A Suffolk New York Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor is a legally binding document that outlines the terms and conditions between an employer and a self-employed individual who is responsible for generating sales on behalf of the employer. This type of agreement is commonly used in various industries and businesses in Suffolk County, New York. One type of Suffolk New York Employment Agreement — Percentage of Sales — Self-Employed Independent Contractor is the Real Estate Salesperson Agreement. This agreement is specifically designed for self-employed individuals operating in the real estate industry in Suffolk County. It defines the commission structure and other terms related to sales of properties. Another type of agreement is the Sales Representative Agreement. This agreement is suitable for self-employed independent contractors who represent a company or organization in promoting and selling its products or services in Suffolk County. It often includes details about sales targets, payment structure, and exclusivity rights. The Suffolk New York Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor typically includes key clauses such as: 1. Parties involved: Clearly identifying the employer/business and the self-employed contractor. 2. Scope of work: Describing the nature of work the contractor will be engaged in, such as sales, marketing, or promoting products/services. 3. Compensation: Outlining the commission structure and the percentage of sales the contractor will receive as payment. 4. Performance expectations: Defining sales targets or objectives that the contractor is expected to meet or exceed. 5. Termination clause: Stating the conditions under which either party can terminate the agreement. 6. Confidentiality and non-disclosure: Protecting sensitive company information and trade secrets. 7. Duration and renewal: Specifying the initial term of the agreement and the process for renewal. It is crucial for both the employer and the self-employed contractor to carefully review and understand the terms of the agreement before signing. Consulting with a legal professional familiar with labor laws in Suffolk County, New York, is highly recommended ensuring compliance with local regulations and to address any specific industry-related requirements.

Suffolk New York Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

How to fill out Suffolk New York Employment Agreement - Percentage Of Sales - Self-Employed Independent Contractor?

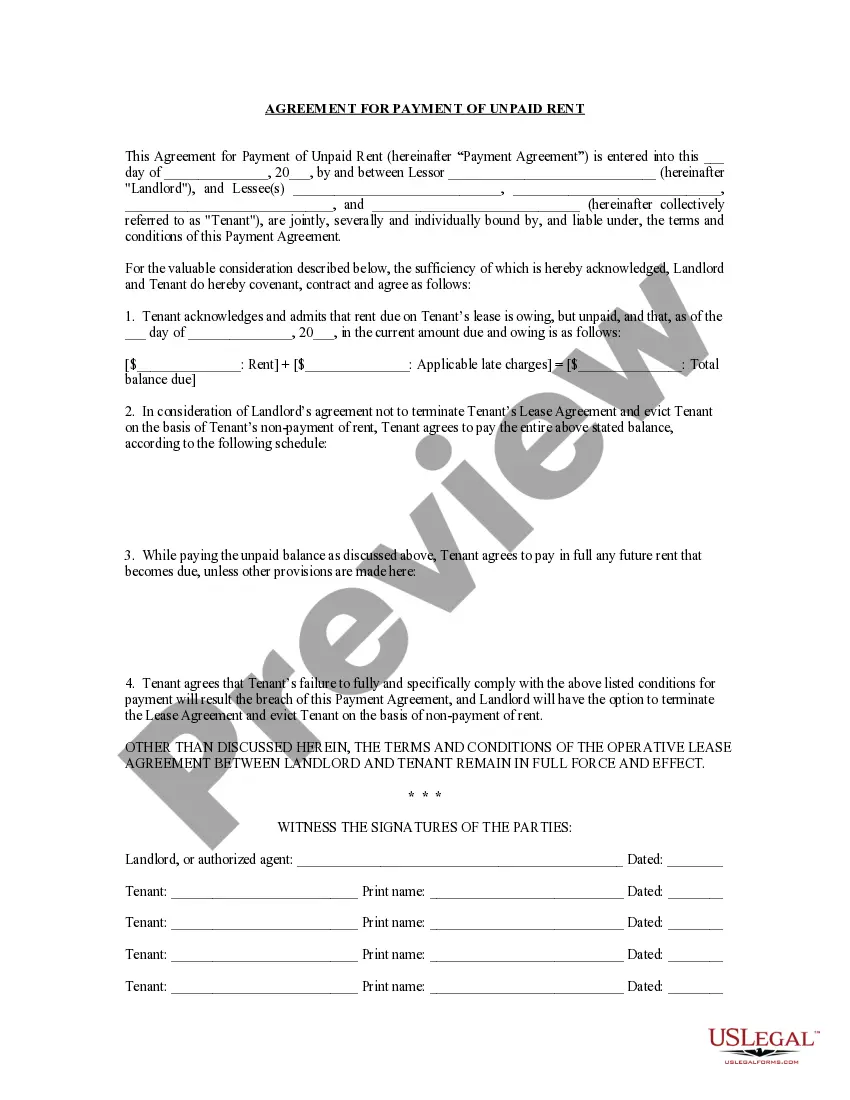

Preparing legal paperwork can be difficult. Besides, if you decide to ask an attorney to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Suffolk Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case accumulated all in one place. Consequently, if you need the recent version of the Suffolk Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Suffolk Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Suffolk Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor and download it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!