosure: The addendum requires the seller to disclose any known defects, liens, or other encumbrances on the relinquished property, ensuring transparency and protecting the buyer's interests. Types of San Jose California Exchange Addendum to Contract — Tax-Free Exchange Section 1031: There may be various versions or variations of the San Jose California Exchange Addendum to Contract — Tax-Free Exchange Section 1031, depending on specific factors such as property type, parties involved, or additional contractual requirements. 1. Residential Property Addendum: This addendum is tailored for residential properties, including single-family homes, condos, or townhouses located in San Jose, California. 2. Commercial Property Addendum: Designed for commercial real estate transactions, this addendum addresses the specific requirements and considerations associated with exchanging commercial properties within San Jose, California. 3. Multi-Unit Property Addendum: This addendum is focused on multi-unit properties, such as apartment buildings or complexes, and provides guidance on the exchange process for these types of properties. Conclusion: The San Jose California Exchange Addendum to Contract — Tax-Free Exchange Section 1031 is an essential legal document for parties involved in a tax-free exchange of investment properties in San Jose, California. It outlines the necessary steps, timeframes, and responsibilities for complying with IRS regulations and ensuring a successful exchange transaction. Different types of addendums may exist for specific property types, catering to the unique considerations of residential, commercial, or multi-unit properties.

San Jose California Exchange Addendum to Contract - Tax Free Exchange Section 1031

Description

How to fill out San Jose California Exchange Addendum To Contract - Tax Free Exchange Section 1031?

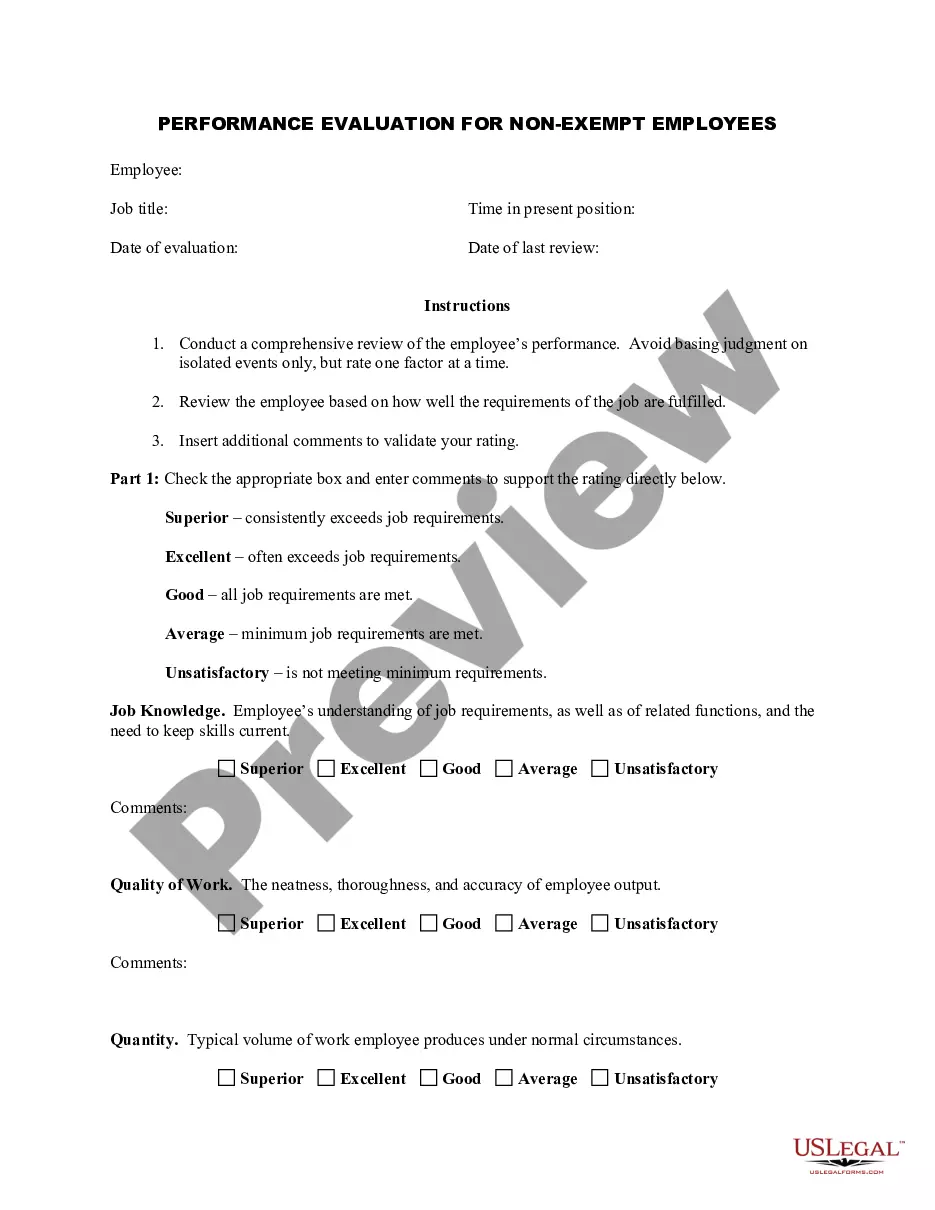

Creating forms, like San Jose Exchange Addendum to Contract - Tax Free Exchange Section 1031, to manage your legal affairs is a challenging and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents crafted for various scenarios and life circumstances. We ensure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the San Jose Exchange Addendum to Contract - Tax Free Exchange Section 1031 form. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before downloading San Jose Exchange Addendum to Contract - Tax Free Exchange Section 1031:

- Make sure that your document is compliant with your state/county since the rules for creating legal paperwork may vary from one state another.

- Learn more about the form by previewing it or reading a brief intro. If the San Jose Exchange Addendum to Contract - Tax Free Exchange Section 1031 isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start utilizing our website and get the form.

- Everything looks great on your side? Click the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s easy to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!