A Nassau New York Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate is a legal document used in the state of New York when an attorney-in-fact is acting as the executor of an estate. This affidavit provides important details and information regarding the attorney-in-fact's authority and responsibilities in administering the estate. Keywords: Nassau New York, affidavit, attorney-in-fact, executor, estate, legal document, authority, responsibilities. Different types of Nassau New York Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate can be categorized based on specific circumstances or requirements. Some potential types include: 1. Standard Affidavit by an Attorney-in-Fact: This type of affidavit is used when the attorney-in-fact is appointed as the executor of the estate in accordance with the deceased person's last will and testament. It includes details about the attorney-in-fact's appointment, duties, and any limitations or special instructions. 2. Affidavit by an Attorney-in-Fact with Limited or Specific Authority: In certain cases, an attorney-in-fact may be granted limited or specific authority to handle certain aspects of the estate administration. This type of affidavit would outline the scope of authority granted and any restrictions or guidelines to be followed. 3. Substitute Affidavit by an Alternate Attorney-in-Fact: In situations where the initially appointed attorney-in-fact is unable or unwilling to fulfill their duties, an alternate attorney-in-fact can step in. This type of affidavit would document the substitute attorney-in-fact's appointment and the reasons for the substitution. 4. Modified Affidavit by an Attorney-in-Fact: In some instances, the attorney-in-fact may need to modify or amend specific provisions of the original affidavit. This could involve changes to the estate administration plan, distribution of assets, or other necessary modifications. The modified affidavit would reflect these changes and provide updated information. It is important to consult with an experienced attorney to determine the specific requirements and forms necessary for a Nassau New York Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate, as the content and format may vary depending on the individual circumstances of the estate.

