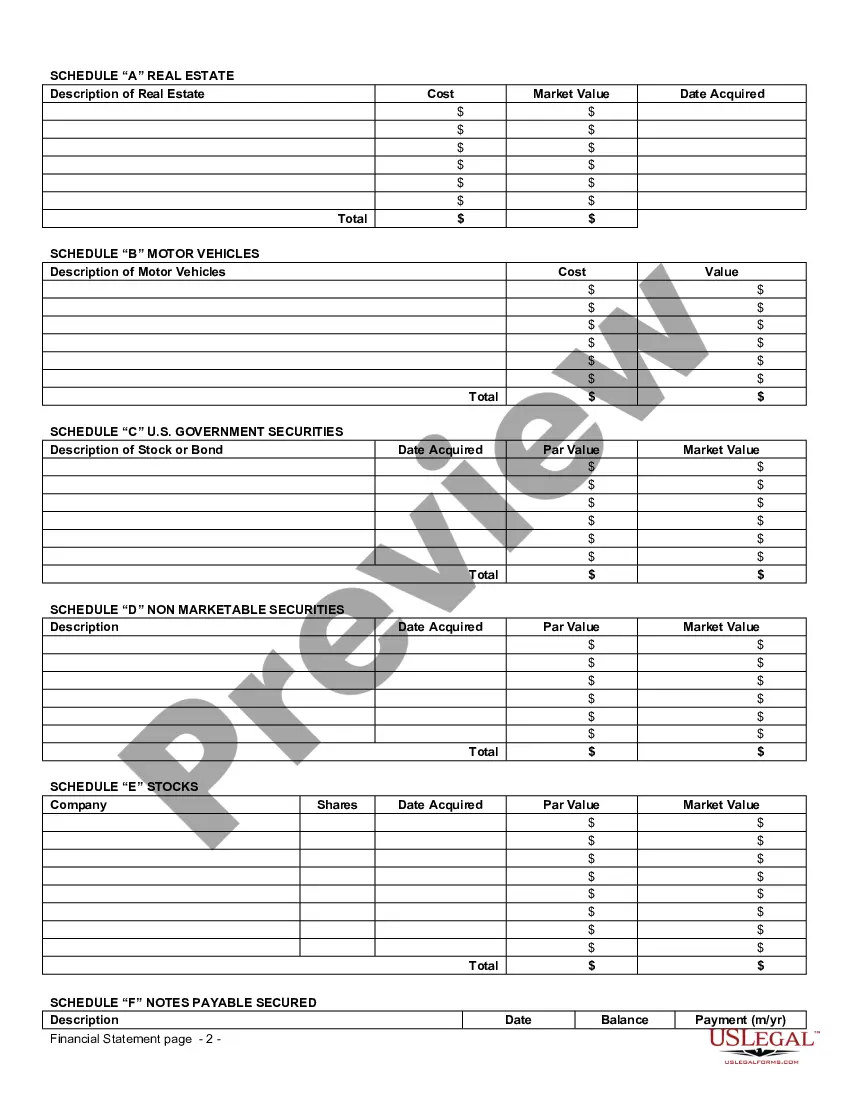

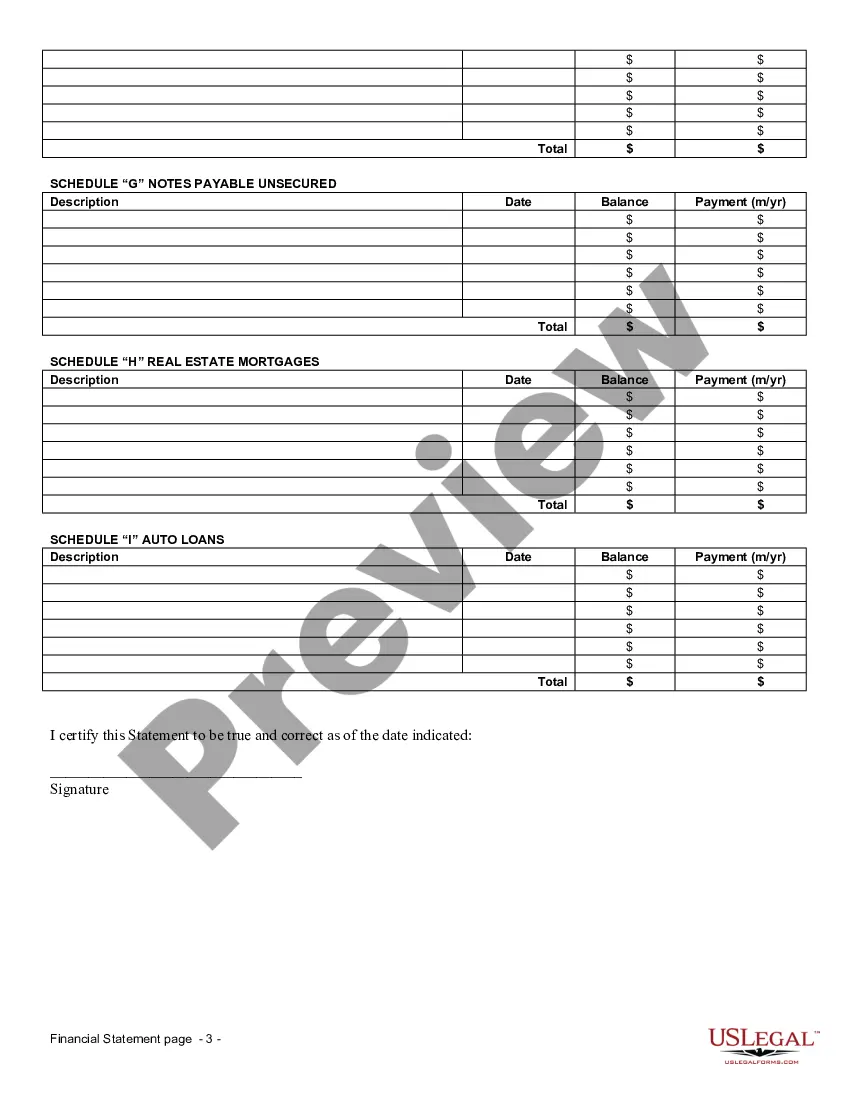

Riverside California Financial Statement Form — Individual is a crucial document used in the state of California to assess an individual's financial situation accurately. This form provides a comprehensive overview of an individual's income, expenses, assets, and liabilities. It plays a vital role in various scenarios, including loan applications, divorce proceedings, tax assessments, and financial planning. The Riverside California Financial Statement Form — Individual is designed to capture specific financial details to gauge an individual's financial health accurately. It includes various sections, such as personal information, income sources, monthly expenses, assets, and liabilities. By gathering this information, financial institutions, legal entities, or government agencies can evaluate an individual's income-to-debt ratio, liquidity, net worth, and overall financial viability. The Riverside California Financial Statement Form — Individual typically starts with personal information, such as name, address, contact details, and social security number. This section establishes the identity of the individual for proper record-keeping and identification. The income sources section is crucial for assessing an individual's earning capacity and financial stability. It requires detailed information about wages, salary, bonuses, commissions, rental income, self-employment income, pension, social security benefits, and any other sources of income. This section aids in analyzing the individual's ability to generate income and meet financial obligations. The monthly expense section captures all recurring expenses an individual incurs. It includes housing costs (mortgage/rent, property taxes, utilities), transportation expenses (car payments, insurance, fuel), food expenses, healthcare costs, insurance premiums, education expenses, personal care, entertainment, and other miscellaneous expenses. This section assists in understanding an individual's spending habits, lifestyle, and financial commitments. The assets and liabilities section is crucial for evaluating an individual's net worth. Assets include cash, bank accounts, investments, real estate properties, vehicles, personal belongings, and any other valuable possessions. Liabilities