Cuyahoga Ohio Reduce Capital — Resolution For— - Corporate Resolutions is an essential legal document used by businesses operating in Cuyahoga County, Ohio, to formally and legally reduce the amount of capital of a corporation. This resolution form provides a clear framework for companies to make necessary adjustments to their capital structure in accordance with the laws and regulations governing corporations in Cuyahoga County. By utilizing this resolution form, businesses in Cuyahoga County can effectively reduce their capital to reflect changes in financial circumstances, business strategies, or other relevant factors that may require a reduction in corporate capital. This form ensures that the reduction of capital is conducted in a legally sound manner, protecting the interests of all stakeholders involved. Keywords: Cuyahoga Ohio, reduce capital, resolution form, corporate resolutions, legal document, capital structure, financial circumstances, business strategies, stakeholders. Types of Cuyahoga Ohio Reduce Capital — Resolution For— - Corporate Resolutions: 1. Voluntary Capital Reduction Resolution Form: This type of resolution form is used when a corporation voluntarily decides to reduce its capital due to various reasons such as diminishing profitability, restructuring, or change in business objectives. It allows businesses to proactively reorganize their capital structure to better align with their current and future needs. 2. Court-Ordered Capital Reduction Resolution Form: In certain situations, a corporation may be required to reduce its capital by court order. This could arise from legal disputes, liquidation proceedings, or compliance with regulatory requirements. The court-ordered capital reduction resolution form provides a framework for corporations to comply with the court's directive while safeguarding the rights and interests of all parties involved. 3. Capital Reduction for Shareholder Distributions Resolution Form: When a corporation decides to distribute surplus capital or dividend payments to its shareholders, a specific resolution form is used to outline the reduction of capital necessary for such distributions. This form ensures that the shareholders receive their entitlements while maintaining compliance with relevant corporate laws and regulations in Cuyahoga County. Keywords: voluntary capital reduction, court-ordered capital reduction, shareholder distributions, surplus capital, dividend payments, legal disputes, liquidation proceedings, compliance, corporate laws, regulatory requirements.

Cuyahoga Ohio Reduce Capital - Resolution Form - Corporate Resolutions

Description

How to fill out Cuyahoga Ohio Reduce Capital - Resolution Form - Corporate Resolutions?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, locating a Cuyahoga Reduce Capital - Resolution Form - Corporate Resolutions suiting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, collected by states and areas of use. Apart from the Cuyahoga Reduce Capital - Resolution Form - Corporate Resolutions, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Professionals check all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Cuyahoga Reduce Capital - Resolution Form - Corporate Resolutions:

- Examine the content of the page you’re on.

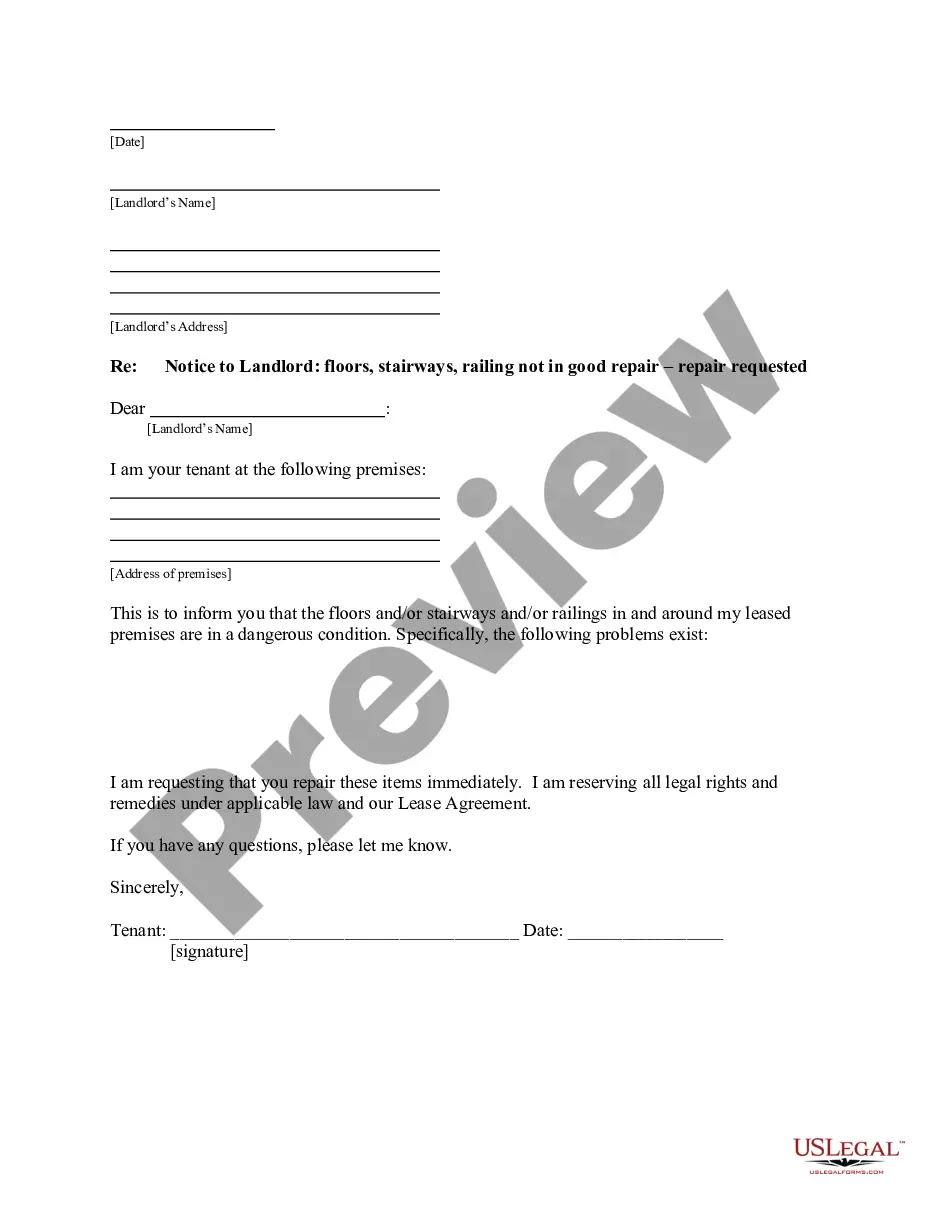

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Cuyahoga Reduce Capital - Resolution Form - Corporate Resolutions.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!