Broward Florida Corporation — Transfer of Stock refers to the process of transferring ownership of stocks or shares in a corporation based in Broward County, Florida. This process involves the legal transfer of ownership rights from one shareholder to another, allowing the transference of benefits and obligations associated with the stock. The transfer of stock is an important aspect of corporate transactions, mergers, acquisitions, and various business activities involving securities. It enables shareholders to buy, sell, or gift their ownership interests in a Broward, Florida-based corporation. There are different types of Broward Florida Corporation — Transfer of Stock that are commonly encountered in practice: 1. Standard Stock Transfer: This is the typical transfer involving the sale or transfer of shares from one shareholder to another. It requires the completion and submission of relevant documentation, including stock transfer forms, a stock power of attorney, and the issuance of new stock certificates to the purchasing shareholder. 2. Stock Transfer through Inheritance: In cases where a shareholder passes away, their stocks can be transferred to their beneficiaries or heirs. This process involves following legal procedures such as probate or estate administration, as well as fulfilling any relevant requirements set by the corporation's bylaws or shareholder agreements. 3. Stock Transfer for Employee Compensation: Some corporations offer their employees the opportunity to acquire stocks as part of their compensation packages. When an employee exercises their options or receives allocated stocks, a transfer of ownership takes place. This type of transfer typically involves specific rules and restrictions, such as vesting schedules or restrictions on selling the shares. 4. Stock Transfer in Corporate Reorganizations: During corporate reorganizations like mergers, acquisitions, or spin-offs, the transfer of stocks plays a crucial role. Shareholders of the acquiring or merged company may exchange their existing shares for stocks in the newly formed entity. 5. Stock Transfer for Financing: Corporations often raise capital by issuing new shares of stock to investors. The transfer occurs when the investors purchase these newly issued shares, providing the corporation with necessary funds for business expansion or other financial needs. It is important to consult legal and financial professionals, such as attorneys or stockbrokers, to guide and execute Broward Florida Corporation — Transfer of Stock. Compliance with relevant state and federal securities laws, as well as the corporation's own bylaws and shareholder agreements, is essential to ensure a smooth and lawful transfer process.

Broward Florida Corporation - Transfer of Stock

Description

How to fill out Broward Florida Corporation - Transfer Of Stock?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life scenario, finding a Broward Corporation - Transfer of Stock meeting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. Aside from the Broward Corporation - Transfer of Stock, here you can get any specific document to run your business or individual affairs, complying with your county requirements. Professionals verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can retain the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Broward Corporation - Transfer of Stock:

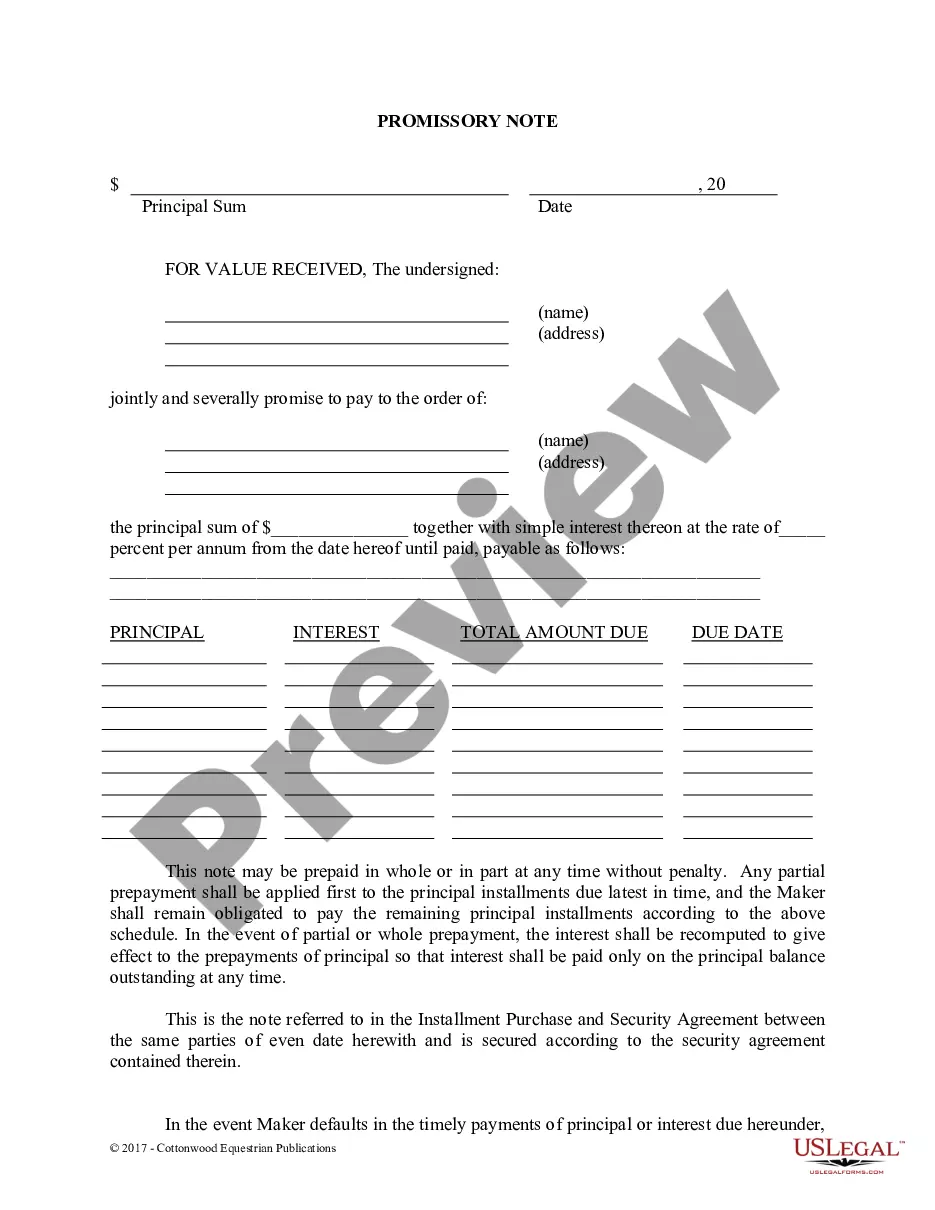

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Broward Corporation - Transfer of Stock.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!