An Alameda California Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate is a legal document that authorizes an appointed attorney-in-fact, also known as a personal representative or executor, to act on behalf of the deceased person's estate in Alameda County, California. This affidavit grants the attorney-in-fact the authority to manage and distribute the estate's assets, pay debts and expenses, file tax returns, and handle any legal matters related to the estate administration process. This affidavit is often required when the deceased person has named an attorney-in-fact in their will as the executor of their estate. The attorney-in-fact is responsible for ensuring that the last wishes of the deceased are carried out according to their instructions. They must also comply with the laws and regulations of Alameda County and the state of California. There are several types of Alameda California Affidavits by an Attorney-in-Fact in the Capacity of an Executor of an Estate, including: 1. General Alameda California Affidavit: This affidavit is used when the assets of the estate are relatively straightforward and do not require complex legal proceedings. It grants the attorney-in-fact the authority to perform general administrative tasks such as gathering and distributing assets, paying bills, and resolving any outstanding financial matters. 2. Small Estate Affidavit: In cases where the deceased person's estate is considered "small" in value, typically less than $166,250 as of 2021, a small estate affidavit may be used. This streamlined process allows the attorney-in-fact to transfer the assets of the estate without going through the formal probate process, saving time and costs. 3. Independent Administration of Estate: Under certain circumstances, the attorney-in-fact may request independent administration of the estate. This type of affidavit grants the attorney-in-fact increased decision-making authority, enabling them to act independently without seeking court approval for every step of the estate administration process. This is often preferred when the estate is complex or when the deceased person's will specifically grant this authority. It is essential to seek legal advice from an experienced estate attorney to determine the appropriate Alameda California Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate based on the specific circumstances of the deceased person's estate. This will ensure compliance with the relevant laws and proper administration of the estate while protecting the interests of all beneficiaries involved. NOTE: While the information provided here offers a general overview, it is crucial to consult with an attorney for accurate legal guidance tailored to your situation.

Alameda California Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate

Description

How to fill out Alameda California Affidavit By An Attorney-in-Fact In The Capacity Of An Executor Of An Estate?

Whether you intend to open your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Alameda Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to get the Alameda Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate. Adhere to the guide below:

- Make sure the sample fulfills your personal needs and state law regulations.

