Nassau New York Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor is a legally binding document that outlines the terms and conditions between an employer and a self-employed independent contractor based in Nassau County, New York. This employment agreement is specifically designed for individuals who are compensated based on a percentage of sales. The Nassau New York Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor focuses on the unique working relationship between an employer and a self-employed contractor who earns a percentage of the sales they generate. This arrangement allows the contractor to have control over their earnings, as their compensation is directly linked to their sales performance. The agreement details various aspects such as the contractor's responsibilities, scope of work, sales targets, commission structure, payment terms, and terms of termination. It also includes clauses related to non-disclosure, confidentiality, non-compete, and intellectual property rights protection. Nassau County in New York offers various types of Employment Agreements — Percentage of Sale— - Self-Employed Independent Contractor, tailored to different industries and sectors. Some examples include: 1. Real Estate Sales Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor: This agreement is specifically designed for self-employed real estate agents or brokers operating in Nassau County. It outlines the terms of engagement, commission structure, marketing support, and other relevant provisions. 2. Automotive Sales Employment Agreement — Percentage of Sales — Self-Employed Independent Contractor: This agreement caters to self-employed salespersons working in the automotive industry in Nassau County. It covers aspects such as target sales figures, commission rates, customer retention strategies, and dealership guidelines. 3. Retail Sales Employment Agreement — Percentage of Sales — Self-Employed Independent Contractor: This agreement is suitable for self-employed contractors working in the retail sector in Nassau County. It specifies the product range, sales targets, commission structure, visual merchandising requirements, and other important details. By implementing a Nassau New York Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor, both parties can establish clear expectations and protect their rights. It ensures that the contractor receives fair compensation based on their sales performance, while the employer maintains control over the terms of engagement and protection of their business interests.

Nassau New York Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

How to fill out Nassau New York Employment Agreement - Percentage Of Sales - Self-Employed Independent Contractor?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Nassau Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Nassau Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor from the My Forms tab.

For new users, it's necessary to make some more steps to get the Nassau Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor:

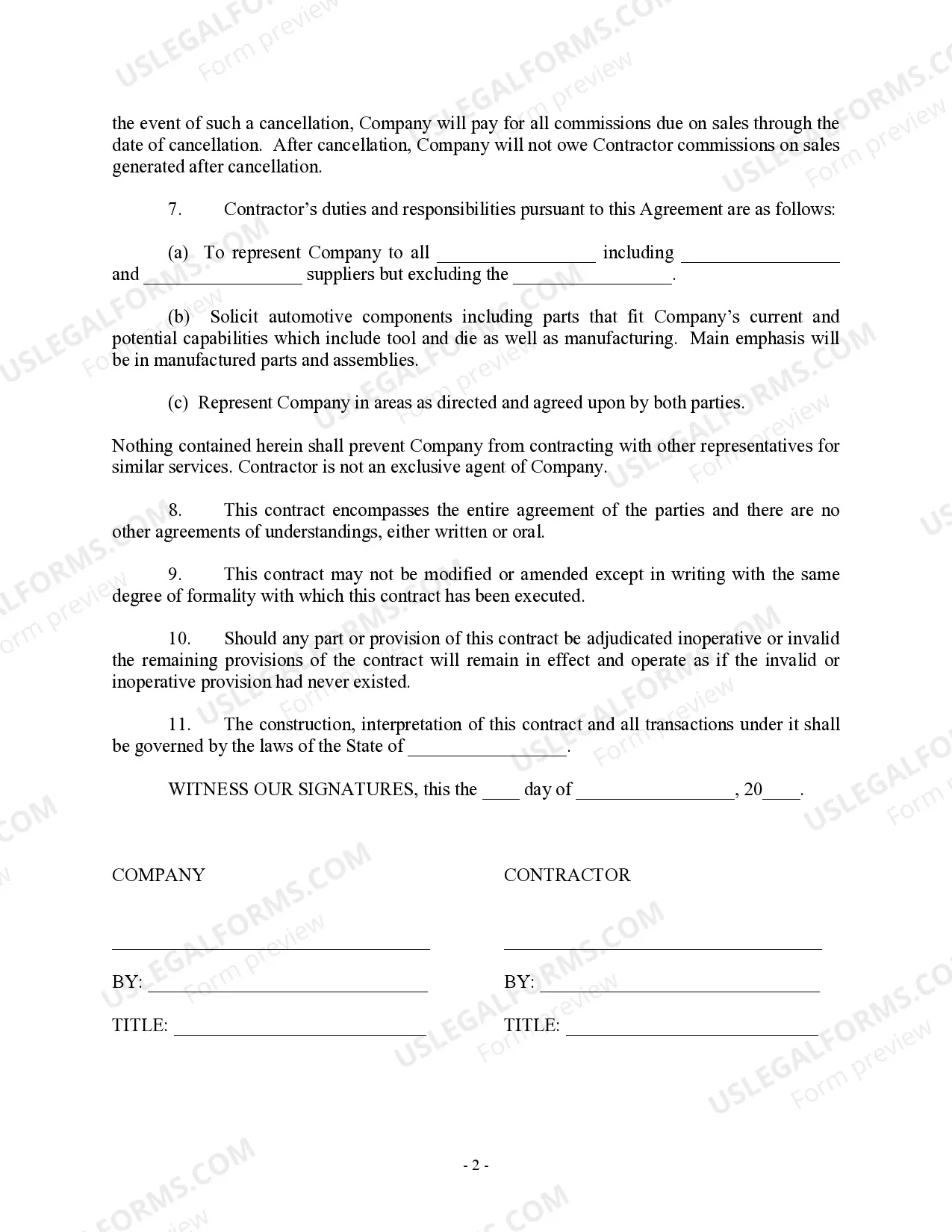

- Analyze the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document once you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!