Dallas, Texas, Reduce Capital — Resolution For— - Corporate Resolutions Dallas, Texas is a vibrant city renowned for its booming corporate environment and supportive business climate. For businesses operating in this dynamic city, understanding the process of reducing capital through resolution forms becomes crucial. Corporate resolutions regarding the reduction of capital are important legal documents that enable businesses to decrease their capital base while adhering to legal requirements and protecting the interests of shareholders. Companies in Dallas, Texas, seeking to reduce their capital may utilize different types of resolution forms, namely: 1. General Resolution for Capital Reduction: This type of resolution form is commonly used when the primary purpose is to reduce the overall capital of the corporation. It outlines the details of the capital reduction, including the reasons behind the decision, the proposed amount to be reduced, and any additional provisions that accompany the reduction process. 2. Special Resolution for Capital Reduction: In certain cases, businesses may require a special resolution to effectuate a capital reduction. This resolution form is used when a specific issue, such as the repayment of share capital or the cancellation of unpaid share capital, needs to be resolved. 3. Board of Directors' Resolution for Capital Reduction: As the decision-making body of a corporation, the board of directors may issue a resolution to reduce the company's capital. This form of resolution is typically adopted during a board meeting and identifies the approval of the board members, the conditions for the reduction, and any necessary next steps. 4. Shareholders' Resolution for Capital Reduction: When a capital reduction requires the consent of the shareholders, a shareholders' resolution is essential. It outlines the shareholders' agreement to the reduction and records the voting results. This resolution requires a significant majority of shareholders to approve the capital reduction, ensuring transparency and protection of shareholders' interests. Reducing capital through corporate resolutions is a strategic move often pursued by businesses in Dallas, Texas, as it allows for financial flexibility, investment opportunities, or reallocation of resources. Companies must carefully draft these resolution forms with the guidance of legal professionals to ensure compliance with applicable laws and the smooth execution of the capital reduction process. In conclusion, Dallas, Texas, Reduce Capital — Resolution For— - Corporate Resolutions are critical legal documents that allow businesses in Dallas, Texas, to decrease their capital while safeguarding the interests of shareholders. Different types of resolutions, such as general resolutions, special resolutions, board of directors' resolutions, and shareholders' resolutions, may be used to effectuate the capital reduction. Successful execution of these resolution forms requires careful attention to legal requirements and the expertise of professionals well-versed in corporate law.

Dallas Texas Reduce Capital - Resolution Form - Corporate Resolutions

Description

How to fill out Dallas Texas Reduce Capital - Resolution Form - Corporate Resolutions?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from the ground up, including Dallas Reduce Capital - Resolution Form - Corporate Resolutions, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various categories varying from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find detailed resources and guides on the website to make any tasks associated with paperwork execution straightforward.

Here's how you can find and download Dallas Reduce Capital - Resolution Form - Corporate Resolutions.

