Los Angeles California Credit Agreement refers to a legal document that outlines the terms and conditions under which a borrower can obtain credit from a financial institution or a lender within the Los Angeles area of California. This agreement serves as a binding contract between the lender and the borrower, ensuring that both parties are aware of their rights and obligations regarding the credit facility. The Los Angeles California Credit Agreement typically covers various aspects, including the amount of credit extended, interest rates, repayment terms, fees, penalties, and any collateral or guarantees required to secure the credit. The agreement may also define the purpose for which the credit will be used, whether it's for personal expenses, business investments, or other specific purposes. In Los Angeles, there are several types of credit agreements that individuals, businesses, and organizations can enter into depending on their specific needs. Some common types include: 1. Personal Credit Agreement: This type of agreement is entered into by individuals seeking credit for personal use, such as purchasing a home, financing education, or covering unexpected expenses. 2. Business Credit Agreement: Designed for businesses, this agreement allows companies to access credit to fund operations, invest in assets, expand operations, or manage cash flow. 3. Mortgage Credit Agreement: This agreement is specifically for individuals or businesses seeking credit to finance the purchase of real estate properties in Los Angeles. It outlines the terms and conditions of the mortgage, including repayment schedules and interest rates. 4. Revolving Credit Agreement: This type of agreement provides borrowers with a line of credit that can be utilized repeatedly, up to a predetermined credit limit. It allows individuals or businesses to borrow, repay, and borrow again within the credit limit, providing flexibility in managing their finances. 5. Vendor Credit Agreement: A vendor or supplier may offer credit terms to a business for purchasing goods or services on credit. This agreement defines the terms and conditions of credit provided by the vendor, including payment terms and any discounts or penalties associated with it. It is important for both lenders and borrowers to thoroughly understand the terms and conditions stated in a Los Angeles California Credit Agreement before signing it. Seeking legal advice and conducting due diligence is highly recommended ensuring compliance with applicable laws and to safeguard the interests of all parties involved.

