Phoenix Arizona Demand for Collateral by Creditor refers to the legal process through which a creditor requests a borrower to provide additional collateral to secure a loan or debt. In this process, the lender asks the debtor to pledge specific assets or properties to mitigate the risk of default or non-payment. The demand for collateral serves as a protective measure for the creditor in case the debtor fails to fulfill their financial obligations. Various types of Phoenix Arizona Demand for Collateral by Creditor may include: 1. Real Estate Collateral Demand: In this scenario, the creditor asks the debtor to pledge their real estate property, such as a home, land, or commercial building, to secure the debt. If the debtor defaults, the creditor can seize and sell the property to recover the loan amount. 2. Vehicle Collateral Demand: This type of collateral demand involves the debtor providing their vehicle as collateral to secure the loan. It can include cars, motorcycles, boats, or any other motorized vehicle. If the debtor fails to repay the debt, the creditor can repossess and sell the vehicle to recover the outstanding balance. 3. Financial Asset Collateral Demand: Creditors may demand collateral in the form of financial assets, such as stocks, bonds, certificates of deposit, or other securities. The debtor effectively grants the lender a security interest in these assets, allowing the creditor to seize and sell them if the debtor defaults. 4. Personal Property Collateral Demand: Creditors can ask for collateral in the form of personal property, including valuable possessions such as jewelry, artwork, collectibles, or electronics. If the debtor fails to repay the debt, the creditor can assert their rights on these assets and sell them to recoup the outstanding loan amount. 5. Business Asset Collateral Demand: This type of demand occurs when business loans are involved. Creditors may require collateral in the form of business assets, such as equipment, inventory, intellectual property, or accounts receivable. In the event of default, the creditor can seize and liquidate these assets to recover their investment. In Phoenix, Arizona, the demand for collateral by creditors follows the legal procedures established by state law. It is essential for both borrowers and creditors to understand their rights and obligations regarding collateral demand to ensure a fair and transparent lending process. With collateral in place, creditors have greater confidence in lending funds, while borrowers may have better access to loans or better terms based on their collateral value and creditworthiness.

Phoenix Arizona Demand for Collateral by Creditor

Description

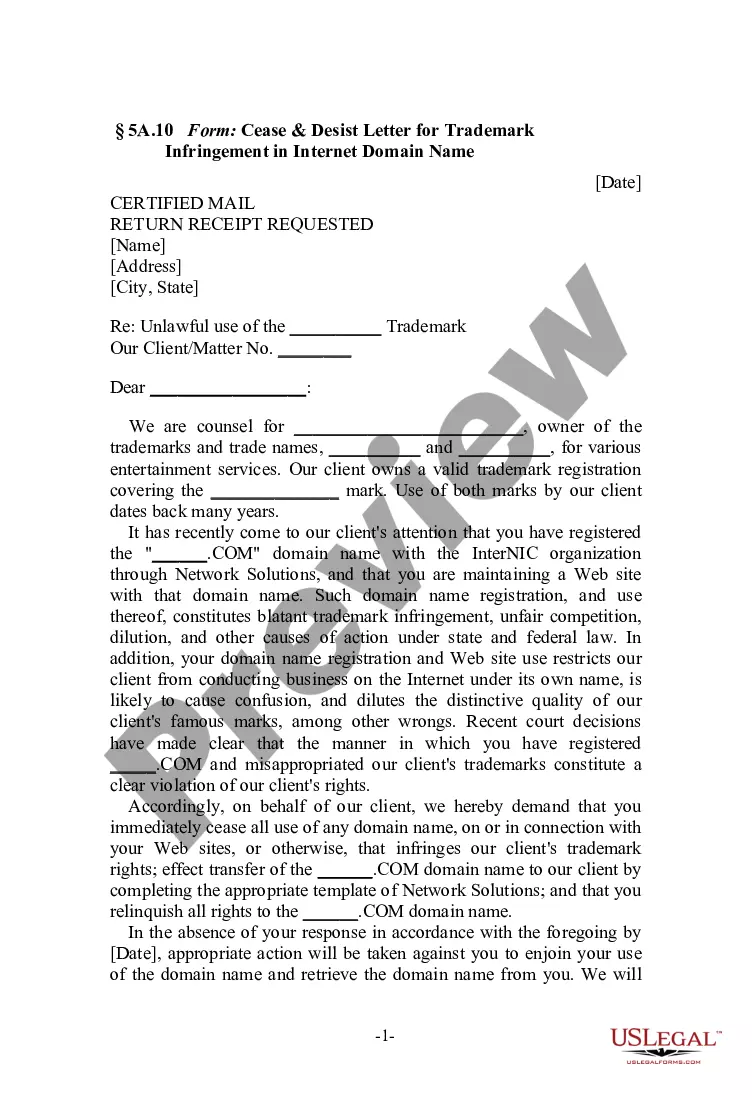

How to fill out Phoenix Arizona Demand For Collateral By Creditor?

Whether you plan to start your business, enter into a contract, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business case. All files are collected by state and area of use, so opting for a copy like Phoenix Demand for Collateral by Creditor is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several additional steps to obtain the Phoenix Demand for Collateral by Creditor. Follow the instructions below:

- Make certain the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to get the sample when you find the correct one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Phoenix Demand for Collateral by Creditor in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!