Mecklenburg North Carolina Escrow Agreement — Long Form is a legally binding contract designed to protect both parties involved in a real estate transaction through a secure and impartial intermediary. In this agreement, various terms and conditions are outlined to ensure the proper handling and disbursement of funds or documents held in escrow until the specified conditions are met. Here is a detailed description of the Mecklenburg North Carolina Escrow Agreement — Long Form and its different types: 1. Purpose: The Mecklenburg North Carolina Escrow Agreement — Long Form serves as a safeguard for buyers, sellers, and lenders involved in a real estate transaction. It ensures that all parties fulfill their obligations and that funds or documents are held securely until completion, preventing any potential fraudulent activities. 2. Parties involved: This agreement typically involves three main parties: the buyer, the seller, and the escrow agent. The escrow agent acts as a neutral third party, responsible for receiving, holding, and disbursing funds or documents according to the agreed-upon terms. 3. Key components: The Mecklenburg North Carolina Escrow Agreement — Long Form includes detailed information such as the property description, purchase price, deposit amount, closing date, and any specific conditions that must be met before releasing the BS crowed funds or documents. 4. Conditions for release: Common conditions in a Mecklenburg North Carolina Escrow Agreement — Long Form include obtaining clear title, satisfactory property inspection, completion of repairs, lender approval, and adherence to any other terms specified in the purchase agreement. 5. Types of Mecklenburg North Carolina Escrow Agreement — Long Form: Although various real estate transactions may use similar escrow agreements, there can be certain specific documents tailored to different situations, such as: — Residential Escrow Agreement: Used for residential property transactions, this agreement outlines the terms and conditions specifically relevant to residential real estate sales. — Commercial Escrow Agreement: This type of escrow agreement is designed for commercial property transactions, taking into account the unique aspects of commercial leasing, sales, or development projects. — New Construction Escrow Agreement: When purchasing a newly constructed property, buyers may enter into this escrow agreement, which includes provisions for the release of funds based on construction milestones or completion stages. — Lease Escrow Agreement: For leasehold transactions, this agreement safeguards the tenant's security deposit, outlining the terms and conditions for its release once the lease term ends. In summary, the Mecklenburg North Carolina Escrow Agreement — Long Form is a detailed contract used to protect parties involved in real estate transactions, ensuring secure handling of funds or documents until specific conditions are met. Different types of Mecklenburg North Carolina Escrow Agreements exist to address the unique aspects of residential, commercial, new construction, and leasehold transactions.

