Subject: Comprehensive Guide to Chicago, Illinois — Sample Letter for Agreement to Compromise Debt Dear [Creditor's Name], I hope this letter finds you well. I am writing to propose a mutually beneficial agreement to compromise my outstanding debt with your esteemed institution. Before delving into the details of our proposed arrangement, allow me to provide you with some key information about my current situation and the city where I reside, Chicago, Illinois. Chicago, often referred to as the "Windy City," is the third-largest city in the United States, known for its rich history, iconic architecture, diverse culture, and vibrant economy. Located in the heart of the Midwest, Chicago offers a myriad of opportunities for commerce, education, and entertainment. Now, coming to my financial circumstances, I regretfully admit that I find myself in a predicament where I am unable to meet the full obligations of my debt. However, I am earnestly committed to resolving this issue in a responsible and mutually agreeable manner. Hence, I propose a framework for debt compromise that takes into account both your institution's need for recovery and my dedication to resolving this outstanding matter. Two common types of Chicago, Illinois Sample Letters for Agreement to Compromise Debt can be outlined as follows: 1. Lump-Sum Settlement: Under this agreement, I am willing to offer a one-time payment to settle a portion of my outstanding debt. This lump-sum amount will be reflective of the financial constraints I currently face while ensuring a legitimate effort is made to settle the debt promptly. By agreeing to this compromise, both parties can avoid protracted legal proceedings and expedite the resolution process. 2. Structured Payment Plan: If a lump-sum settlement is not feasible at this time, an alternative approach could involve creating a structured payment plan that would allow for incremental repayment of my debt over a predetermined period. This mutually agreed-upon plan will consider my financial capacity and ensure regular, monthly installments that align with my present means. This approach demonstrates my commitment to eventual full repayment and acknowledges my sincere effort to fulfill my financial obligations. In either case, it is essential to establish a comprehensive agreement documenting the terms and conditions of our proposed debt compromise. This agreement should highlight the negotiated settlement amount, the method of payment, any interest or penalties waived, and a clear acknowledgment of the final resolution of this debt. Given the complexity of this matter, I kindly request that you review and consider this proposal with a sense of empathy and fairness. Resolving this debt amicably will help alleviate the financial burden on my end and also contribute to maintaining a positive credit history. Please find enclosed the necessary financial documentation to support my present situation. We eagerly await your response to initiate further dialogue and formalize this agreement to compromise my outstanding debt with your institution. Thank you for your understanding, and I look forward to reaching a favorable resolution that satisfies both parties involved. Yours sincerely, [Your Name] [Your Contact Information]

Chicago Illinois Sample Letter for Agreement to Compromise Debt

Description

How to fill out Chicago Illinois Sample Letter For Agreement To Compromise Debt?

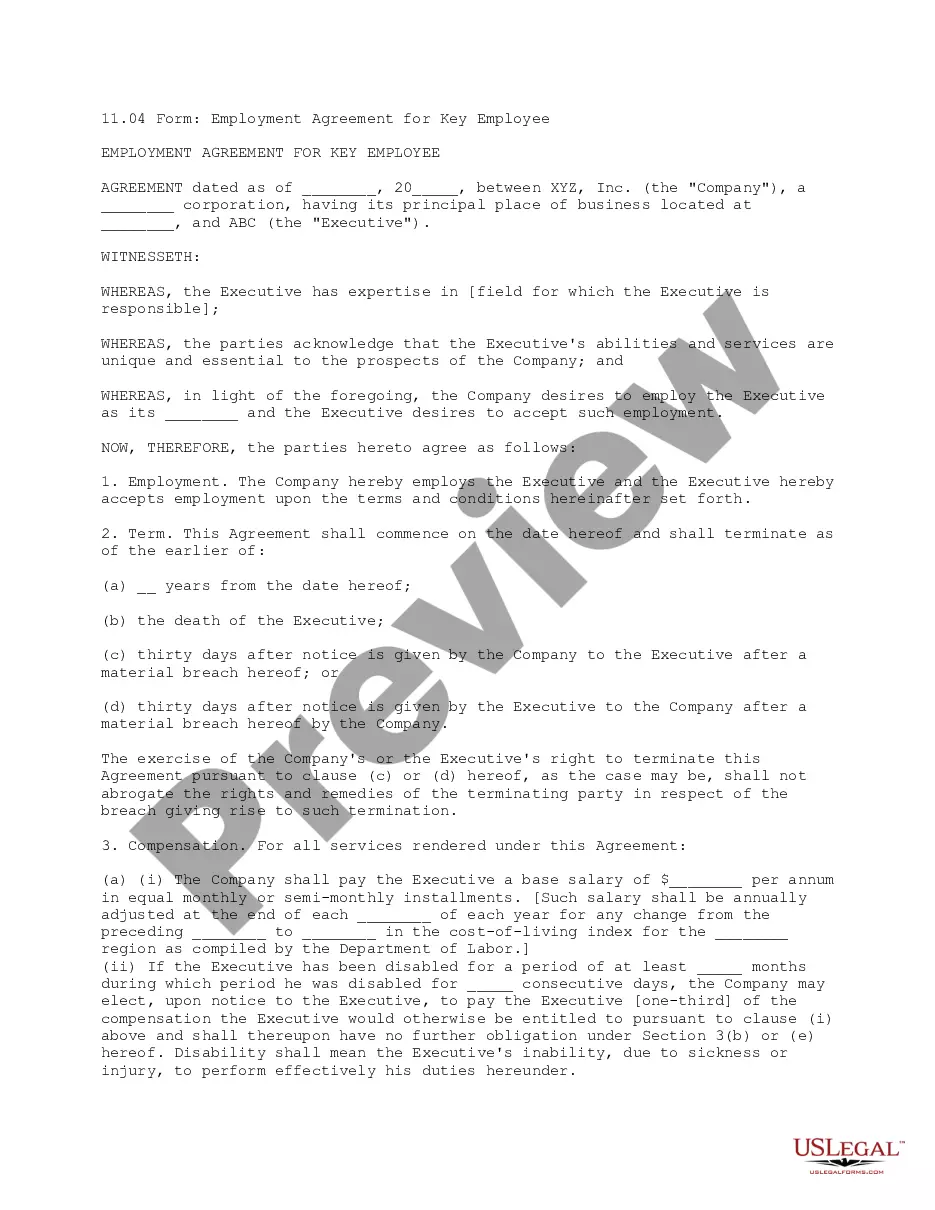

How much time does it typically take you to draw up a legal document? Considering that every state has its laws and regulations for every life situation, locating a Chicago Sample Letter for Agreement to Compromise Debt meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. Apart from the Chicago Sample Letter for Agreement to Compromise Debt, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Specialists check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can pick the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Chicago Sample Letter for Agreement to Compromise Debt:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Chicago Sample Letter for Agreement to Compromise Debt.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!