Palm Beach, Florida is a vibrant coastal city located in Palm Beach County, known for its pristine beaches, luxurious resorts, and upscale lifestyle. It is a popular destination for tourists and celebrities alike, offering a wide range of recreational activities, cultural attractions, and a thriving business community. One important aspect of financial transactions in Palm Beach, Florida is the concept of Demand for Collateral by Creditor. When individuals or businesses seek loans, lenders may require collateral as a form of security against the borrowed amount. In the event of default on loan repayment, lenders can exercise their rights to demand collateral, allowing them to recoup their losses. There are various types of Demand for Collateral by Creditor prevalent in Palm Beach, Florida, including: 1. Mortgage loans: Mortgage lenders often require the property being financed as collateral for the loan. This ensures that if the borrower fails to repay, the lender can seize the property and sell it to recover the outstanding balance. 2. Business loans: In the case of business loans, lenders may demand collateral such as real estate, equipment, inventory, or accounts receivable. This provides assurance to lenders in case the business fails to meet its repayment obligations. 3. Personal loans: When individuals require financing for personal reasons, lenders may ask for collateral like vehicles, jewelry, or other valuable assets. In case of default, the lender can seize the collateral to compensate for the unpaid debt. Palm Beach, Florida, being an affluent area, witnesses a substantial demand for collateral by creditors. Lenders often impose strict criteria to ensure the security of their loans, mitigating the risk of non-repayment. The value of collateral plays a crucial role in determining the loan amount, interest rates, and repayment terms offered to borrowers. Individuals and businesses seeking loans in Palm Beach, Florida should carefully assess their collateral options and understand the potential consequences of defaulting on loan repayment. It is advisable to consult with financial advisors or legal professionals to fully comprehend the terms and implications associated with the Demand for Collateral by Creditor.

Palm Beach Florida Demand for Collateral by Creditor

Description

How to fill out Palm Beach Florida Demand For Collateral By Creditor?

How much time does it usually take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, locating a Palm Beach Demand for Collateral by Creditor meeting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. In addition to the Palm Beach Demand for Collateral by Creditor, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Experts verify all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Palm Beach Demand for Collateral by Creditor:

- Check the content of the page you’re on.

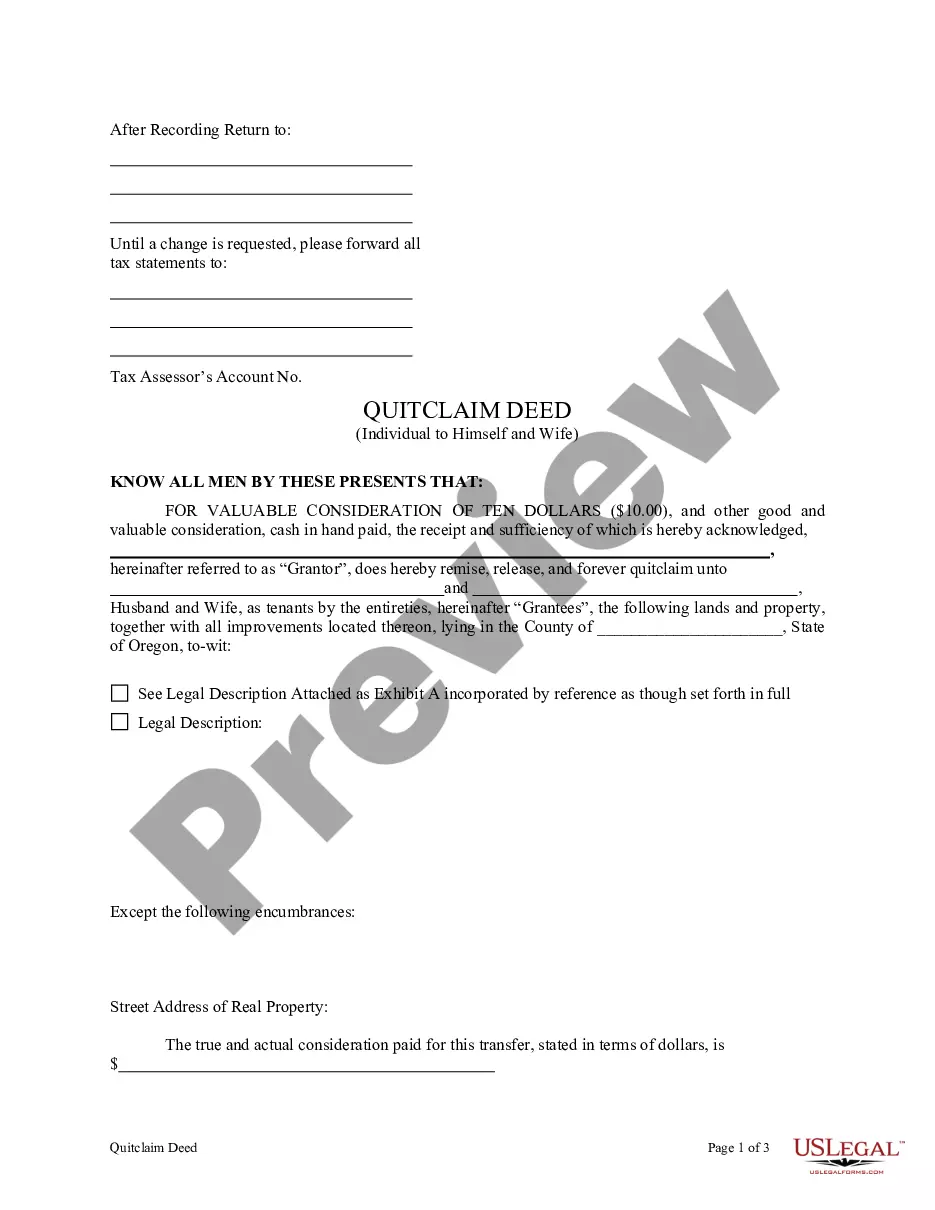

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Palm Beach Demand for Collateral by Creditor.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!