Franklin Ohio Reduce Capital - Resolution Form - Corporate Resolutions

Description

How to fill out Reduce Capital - Resolution Form - Corporate Resolutions?

Drafting legal documents is essential in the contemporary world.

However, it is not always necessary to seek expert help to generate some of them from the ground up, including Franklin Reduce Capital - Resolution Form - Corporate Resolutions, utilizing a service such as US Legal Forms.

US Legal Forms provides over 85,000 templates across diverse categories spanning living wills to property paperwork to divorce documents.

Select the pricing plan, then a suitable payment method, and purchase Franklin Reduce Capital - Resolution Form - Corporate Resolutions.

Choose to save the form template in any available file format. Visit the My documents tab to re-download the document. If you’re already subscribed to US Legal Forms, you can find the needed Franklin Reduce Capital - Resolution Form - Corporate Resolutions, Log In to your account, and download it. It is important to mention that our platform cannot fully replace a legal expert. If you need to address an exceptionally complex case, we advise consulting an attorney to review your document before signing and submitting it. With over 25 years in the market, US Legal Forms has established itself as a preferred platform for various legal forms for millions of users. Join them today and acquire your state-compliant documents effortlessly!

- All forms are categorized by their applicable state, simplifying the search process.

- You can also access comprehensive resources and guides on the site to facilitate any tasks related to document completion.

- Here’s the process to acquire and download Franklin Reduce Capital - Resolution Form - Corporate Resolutions.

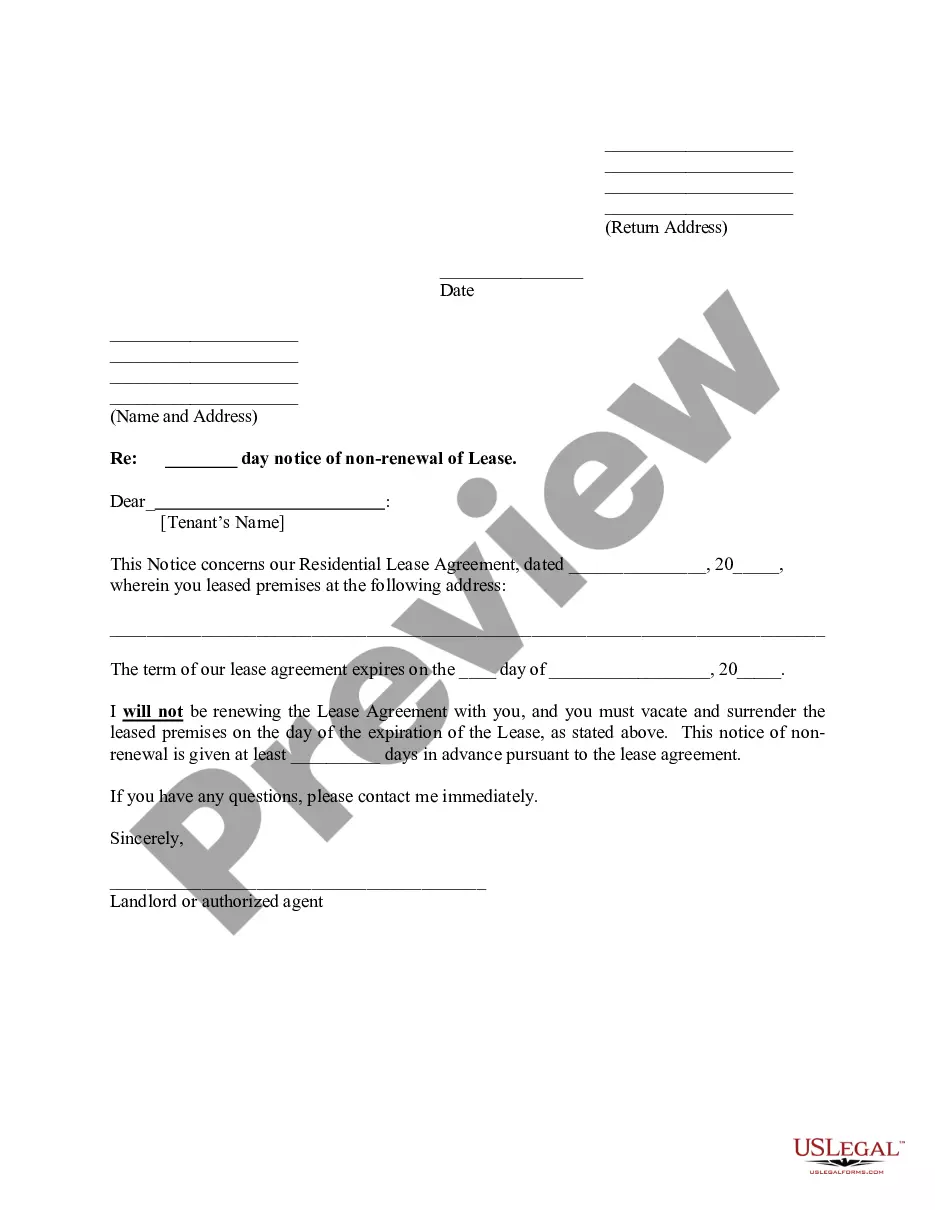

- View the document’s preview and description (if available) to gain an overview of what you’ll receive upon obtaining the form.

- Make sure that the template you select is suitable for your state/county/region as state laws can influence the legitimacy of certain documents.

- Examine related document templates or restart the search to find the appropriate document.

- Click Buy now and create your account. If you have an existing account, opt to Log In.

Form popularity

FAQ

To allow suitable time for the delivery of your documents, we recommend you check Australia Post delivery times. Late fees may apply if a document is not received by us within the required timeframe.

A selective capital reduction involves a company selectively reducing its share capital by a determined amount.

A company may generally reduce its share capital in any way. In particular, a company may do so by cancelling or reducing the liability on partly paid shares, repaying any paid-up share capital in excess of the company's wants, or cancelling any paid-up share capital that is lost or unrepresented by available assets.

As per Section 61(1)(e) of the Companies Act, 2013, provides that, a limited company having share capital, if authorised by its Articles of Association, may cancel shares, by passing an ordinary resolution in that behalf, which have not been taken or agreed to be taken by any person, and diminish the amount of its

A company may reduce its share capital by doing either of the following: (a) Seeking members' approval. (b) Filing an Order of Court.

A share buy-back, on the other hand, is when a company acquires shares in itself from existing shareholders, and then cancels these shares. A reduction in share capital occurs when any money paid to a company in respect of a member's shares is returned to the member.

A company may want to reduce its share capital for various reasons, including to create distributable reserves to pay a dividend or to buy back or redeem its own shares; to reduce or eliminate accumulated realised losses in order to be able to make distributions in the future; to return surplus capital to shareholders;

1 of the Corporations Act 2001 (the Corporations Act) and does NOT cover a reduction in share capital achieved through: redemption of redeemable preference shares (s254J-254K)

Capital reduction is the process of decreasing a company's shareholder equity through share cancellations and share repurchases, also known as share buybacks. The reduction of capital is done by companies for numerous reasons, including increasing shareholder value and producing a more efficient capital structure.

If the amount of paid up capital including share premium is reduced then the share capital will be debited with the amount of the reduction. If the reduction was effected by a repayment then the credit will go to cash, otherwise a reserve account will be created which is treated as a realised profit.