Title: Understanding the Harris Texas Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor Introduction: In Harris, Texas, many individuals choose to pursue a self-employment career as independent contractors. This allows them to work flexibly, set their own hours, and potentially earn a significant percentage of their sales. The Harris Texas Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor is a legally binding document that outlines the terms and conditions between the contractor and the employer. In this article, we will delve into the details of this agreement, highlighting its key elements, types, and essential keywords to give you a comprehensive understanding. Key Elements of the Harris Texas Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor: 1. Contractor Identification: The agreement will clearly identify the contractor, including their legal name, address, and contact information. 2. Hiring Company Identification: The agreement will state the name and details of the company or organization employing the independent contractor. 3. Scope of Work: It will specify the nature of the services the contractor will provide, including the specific products or services involved. 4. Sales-Based Compensation: The primary characteristic of this agreement is that the contractor will receive a percentage of the sales as compensation instead of a fixed salary or hourly wage. 5. Percentage Calculation: The agreement will outline how the percentage is calculated, such as based on gross sales, net sales, or a combination of factors. Types of Harris Texas Employment Agreement — Percentage of Sales — Self-Employed Independent Contractor: 1. Sales Representative Agreement: This type of agreement is commonly used when the contractor's main responsibility is generating sales leads and closing deals on behalf of the hiring company. 2. Franchise Agreement: In some cases, the agreement may take the form of a franchise agreement, where the independent contractor operates under an established brand name and receives a percentage of the sales generated under that brand. 3. Commission-Only Agreement: This type of agreement is common for sales professionals who work on a commission-only basis, where there is no base salary, and the contractor's compensation solely relies on their ability to generate sales. 4. Co-Marketing Agreement: Under this agreement, the contractor collaborates with the hiring company for joint marketing efforts, sharing the associated costs and subsequently receiving a percentage of the sales resulting from this collaborative campaign. Keywords: Harris Texas, Employment Agreement, Percentage of Sales, Self-Employed, Independent Contractor, Contractor Identification, Hiring Company Identification, Scope of Work, Sales-Based Compensation, Percentage Calculation, Sales Representative Agreement, Franchise Agreement, Commission-Only Agreement, Co-Marketing Agreement. Conclusion: The Harris Texas Employment Agreement — Percentage of Sales — Self-Employed Independent Contractor is designed to provide a fair and transparent framework for self-employed individuals working in Harris, Texas. This agreement allows contractors to enter into mutually beneficial partnerships with hiring companies, where compensation is directly tied to the sales generated. By familiarizing yourself with the various types of agreements and understanding the key elements and relevant keywords discussed above, you will be better equipped to navigate this dynamic and potentially lucrative self-employment arrangement.

Harris Texas Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

How to fill out Harris Texas Employment Agreement - Percentage Of Sales - Self-Employed Independent Contractor?

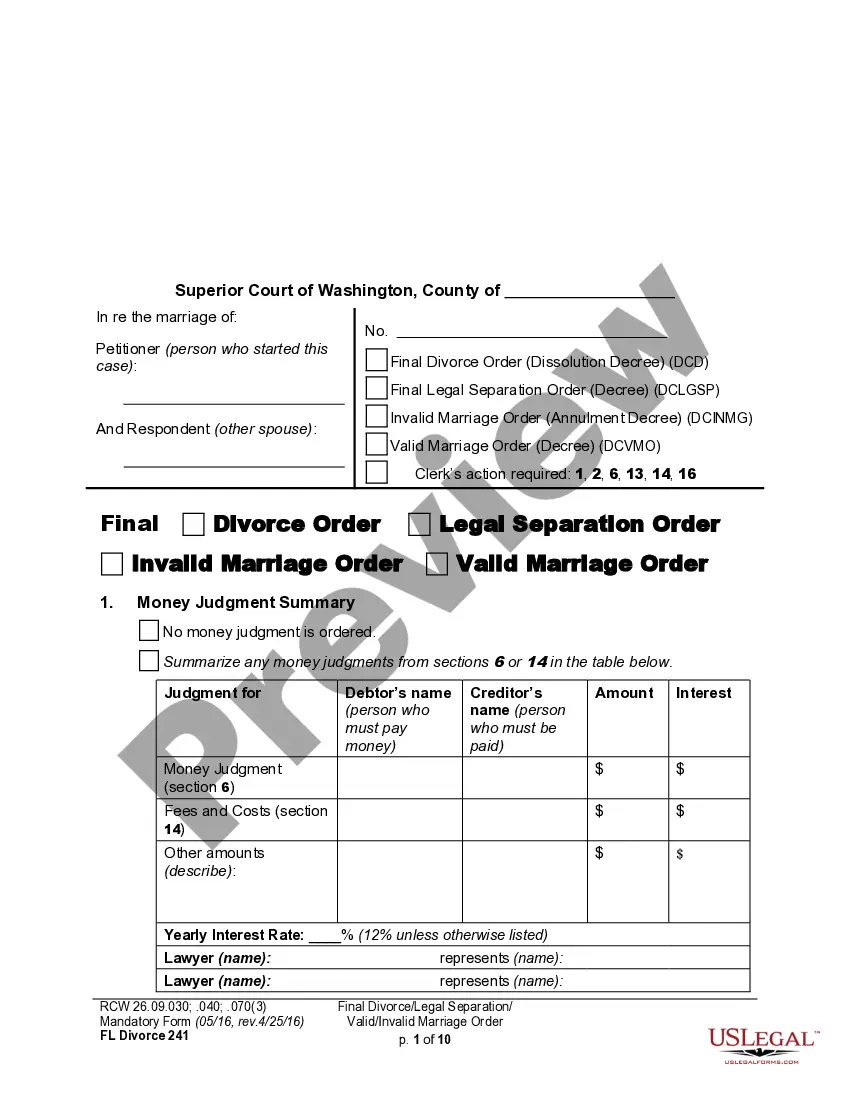

Preparing legal documentation can be burdensome. Besides, if you decide to ask an attorney to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Harris Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the recent version of the Harris Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Harris Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Harris Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!