Maricopa Arizona Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor is a legally binding contract that outlines the terms and conditions between an employer and a self-employed individual working in Maricopa, Arizona. This agreement is especially relevant for individuals working in sales or where compensation is based on a percentage of sales. Within Maricopa, Arizona, there are several types of Employment Agreements — Percentage of Sale— - Self-Employed Independent Contractor, categorized based on the industry or specific terms involved. Here are a few examples: 1. Real Estate Sales Agreement — Percentage of Sale— - Self-Employed Independent Contractor: This type of agreement is commonly used in the real estate industry, where independent contractors work as agents or brokers and earn a commission based on the percentage of sales or transactions closed. 2. Retail Sales Agreement — Percentage of Sale— - Self-Employed Independent Contractor: This agreement is applicable to individuals engaged in retail sales activities, such as selling products or services in a store or marketplace. The compensation will be determined by a percentage of the sales made by the contractor. 3. Direct Sales Agreement — Percentage of Sale— - Self-Employed Independent Contractor: Independent contractors involved in direct sales, such as multi-level marketing or door-to-door sales, utilize this specific agreement. The compensation for these contractors is based on a percentage of the sales they generate. 4. Consulting Services Agreement — Percentage of Sale— - Self-Employed Independent Contractor: In the consulting industry, where professionals provide advisory or specialized services, this agreement outlines the terms for compensation based on a percentage of the sales or revenue generated through their consultancy services. Irrespective of the specific industry or type of Maricopa Arizona Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor, certain key elements should be included. These may consist of provisions related to payment terms, commission calculations, liability, termination clauses, non-disclosure agreements, and confidentiality agreements, among others. It is crucial for both the employer and the self-employed independent contractor to carefully review and understand the terms of the agreement before signing. Seeking legal advice and making any necessary modifications to align with individual circumstances is highly recommended.

Maricopa Arizona Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

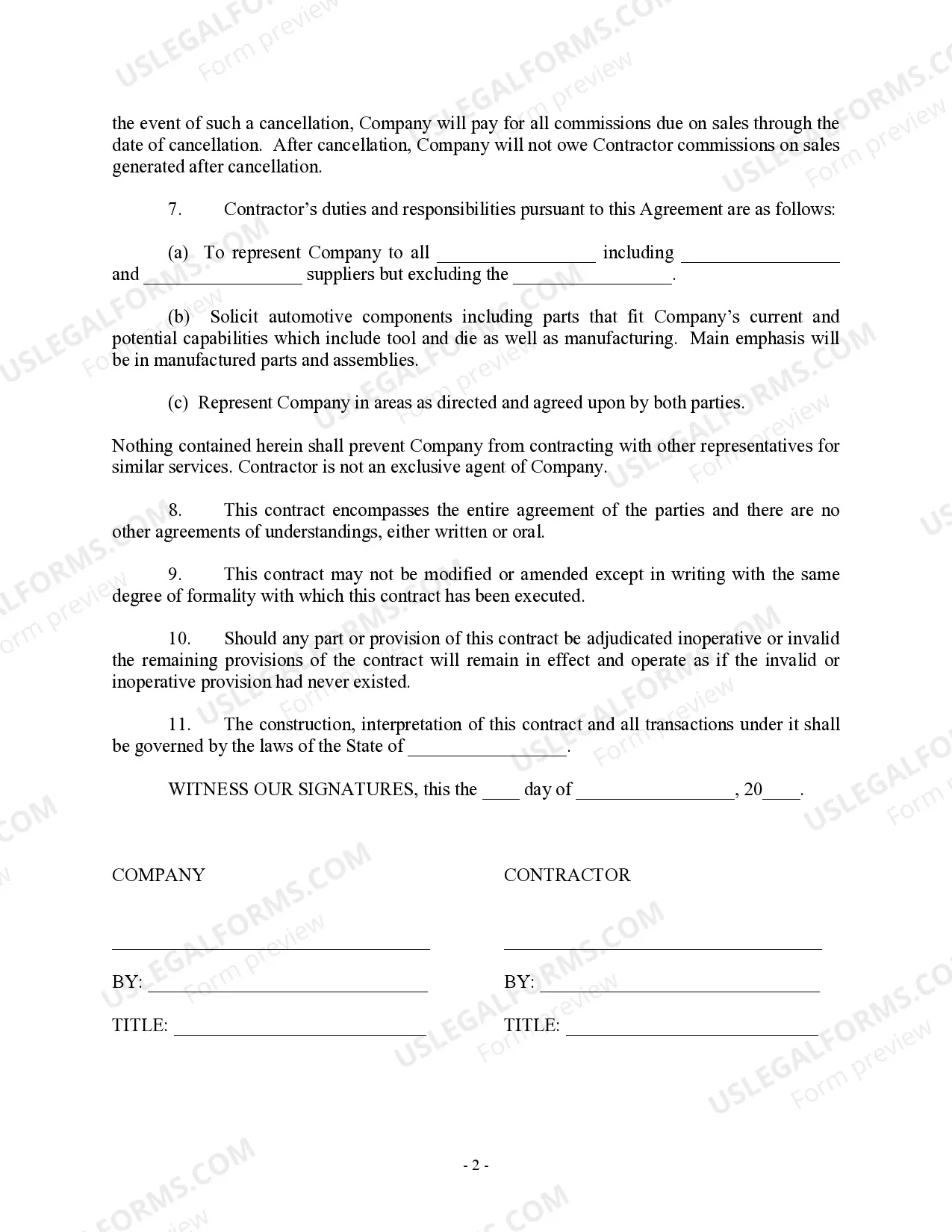

How to fill out Maricopa Arizona Employment Agreement - Percentage Of Sales - Self-Employed Independent Contractor?

If you need to get a reliable legal document supplier to get the Maricopa Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, consider US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of learning materials, and dedicated support make it easy to get and complete different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

You can simply select to look for or browse Maricopa Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, either by a keyword or by the state/county the document is created for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Maricopa Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor template and take a look at the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be instantly available for download once the payment is processed. Now you can complete the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes this experience less costly and more affordable. Create your first company, arrange your advance care planning, draft a real estate agreement, or execute the Maricopa Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor - all from the comfort of your home.

Join US Legal Forms now!