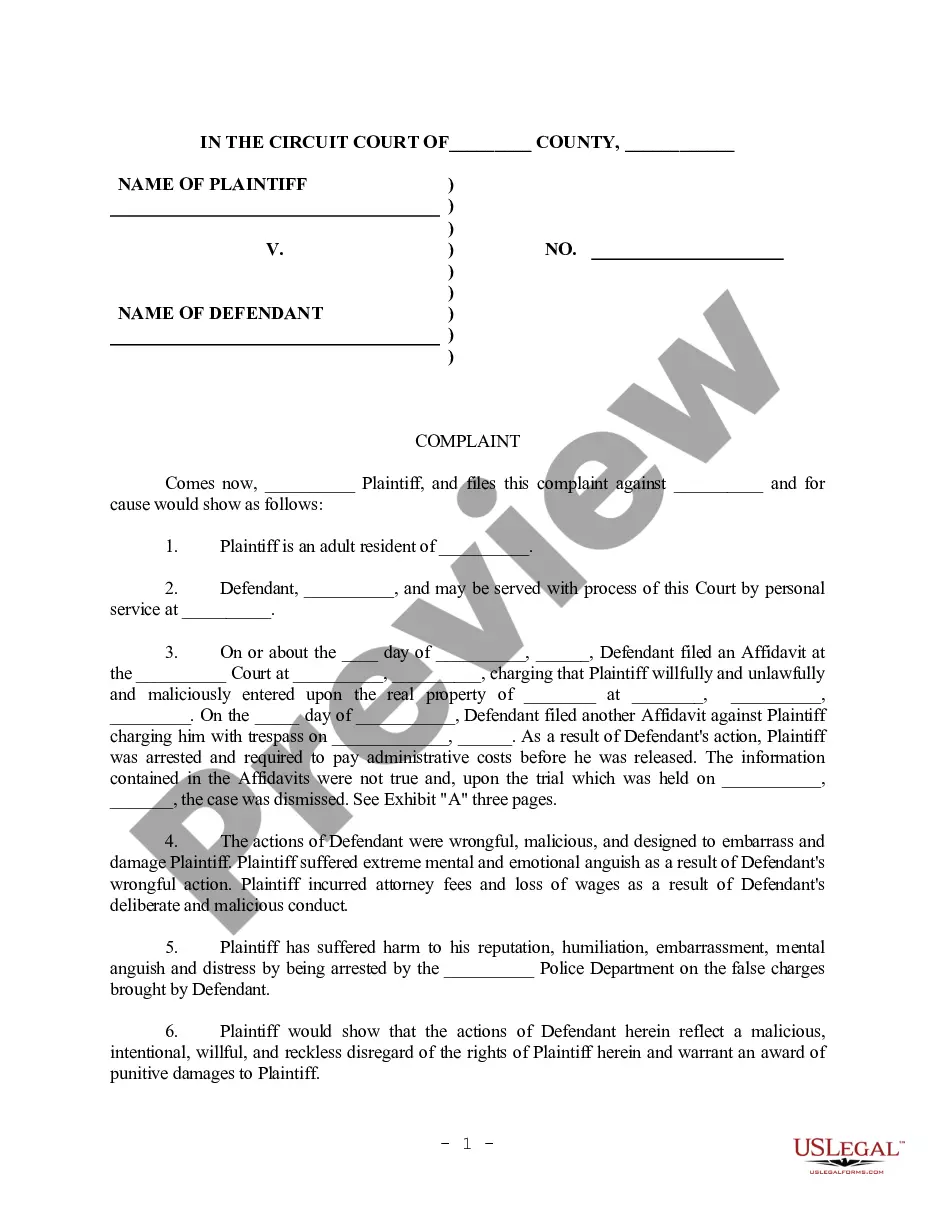

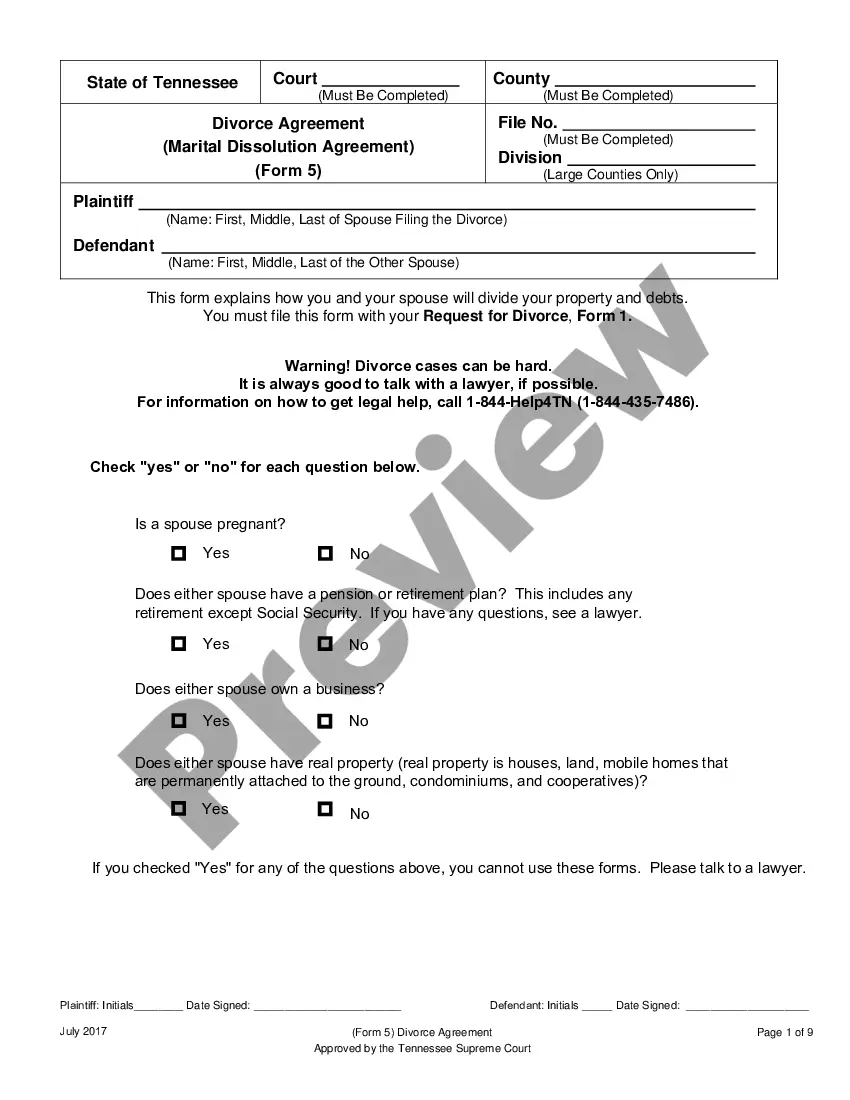

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file once you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Alameda Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

The amount of commission an executor will be paid ranges from 1 3% of the corpus of the estate. The corpus means the assets of the estate less all liabilities. In addition, an executor may earn up to 6% of income earned during the administration. An executor does not need to accept remuneration for their services.

Here are legal and financial documents almost everyone will need; you may think of others.Bank statements.Birth certificate.Brokerage statements.Insurance policies or cards (car, house, life, healthcare)Death certificate.Deeds to real estate.Divorce decree.Marriage certificate.More items...

Proof of death (e.g. the death certificate) The inventory of property. An executor's affidavit. The original will.

An affidavit or declaration signed under penalty of perjury at least 40 days after the death can be used to collect the assets for the beneficiaries or heirs of the estate. No documents are required to be filed with the Superior Court if the small estates law (California Probate Code Sections 13100 to 13116) is used.

Use the Court Locator and find the probate court where the decedent was a resident. The State filing fee is $435.

A small estate affidavit is just a written legal document you can get a small estate. affidavit from the county clerk's office or have an attorney prepare one. Administering the estate with an affidavit is one of the key ways to avoid probate.

The limit for small estates in California is currently at $166,250. This means any estate with a total value at or under this amount can qualify as a small estate and take advantage of a probate skip. The typical probate process can take at least seven months and up to several years.

In order to do this, you'll need to be able to prove to the relevant authorities that you have control over the estate. Usually, this is managed by showing them a copy of the Grant of Probate if a Will is in place, or Letters of Administration, if the estate has been passed into intestacy.

Paying Debts and Taxes Illinois, for example, requires executors to allow six months. California requires a bit less, with four months.

Follow these steps:Obtain and complete the California small estate affidavit. You must obtain the form used by the probate court in the county where the deceased was a resident.Include attachments.Obtain other signatures.Get the documents notarized.Transfer the property.