Wake North Carolina General Guaranty and Indemnification Agreement refers to a legal document created to establish financial protection and indemnity for a specific situation or party in Wake County, North Carolina. This agreement is commonly used in various business transactions to safeguard parties involved from potential financial losses or damages. It outlines the responsibilities, obligations, and liabilities of each party involved, providing security and assurance in cases where a breach of contract or financial loss occurs. Keywords: Wake North Carolina, general guaranty, indemnification agreement, legal document, financial protection, indemnity, Wake County, business transactions, parties, responsibilities, obligations, liabilities, breach of contract, financial loss. There are various types of Wake North Carolina General Guaranty and Indemnification Agreements, each serving different purposes based on the involved parties or specific circumstances. Some of these variations include: 1. Wake North Carolina General Guaranty Agreement: This type of agreement primarily focuses on providing security to the creditor by guaranteeing the fulfillment of financial obligations by the debtor. It ensures that, in case of non-payment or default by the debtor, the guarantor will step in and fulfill the outstanding obligations. 2. Wake North Carolina Indemnification Agreement: This agreement is designed to protect one party (indemnity) from any financial losses or damages incurred due to the actions or omissions of another party (indemnity). The indemnity agrees to reimburse or compensate the indemnity for any losses suffered as a result of a specific event or circumstance. 3. Wake North Carolina General Guaranty and Indemnification Agreement for Loans: This agreement is specifically tailored for loan transactions, providing both the guarantee of debt repayment and indemnification against any financial losses suffered by the lender due to borrower's actions or events beyond their control. 4. Wake North Carolina General Guaranty and Indemnification Agreement for Contractors: This type of agreement is typically utilized in construction or contractor-related agreements. It protects the parties involved from any potential financial losses resulting from unexpected events, such as delays, substandard work, or breach of contract, by providing both guarantee and indemnity clauses. 5. Wake North Carolina General Guaranty and Indemnification Agreement for Leases: This agreement is commonly used in commercial real estate leases. It ensures the landlord is protected against financial losses caused by the tenant's actions or failures, such as property damage, violation of lease terms, non-payment, or early termination. In summary, Wake North Carolina General Guaranty and Indemnification Agreement is a legal tool that establishes financial protection and indemnity between parties in various business transactions. It serves to safeguard against potential losses, breach of contract, or damages, with different types tailored to specific circumstances, such as loans, contractors, leases, and general guarantees.

Wake North Carolina General Guaranty and Indemnification Agreement

Description

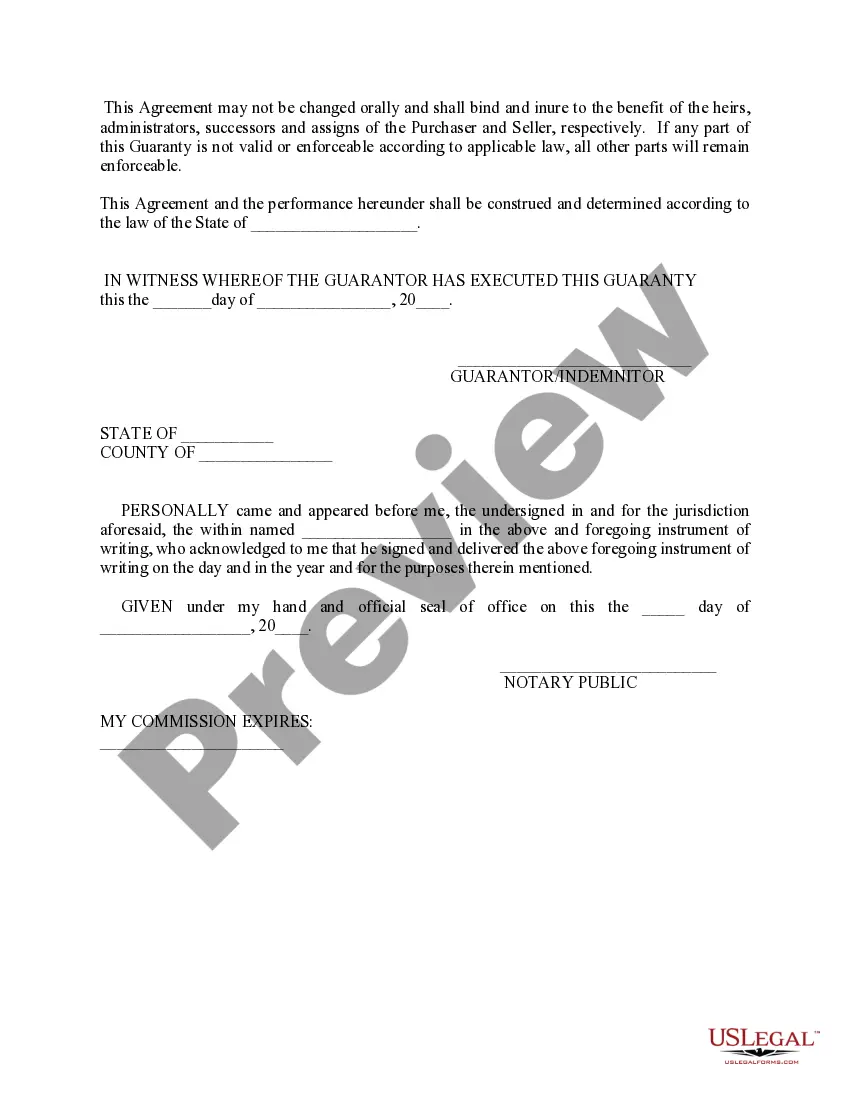

How to fill out Wake North Carolina General Guaranty And Indemnification Agreement?

If you need to get a reliable legal form supplier to find the Wake General Guaranty and Indemnification Agreement, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can search from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of learning materials, and dedicated support team make it simple to find and execute different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Wake General Guaranty and Indemnification Agreement, either by a keyword or by the state/county the document is intended for. After locating required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Wake General Guaranty and Indemnification Agreement template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be instantly available for download once the payment is completed. Now you can execute the form.

Handling your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes these tasks less pricey and more reasonably priced. Create your first business, organize your advance care planning, create a real estate contract, or execute the Wake General Guaranty and Indemnification Agreement - all from the convenience of your home.

Sign up for US Legal Forms now!