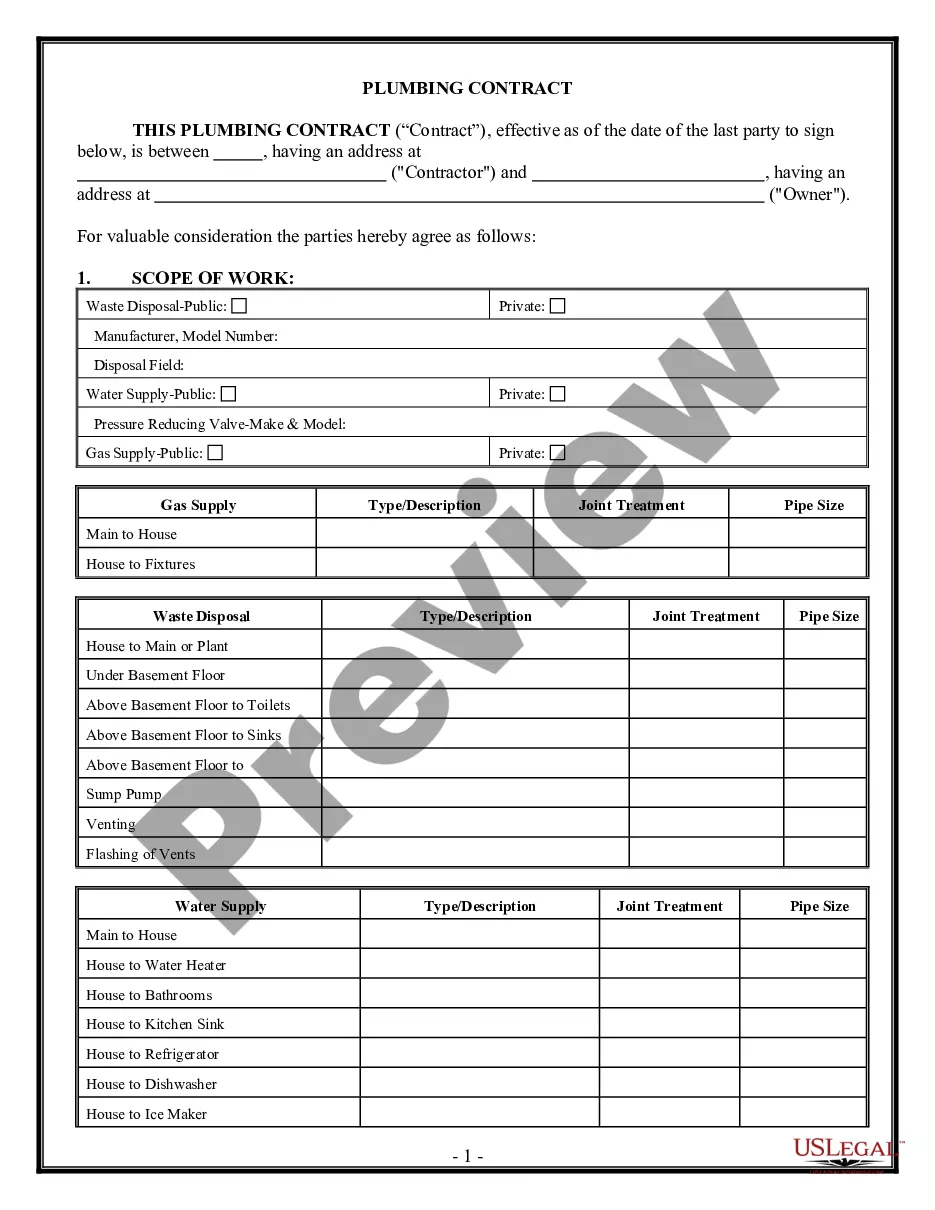

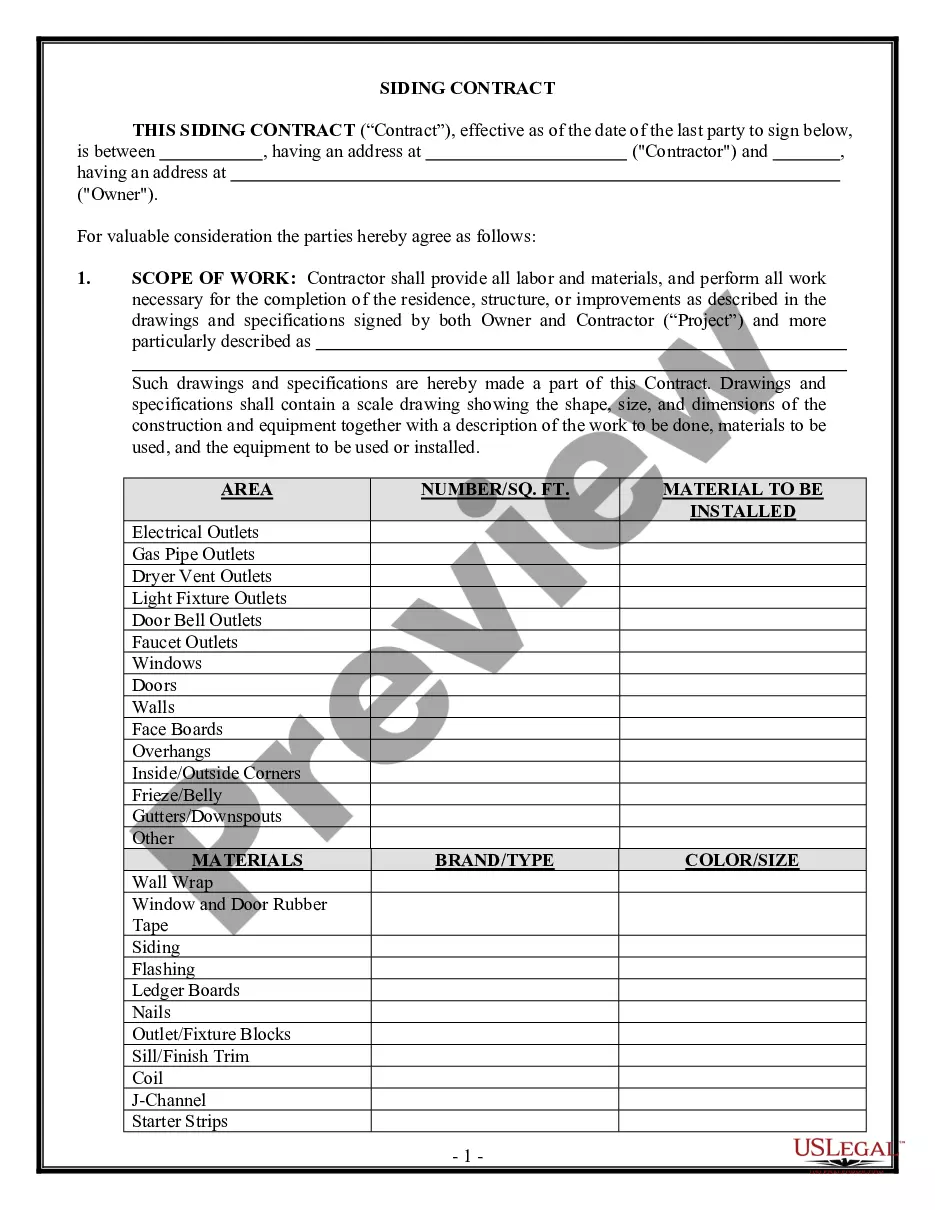

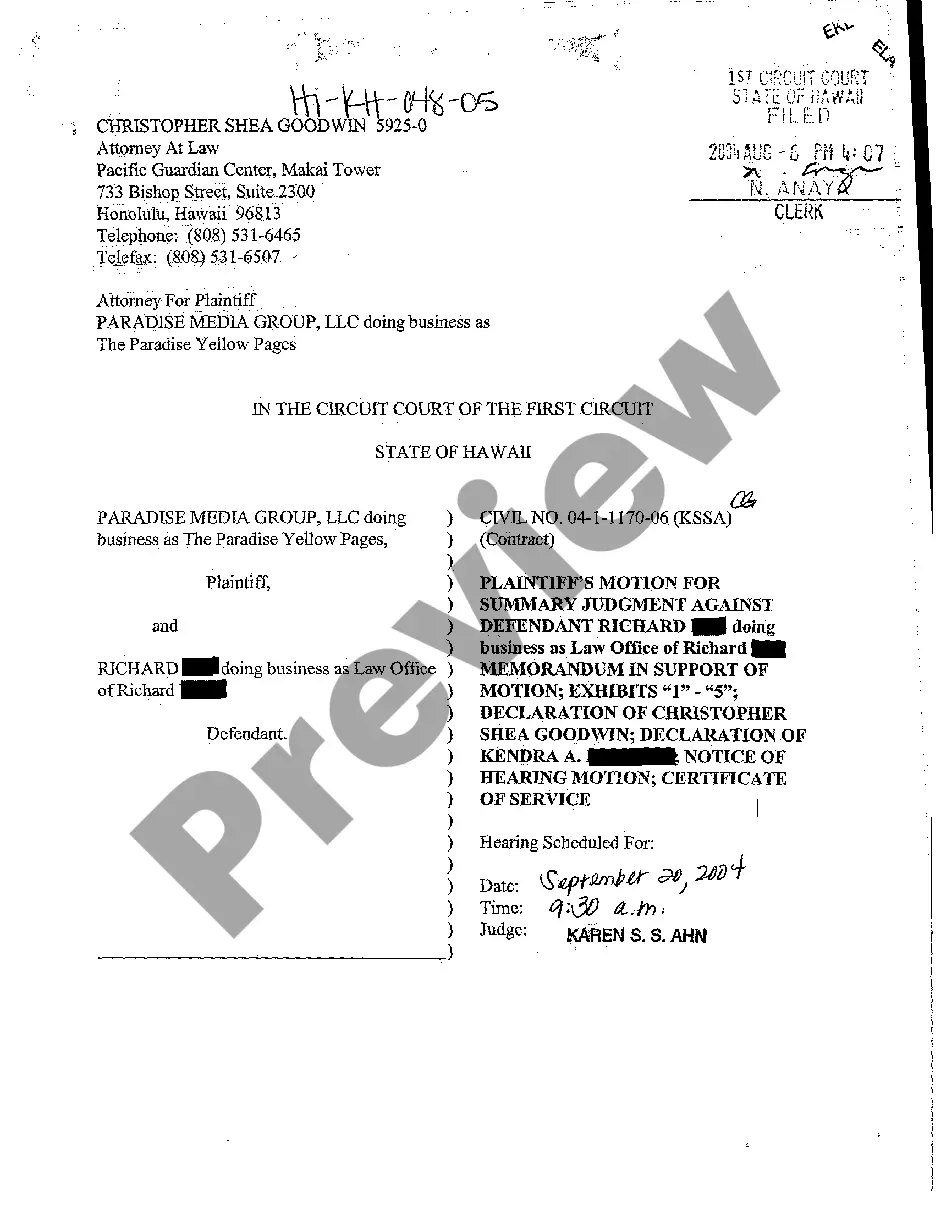

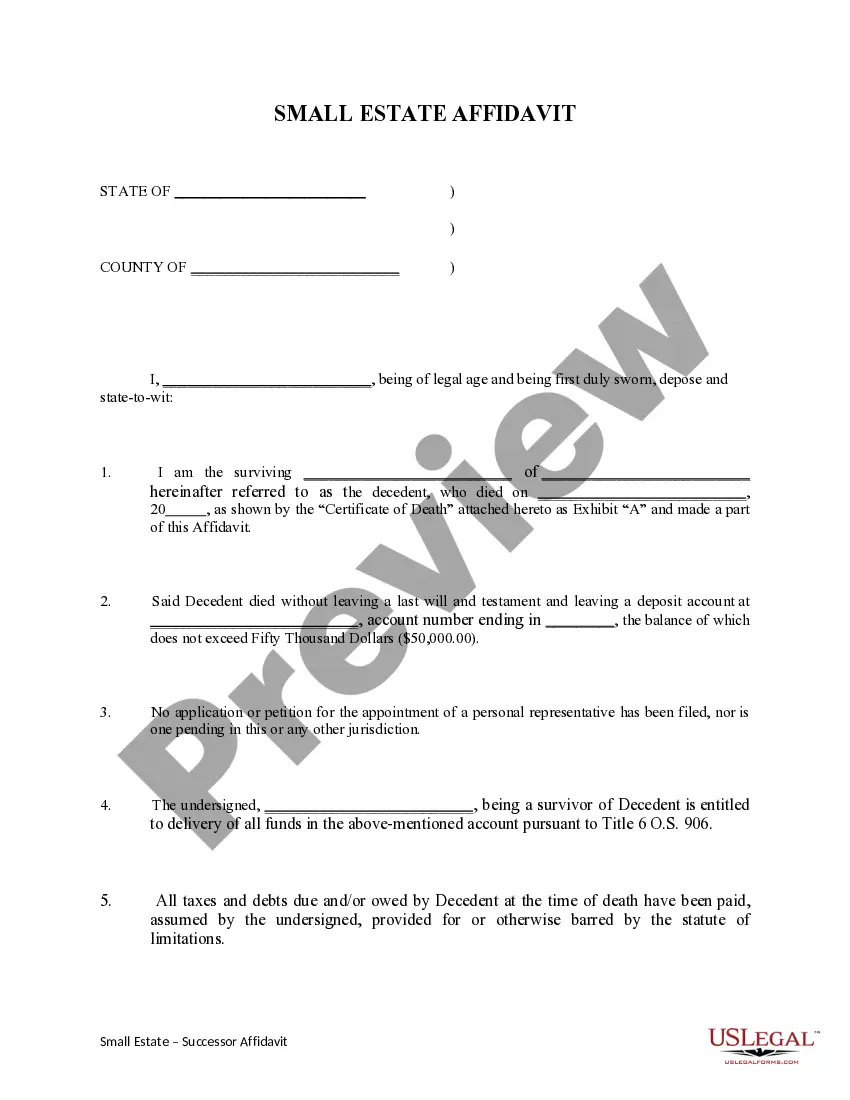

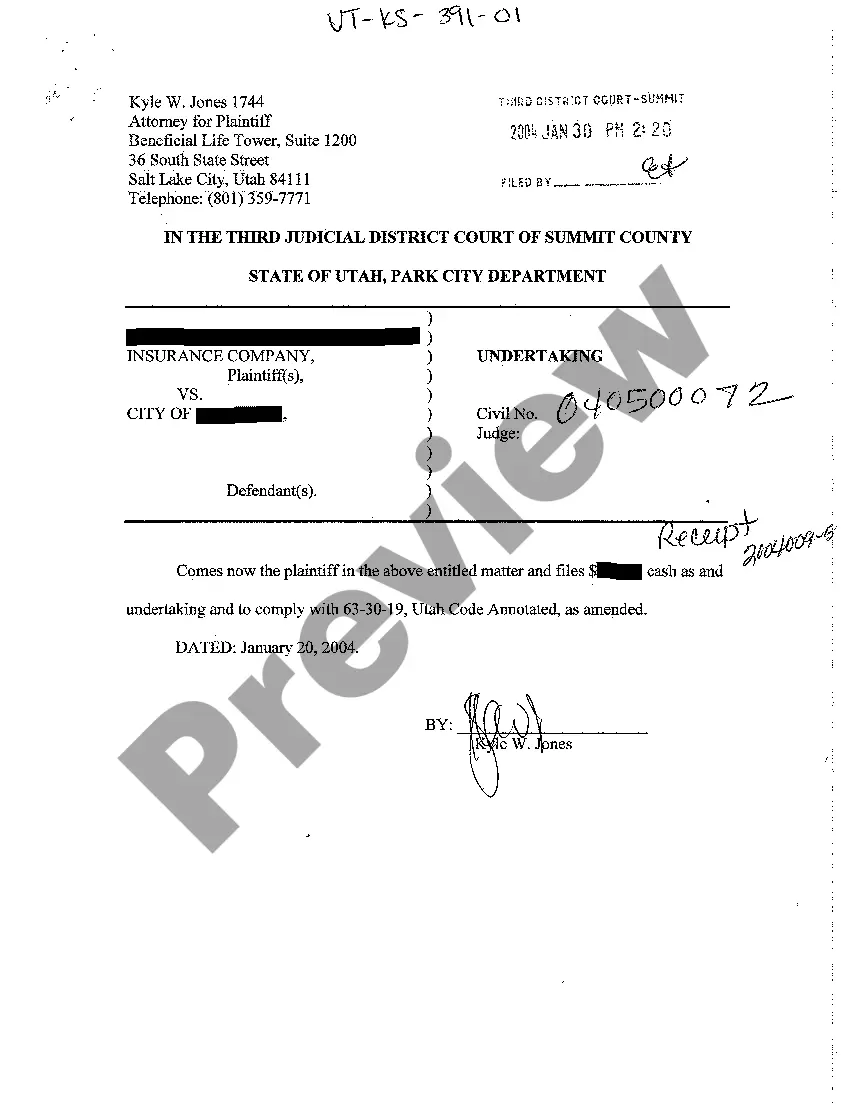

- Go over the document's preview and outline (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can impact the validity of some documents.

- Check the similar forms or start the search over to locate the right file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and purchase Dallas Reduce Capital - Resolution Form - Corporate Resolutions.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Dallas Reduce Capital - Resolution Form - Corporate Resolutions, log in to your account, and download it. Of course, our platform can’t replace an attorney completely. If you have to cope with an extremely challenging situation, we advise using the services of a lawyer to check your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-specific paperwork effortlessly!