Contra Costa California is a county located in Northern California, known for its vibrant communities and scenic landscapes. It attracts thousands of residents and businesses with its excellent quality of life, thriving economy, and abundant recreational opportunities. Demand for collateral by creditors is a legal term used to describe a situation in which a creditor requests additional security from a borrower to secure a loan or debt. In Contra Costa California, there are several types of demand for collateral by creditors, namely: 1. Real Estate Collateral: In cases where the borrower owns real estate properties in Contra Costa County, creditors may demand collateral in the form of a lien on the property's title. This ensures that if the borrower defaults on the loan, the creditor can seize and sell the property to recover their investment. 2. Vehicle Collateral: Another type of collateral commonly demanded by creditors in Contra Costa California is vehicles. Borrowers who own automobiles, motorcycles, or other vehicles may be required to grant a security interest or a lien on the vehicle as collateral. This provides the creditor with the ability to repossess and sell the vehicle if the borrower fails to fulfill their loan obligations. 3. Financial Collateral: Creditors may also demand financial collateral, which can include cash, stocks, bonds, or other financial assets. By requiring borrowers to pledge these assets as collateral, creditors can have recourse in case of default and liquidate the assets to recover their money. 4. Personal Property Collateral: Some creditors may request collateral in the form of personal property, such as jewelry, artwork, or valuable collectibles. This type of collateral serves as an additional security measure for the creditor, ensuring they have an alternative means to recoup their losses if the borrower defaults. In summary, Contra Costa California's demand for collateral by creditors encompasses various types, including real estate, vehicles, financial assets, and personal property. These collateral requirements aim to protect the creditor's investment and mitigate risks associated with lending in the county.

Contra Costa California Demand for Collateral by Creditor

Description

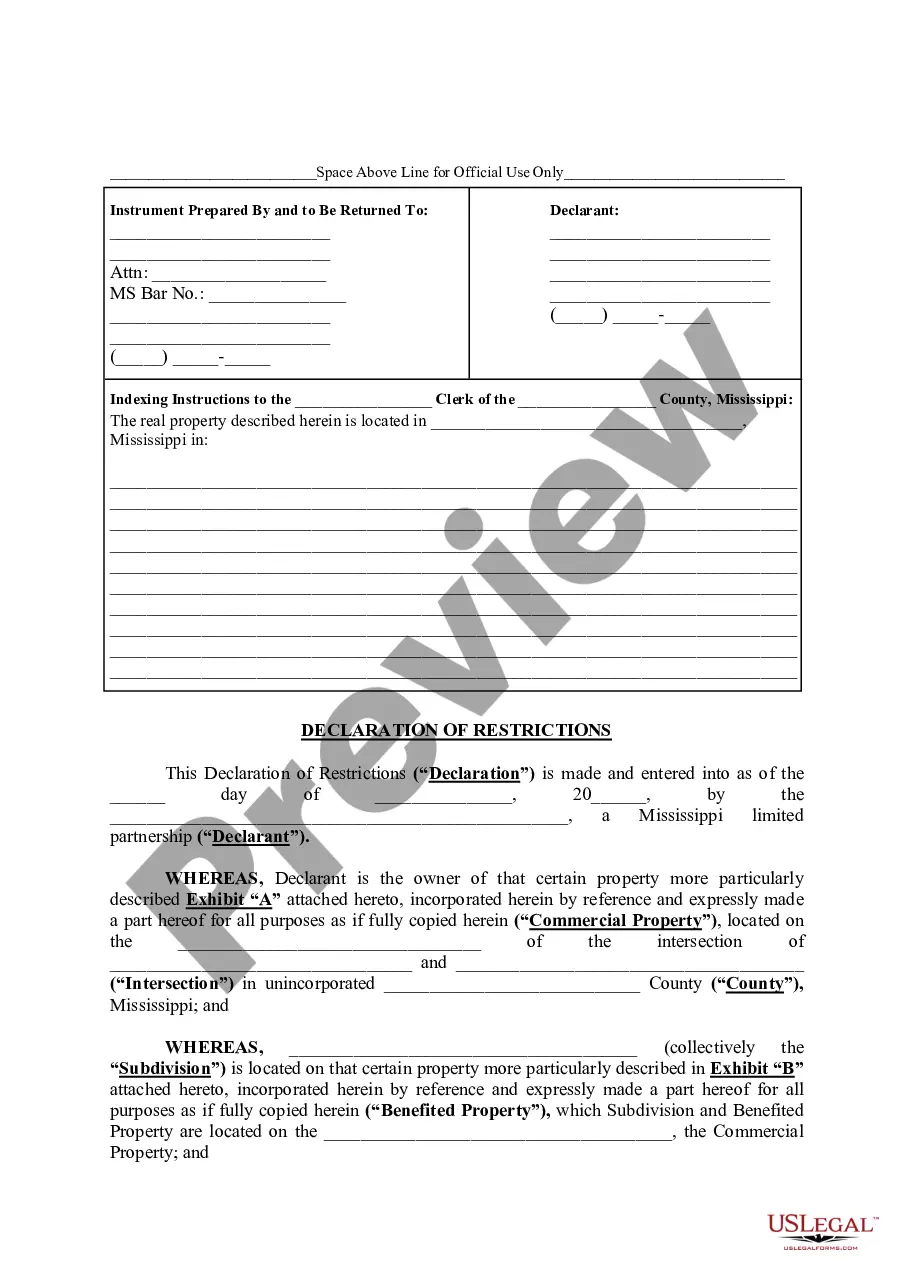

How to fill out Contra Costa California Demand For Collateral By Creditor?

Drafting paperwork for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to draft Contra Costa Demand for Collateral by Creditor without expert help.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Contra Costa Demand for Collateral by Creditor by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Contra Costa Demand for Collateral by Creditor:

- Look through the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any situation with just a couple of clicks!

Form popularity

FAQ

In order to become a secured party, one must (i) prepare a document which grants a security interest (which is the agreement between the parties) and (ii) also perfect on that security interest (which is the notice to the world of the security interest). Without both steps occurring, the lender will be unsecured.

In California, you can't be sued for consumer debt older than four years. But making even a partial payment can restart the debt clock.

The clock starts the date you make your last payment and runs for whatever time period is applicable in your state. If, for example, you haven't made a payment on your credit card since January of 2021 and you live in California where the statute of limitations is four years, the SOL expires in January of 2025.

Perfection by Possession: A secured creditor can perfect his or her security interest by taking possession of the collateral until the debtor has paid the debt for which the collateral was pledged. For example, stocks, bonds, jewelry.

In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

Under Article 9 of the UCC, a secured creditor's remedies include a sale of its collateral. As with a sale under section 363 of the Bankruptcy Code, the secured lender may choose to credit bid in connection with a sale of its collateral and thereby become the owner of the collateral.

Generally, the statute of limitation for most consumer debts arising from written contracts in California expires after four years. This includes credit card debts, auto loans, personal loans, private student loans, and medical debts.

If a borrower defaults on a secured credit product, the secured creditor has a legal right to the secured asset used as collateral. The secured asset may be seized by the secured creditor and sold to pay off any remaining obligations.

Is it true that a debtor can sell collateral without the lender's consent? Yes, under the Bankruptcy Code it can be done ? even if the collateral is sold for less than the amount of outstanding debt. So, a secured creditor must be proactive if a distressed borrower tries to sell the collateral in a bankruptcy.

This is legal, but a collection agency is only allowed to charge interest on a debt that you owe according to what is the original creditor agreement. This means that if any fee or interest was not authorized by the original agreement or by law, it is not allowed.