Mecklenburg North Carolina Escrow Agreement - Long Form

Description

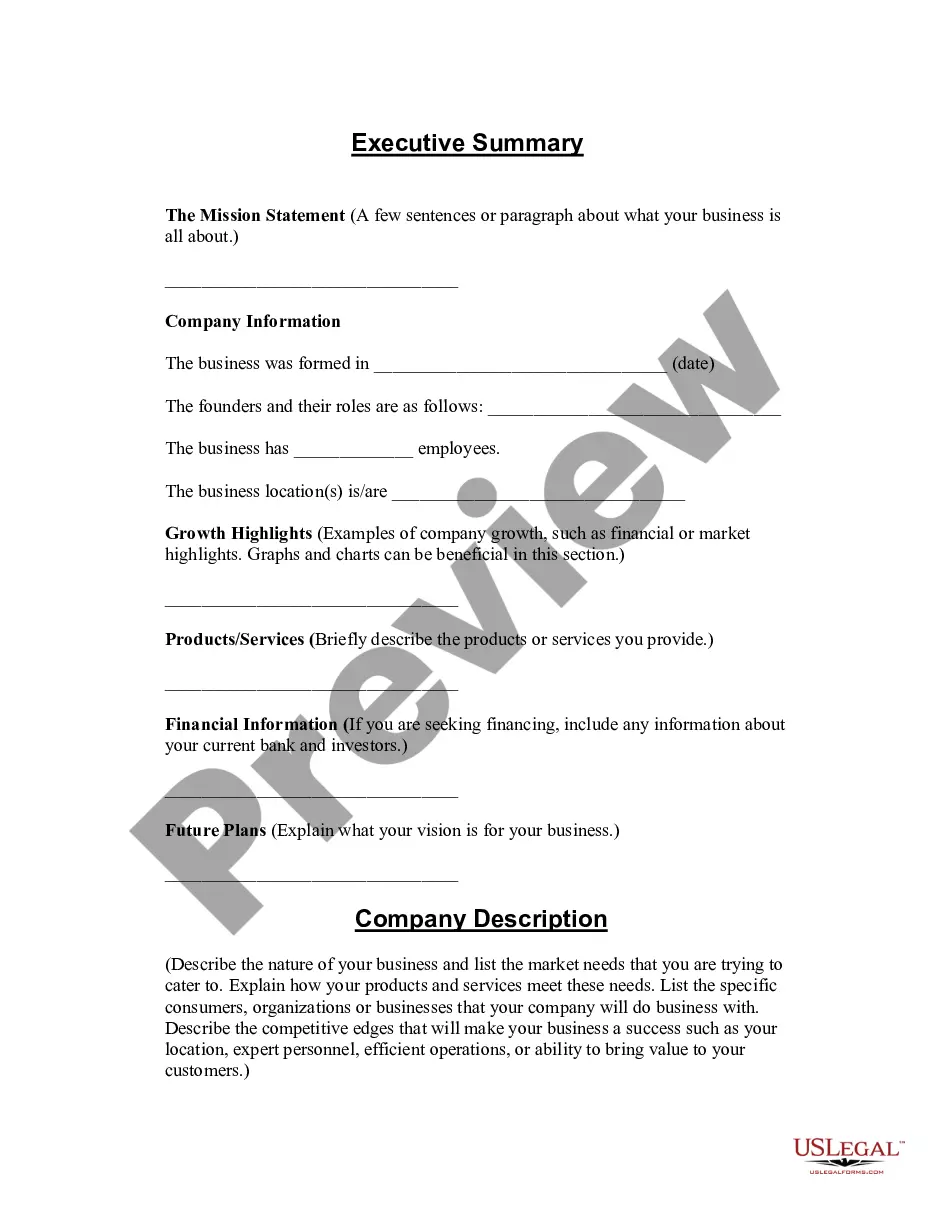

How to fill out Mecklenburg North Carolina Escrow Agreement - Long Form?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Mecklenburg Escrow Agreement - Long Form, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Mecklenburg Escrow Agreement - Long Form from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Mecklenburg Escrow Agreement - Long Form:

- Take a look at the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

An escrow agreement is a contract that outlines the terms and conditions between parties involved, and the responsibility of each. Escrow agreements generally involve an independent third party, called an escrow agent, who holds an asset of value until the specified conditions of the contract are met.

A thorough escrow agreement will list out the information that should be included in JWI or any instructions, such as the amount to be released, the party to whom the funds should be delivered, payment instructions and tax characterizations, or alternatively attach an instructions template to the escrow agreement.

Escrow Letter means the letter from the Facility Agent acknowledged by the Company dated on or about the date hereof regarding the various payments to be made at or about the Closing in respect of the Closing.

An escrow agreement is a contract that outlines the terms and conditions between parties involved, and the responsibility of each. Escrow agreements generally involve an independent third party, called an escrow agent, who holds an asset of value until the specified conditions of the contract are met.

An escrow agreement is a legal agreement, which describes the terms and conditions applicable to the participants involved. An escrow agreement contains a detailed responsibility of the parties involved. An escrow agreement typically includes a nonpartisan party who is referred to as the escrow agent.

Escrow is a legal agreement in which a third party controls money or assets until two other parties involved in a transaction meet certain conditions. Think of escrow as a mediator that reduces risk on both sides of a transaction in this case, the sale, purchase and ownership of a home.

When you close on a mortgage, your lender may set up a mortgage escrow account where part of your monthly loan payment is deposited to cover some of the costs associated with home ownership. The costs may include but are not limited to real estate taxes, insurance premiums and private mortgage insurance.

Escrow and Real Estate Escrow accounts also assure the seller that the buyer can close on the purchase. For example, an escrow account can be used for the sale of a house. If there are conditions attached to the sale, such as the passing of an inspection, the buyer and seller may agree to use escrow.

Before making a transaction, tokens are transferred to a third-party smart contract called the escrow. The escrow holds the deposited tokens until the payment conditions are satisfied. Context. The parties involved in the transaction need to ensure that both the agreed product/service is delivered and payment is made.

Escrow Account Definition An escrow account is essentially a savings account that's managed by your mortgage servicer. Your mortgage servicer will deposit a portion of each mortgage payment into your escrow to cover your estimated property taxes and your homeowners and mortgage insurance premiums. It's that simple.