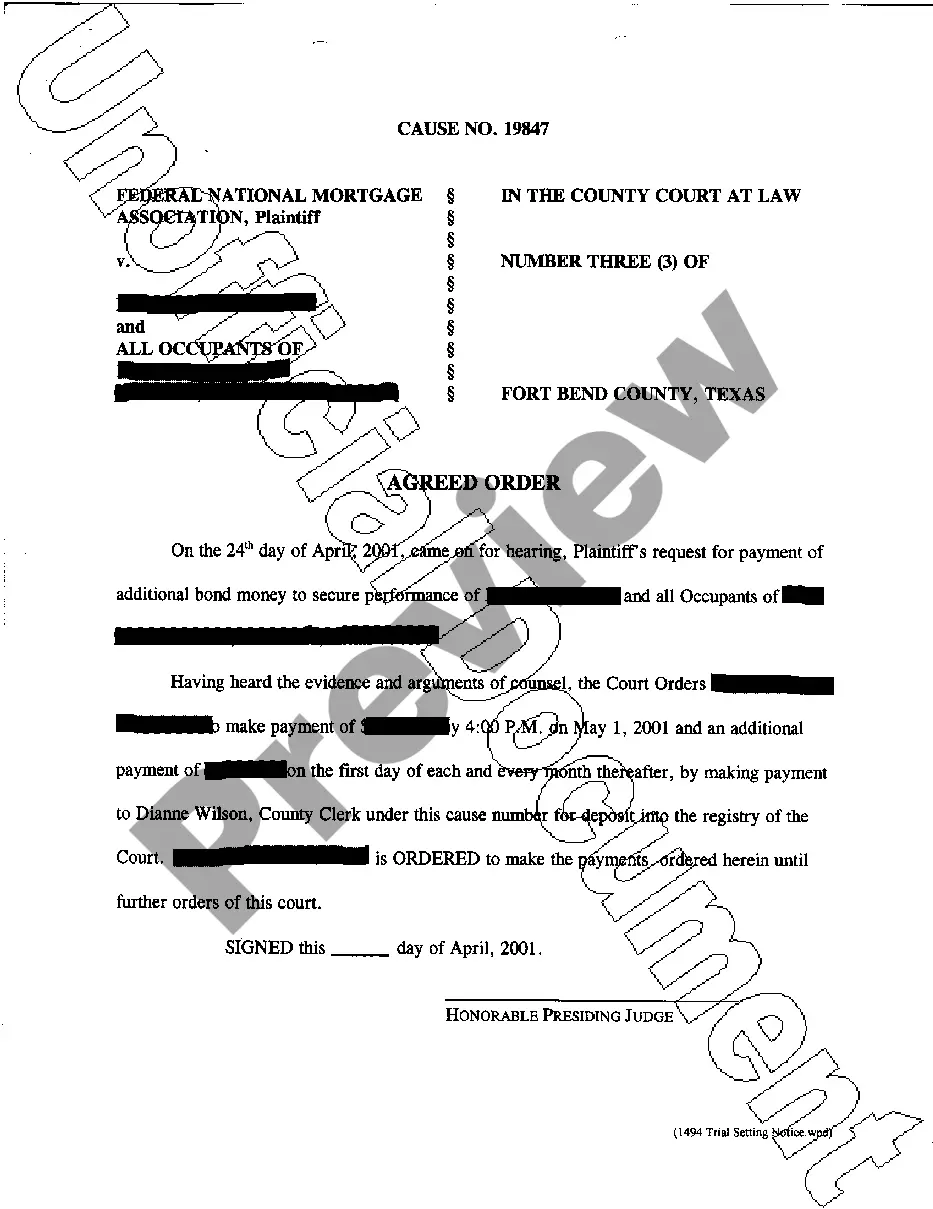

Franklin Ohio Financial Statement Form — Individual is a legal document used for reporting the financial information of an individual residing in Franklin, Ohio. This form is essential for various purposes, including loans, financial planning, tax assessment, and legal matters. It provides a comprehensive overview of an individual's assets, liabilities, income, and expenses, presenting a clear picture of their financial status. Keywords: Franklin Ohio, Financial Statement Form, individual, assets, liabilities, income, expenses, financial status, loans, financial planning, tax assessment, legal matters. Types of Franklin Ohio Financial Statement Form — Individual: 1. Franklin Ohio Financial Statement Form — Individual for Loans: This specific form is often required by financial institutions when individuals apply for loans, mortgages, or credit. It provides lenders with a detailed understanding of an individual's financial health, enabling them to assess the individual's creditworthiness before approving the loan. 2. Franklin Ohio Financial Statement Form — Individual for Tax Assessment: This form may be necessary for individuals who reside in Franklin, Ohio and need to file their taxes. It assists in accurately reporting income, deductions, and assets, ensuring compliance with tax regulations and minimizing the risk of facing penalties or audits. 3. Franklin Ohio Financial Statement Form — Individual for Divorce Proceedings: In cases of divorce or separation, this form might be required to identify and divide assets and liabilities between the parties involved. It plays a crucial role in determining the financial responsibilities of each individual and helps to ensure a fair settlement. 4. Franklin Ohio Financial Statement Form — Individual for Estate Planning: This variant of the form proves useful when individuals are considering estate planning or making arrangements for their assets after their demise. It aids in documenting an individual's financial situation, allowing them to strategize and allocate their assets according to their wishes, minimizing issues during probate. 5. Franklin Ohio Financial Statement Form — Individual for Legal Proceedings: In certain legal matters like bankruptcy, lawsuits, or disputes involving finances, this form might be required to present a comprehensive overview of an individual's financial position. It assists in evaluating their financial capabilities and plays an important role in legal decision-making. Keywords: Franklin Ohio, Financial Statement Form, individual, loans, mortgages, credit, tax assessment, income, deductions, assets, divorce proceedings, estate planning, legal proceedings, bankruptcy, lawsuits, disputes, financial capabilities.

Franklin Ohio Financial Statement Form - Individual

Description

How to fill out Franklin Ohio Financial Statement Form - Individual?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Franklin Financial Statement Form - Individual, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different types ranging from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching process less challenging. You can also find detailed materials and tutorials on the website to make any tasks related to paperwork completion simple.

Here's how to locate and download Franklin Financial Statement Form - Individual.

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the validity of some documents.

- Check the related document templates or start the search over to locate the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment gateway, and buy Franklin Financial Statement Form - Individual.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Franklin Financial Statement Form - Individual, log in to your account, and download it. Needless to say, our platform can’t replace a legal professional entirely. If you have to deal with an extremely difficult situation, we advise using the services of an attorney to review your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Join them today and get your state-compliant paperwork effortlessly!