Nassau New York Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate

Description

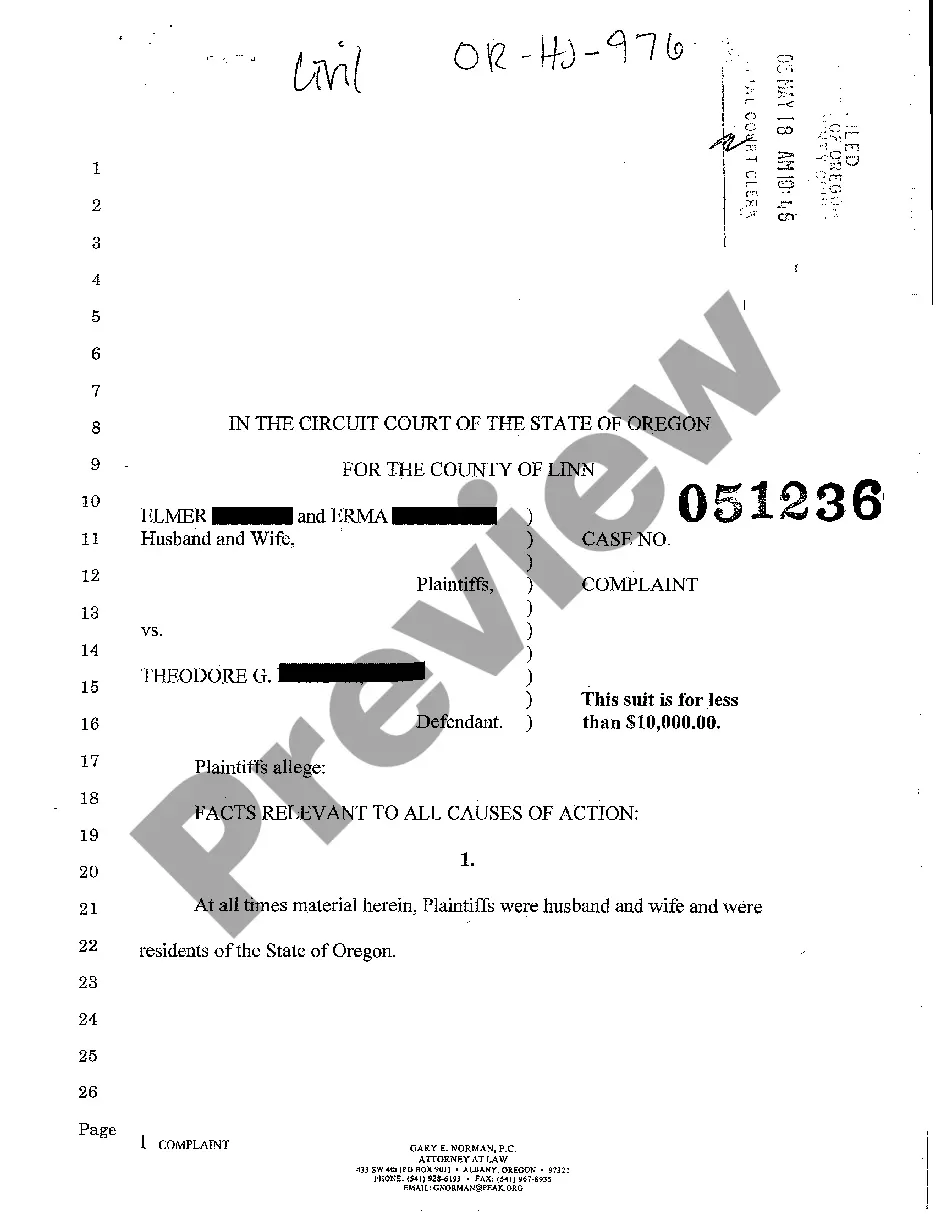

How to fill out Nassau New York Affidavit By An Attorney-in-Fact In The Capacity Of An Executor Of An Estate?

Drafting paperwork for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to create Nassau Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate without expert help.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Nassau Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Nassau Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate:

- Look through the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that meets your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a couple of clicks!

Form popularity

FAQ

If one of the executors loses capacity after the testator dies and a Grant of Probate has been obtained, that Grant will be revoked and the executor(s) who still has/ve mental capacity will have to apply for a new Grant with power being reserved to the executor who has lost capacity, in case they regain the same.

Step 1 Verify Eligibility. This will consist of examining the estate of the decedent.Step 2 Gather Documents.Step 3 File the Affidavit.Section A Surviving Spouse.Section B Surviving Spouse, Blood Relative Or Creditor.Payment Request By Affiant.Section C Creditor Statement Only.New York Notary Public Action.

In order to do this, you'll need to be able to prove to the relevant authorities that you have control over the estate. Usually, this is managed by showing them a copy of the Grant of Probate if a Will is in place, or Letters of Administration, if the estate has been passed into intestacy.

Helen: If someone has left a will and you are a beneficiary of an estate, you would usually be contacted by the executor, or the solicitor the executor has instructed, to notify you that you are a beneficiary.

Executors of an estate have certain obligations to beneficiaries of an estate. When an executor does not fulfill his or her obligations, beneficiaries have certain rights to force an executor to comply. This usually means getting the court involved.

If one of the executors loses capacity after the testator dies and a Grant of Probate has been obtained, that Grant will be revoked and the executor(s) who still has/ve mental capacity will have to apply for a new Grant with power being reserved to the executor who has lost capacity, in case they regain the same.

One of the foremost fiduciary duties required of an Executor is to put the estate's beneficiaries' interests first. This means you must notify them that they are a beneficiary. As Executor, you should notify beneficiaries of the estate within three months after the Will has been filed in Probate Court.

If the Executor continues to ignore your request then you may be forced to take legal proceedings known as entering a caveat which prevents the issue of a Grant until certain steps are taken, one of which would be the disclosure of the Will. Such a step is expensive and lengthy, and should not be taken lightly.

The executor has an obligation to keep the beneficiaries updated on the progress. As a beneficiary, you can also ask the executor for an account of the estate. This should outline how much you are due to receive and the progress made in the estate administration.

Registrar will request that an Affidavit of Due Execution. be filed by one of the attesting witnesses or any other. person present during the execution of the will so as to. satisfy herself that the Will was duly executed within the. provisions of the Wills Act.