Harris Texas Corporate Guaranty — General is a legal agreement that provides a guarantor's assurance to fulfill a corporate debt obligation on behalf of a company in Harris County, Texas. This type of corporate guaranty serves as a protection mechanism for lenders and creditors, ensuring repayment in case the borrowing entity defaults on its financial obligations. Keywords: Harris Texas Corporate Guaranty, general guaranty, corporate debt obligation, guarantor, Harris County, Texas, lenders, repayment, borrowing entity, financial obligations. Different Types of Harris Texas Corporate Guaranty — General: 1. Unconditional Corporate Guaranty: This type of guaranty assures the lender or creditor that the guarantor will fulfill the corporate debt obligation, irrespective of any conditions or circumstances, in case the borrowing company defaults. 2. Limited Corporate Guaranty: A limited corporate guaranty provides partial assurance to lenders or creditors. In this case, the guarantor agrees to be responsible for a specific portion of the corporate debt obligation, rather than assuming full liability. 3. Joint Corporate Guaranty: This form of corporate guaranty involves multiple guarantors who collectively assume responsibility for the borrowing company's debt. Each guarantor agrees to fulfill a portion of the obligation in case of default. 4. Continuing Corporate Guaranty: A continuing guaranty remains in effect until revoked or terminated by the guarantor. It provides ongoing assurance to lenders or creditors for future debt obligations incurred by the borrowing company. 5. Subsidiary Corporate Guaranty: If a company has subsidiaries, a subsidiary corporate guaranty may be required. It involves a guarantor, typically the parent company, assuming responsibility for the debt obligations of its subsidiaries. 6. Cross-Corporate Guaranty: In situations where multiple companies are involved, a cross-corporate guaranty ensures that each entity will guarantee the debts of the others. This helps to strengthen the overall financial stability and creditworthiness of the associated companies. It is crucial to consult legal professionals or experts to gain a comprehensive understanding of the specific terms, conditions, and implications of Harris Texas Corporate Guaranty — General and its various types.

Harris Texas Corporate Guaranty - General

Description

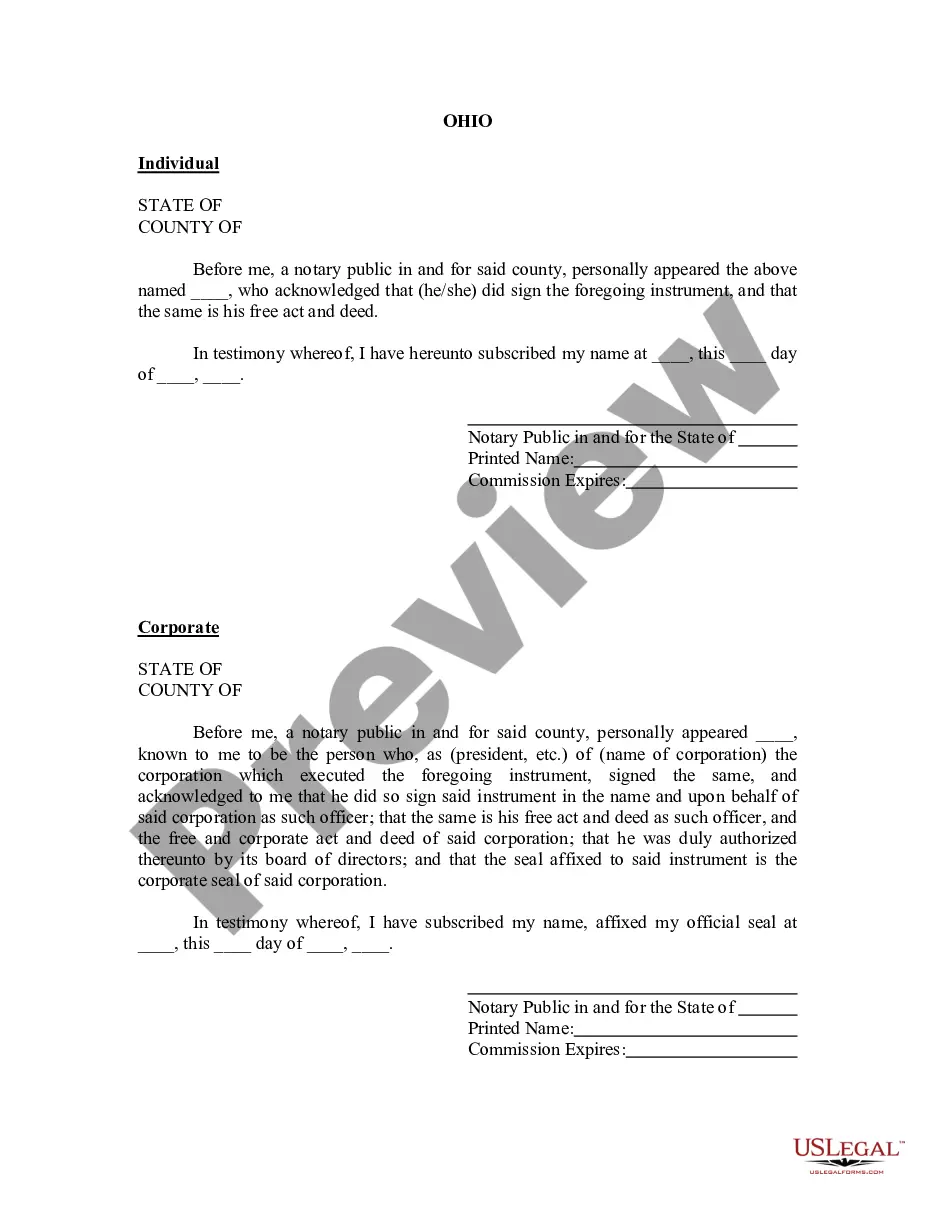

How to fill out Harris Texas Corporate Guaranty - General?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official documentation that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business objective utilized in your region, including the Harris Corporate Guaranty - General.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Harris Corporate Guaranty - General will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Harris Corporate Guaranty - General:

- Make sure you have opened the proper page with your local form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Harris Corporate Guaranty - General on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Bank of Montreal. U.S. Holding Company. BMO Financial Corp. President and Chief Executive Officer. BMO Harris Bank N.A.

On a late summer day in 1984, the day after Labour Day, the Bank of Montreal officially acquired Harris Bankcorp, one of the great Chicago banks established in 1907 as a bank, but with roots extending as far back as 1882. The Chicago bank became a wholly owned subsidiary of the Bank.

Call 1-877-225-5266.

Bank of Montreal. U.S. Holding Company. BMO Financial Corp. President and Chief Executive Officer. BMO Harris Bank N.A.

The bank is a subsidiary of the Canadian multinational investment bank and financial services company Bank of Montreal, commonly known as "BMO" (pronounced /02c8bi02d0mo028a/), which owns BMO Harris Bank through the holding company BMO Financial Corporation (formerly Bankmont Financial Corporation, then Harris Financial

Whether you're a frequent visitor to the U.S. or enjoy extended stays, BMO Bank of Montreal and our U.S. subsidiary, BMO Harris, offer Canadians products and services that make cross-border banking seamless.

BMO Harris Bank N.A. BMO Harris Bank N.A. is part of BMO Financial Group. BMO Financial Group was ranked the 9th largest financial institution in North America based on market capitalization as of June 27, 2011.

Start by sign in to BMO Online Banking and:Click Payments & Transfers.Select Make a Transfer.Choose the From and To accounts, and enter the amount, and currency you'd like to transfer.Review the transaction details, and then click Verify Transfer.Click Complete Transfer.