Chicago Illinois Demand for Collateral by Creditor is a legal process in which a creditor, typically a financial institution, requests collateral from a debtor to secure a loan or debt. This demand can arise in various situations, such as defaulting on a loan or failing to make timely payments. The demand for collateral is a way for creditors to protect their financial interests and ensure repayment of debts. In Chicago, Illinois, the demand for collateral by creditors follows specific legal procedures governed by the state's laws. These procedures aim to ensure fair treatment of debtors and protect both parties' rights. There are different types of Chicago Illinois Demand for Collateral by Creditor, including: 1. Secured Loans: When a borrower applies for a loan in Chicago, a creditor may require collateral, such as real estate, vehicles, or other valuable assets. If the borrower fails to repay the loan, the creditor can demand the collateral to recover the outstanding debt. 2. Mortgage Foreclosure: In cases where a debtor defaults on mortgage payments in Chicago, the creditor, typically a bank, can initiate a demand for collateral by foreclosing on the property. This involves legal actions to transfer ownership of the property to the creditor to recover the debt. 3. UCC Filing: Under the Uniform Commercial Code (UCC) in Illinois, a creditor can file a financing statement to assert its rights over collateral provided by a debtor. This filing serves as public notice that the creditor has a security interest in certain assets, allowing them to demand the collateral if the debtor fails to fulfill their obligations. 4. Repossession: If a debtor in Chicago fails to make payments on financed assets, such as cars or equipment, the creditor may be entitled to repossess the collateral. Repossession involves legally seizing the assets to recover the debt or negotiate a resolution. 5. Judgment Lien: If a creditor obtains a judgment against a debtor in a lawsuit, they may file a lien on the debtor's assets in Chicago. This lien grants the creditor the right to demand the collateral and have it sold to satisfy the judgment debt. It is crucial for both debtors and creditors in Chicago, Illinois, to understand their rights and obligations regarding the demand for collateral. Seeking legal advice and understanding the specific terms and conditions outlined in loan agreements can help navigate these complex situations and ensure fair outcomes for all parties involved.

Chicago Illinois Demand for Collateral by Creditor

Description

How to fill out Chicago Illinois Demand For Collateral By Creditor?

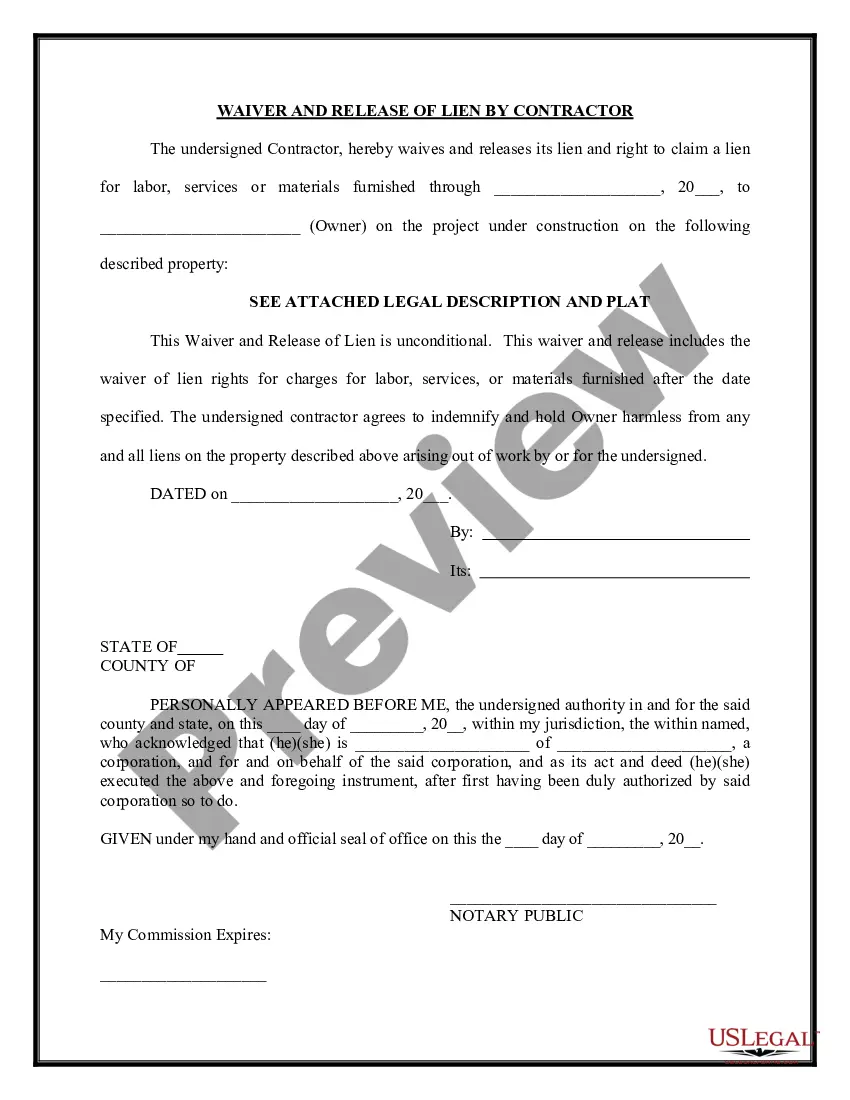

Do you need to quickly draft a legally-binding Chicago Demand for Collateral by Creditor or probably any other form to take control of your personal or corporate matters? You can select one of the two options: contact a legal advisor to write a valid document for you or draft it entirely on your own. Thankfully, there's another solution - US Legal Forms. It will help you get neatly written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-compliant form templates, including Chicago Demand for Collateral by Creditor and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- First and foremost, double-check if the Chicago Demand for Collateral by Creditor is tailored to your state's or county's regulations.

- If the form has a desciption, make sure to check what it's suitable for.

- Start the searching process over if the form isn’t what you were looking for by using the search bar in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Chicago Demand for Collateral by Creditor template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to find and download legal forms if you use our services. In addition, the templates we offer are updated by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!