encompass mortgages, loans, credit card debt, medical debt, unpaid taxes, and any other outstanding debts. This section assists in analyzing an individual's financial standing and their ability to handle debt. Different types of Riverside California Financial Statement Forms — Individual might exist based on specific purposes or institutions. For instance, there may be specialized forms for mortgage applications, divorce proceedings, tax assessments, or personal loan applications. These specialized forms might require additional details specific to the purpose they serve. In conclusion, the Riverside California Financial Statement Form — Individual is a comprehensive document that provides valuable insights into an individual's financial status. It encompasses personal information, income sources, monthly expenses, assets, and liabilities. By analyzing this information, financial institutions, legal entities, or government agencies can evaluate an individual's financial stability, credibility, and ability to meet financial obligations accurately.

Riverside California Financial Statement Form - Individual

Description

How to fill out Riverside California Financial Statement Form - Individual?

Draftwing paperwork, like Riverside Financial Statement Form - Individual, to take care of your legal affairs is a tough and time-consumming task. Many cases require an attorney’s participation, which also makes this task expensive. However, you can get your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms crafted for various scenarios and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Riverside Financial Statement Form - Individual template. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly straightforward! Here’s what you need to do before downloading Riverside Financial Statement Form - Individual:

- Ensure that your form is compliant with your state/county since the regulations for creating legal documents may differ from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Riverside Financial Statement Form - Individual isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to start utilizing our service and download the form.

- Everything looks great on your side? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is all set. You can try and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!