Los Angeles California Credit Agreement

Description

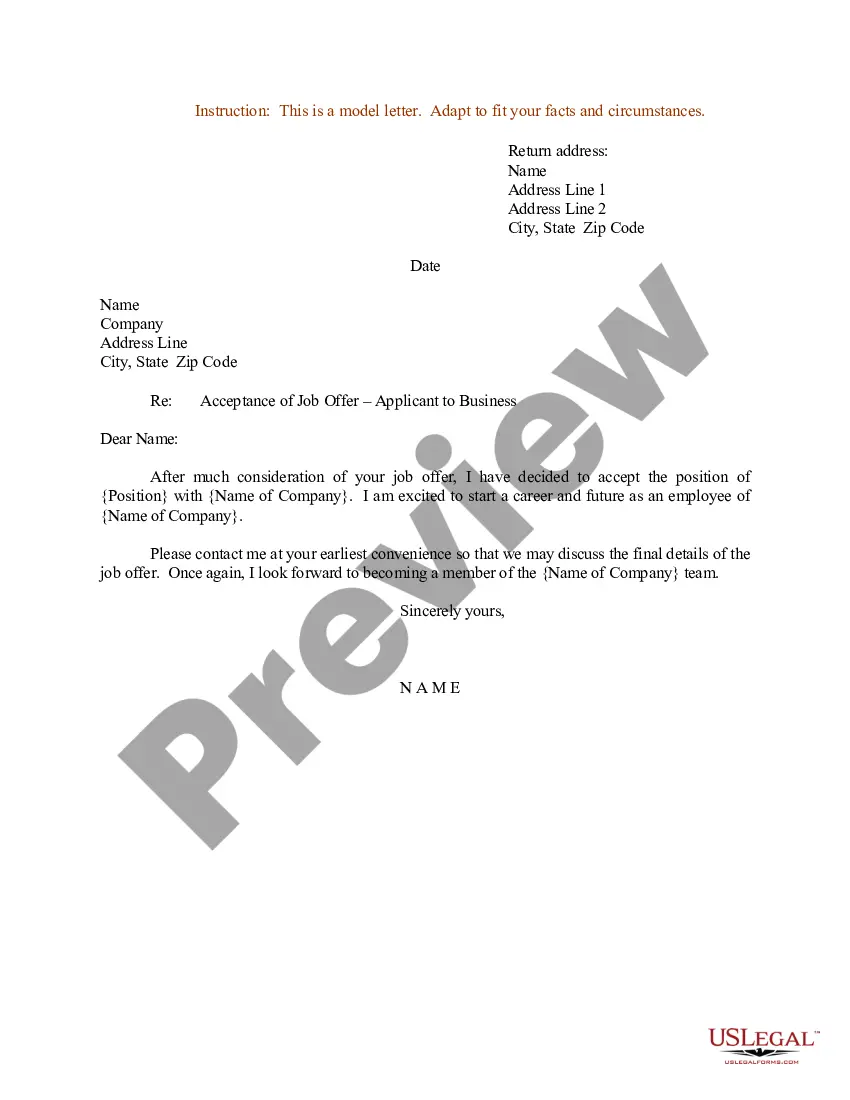

How to fill out Los Angeles California Credit Agreement?

Do you need to quickly draft a legally-binding Los Angeles Credit Agreement or maybe any other document to take control of your personal or corporate matters? You can go with two options: hire a legal advisor to write a legal paper for you or draft it entirely on your own. Luckily, there's another solution - US Legal Forms. It will help you receive professionally written legal documents without paying unreasonable prices for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-compliant document templates, including Los Angeles Credit Agreement and form packages. We offer templates for a myriad of use cases: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a spotless reputation among our clients. Here's how you can become one of them and get the necessary template without extra troubles.

- First and foremost, double-check if the Los Angeles Credit Agreement is adapted to your state's or county's regulations.

- In case the document has a desciption, make sure to check what it's suitable for.

- Start the search over if the form isn’t what you were looking for by utilizing the search box in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Los Angeles Credit Agreement template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our services. Additionally, the documents we provide are reviewed by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

You must notify your lender in writing that you are cancelling the loan contract and exercising your right to rescind. You may use the form provided to you by your lender or a letter. You can't rescind just by calling or visiting the lender.

Tell the lender you want to cancel You have 14 days to cancel once you have signed the credit agreement. Contact the lender to tell them you want to cancel - this is called 'giving notice'. It's best to do this in writing but your credit agreement will tell you who to contact and how.

How do I find my Credit Agreements? Your reported Credit Agreements will appear on your Credit Report, giving you a detailed list of your current and past lenders, amounts owed, the status of the accounts, and more.

A credit agreement is a legally binding contract between a borrower and a lender that must be agreed by both parties. It holds the terms of any type of credit, such as overdrafts, credit cards or personal loans. That's why a credit agreement for a personal loan is normally referred to as a loan agreement.

Credit agreement. An agreement is a credit agreement if it provides for a deferral or delay of payment, and if there is a fee or interest charged for the deferred payment. The Act does not require that a credit agreement be in writing and signed by both parties, although this is implied throughout the Act.

A personal loan contract is a legally binding document regardless of whether the lender is a financial institution or another person. The consequences are the same if you default on the contract. As a borrower, you could be sued by the lender or lose the asset or assets used to secure the loan.

All loan agreements must specify general terms that define the legal obligations of each party. For instance, the terms regarding repayment schedule, default or contract breach, interest rate, loan security, as well as collateral offered must be clearly outlined.

A credit agreement is a legally-binding contract documenting the terms of a loan agreement; it is made between a person or party borrowing money and a lender. The credit agreement outlines all of the terms associated with the loan.

If you're borrowing money, you're getting credit this could include overdrafts, credit cards and loans. The lender should typically provide you with a credit agreement, which spells out the details of the deal, including your rights.

Credit agreements are not legally binding. Lenders do not check a person's likelihood to repay before accepting a credit agreement. An annual fee is an amount paid to you by the credit card company for using their service each year.