A Bronx New York Guaranty of Promissory Note by Individual — Corporate Borrower is a legal document that outlines the financial obligations and liabilities incurred when an individual guarantees repayment of a promissory note on behalf of a corporate borrower. This type of guaranty ensures that, in the event of default, the individual guarantor will be responsible for repaying the debt. In the Bronx, New York context, this type of guaranty is often used in various business transactions, where a corporation seeks financial assistance or credit from lenders or financial institutions. The guarantor, in this case, is an individual who personally guarantees the repayment of the promissory note by assuming legal and financial responsibility if the corporate borrower fails to fulfill the obligations. Keywords: Bronx New York, Guaranty of Promissory Note, Individual, Corporate Borrower, legal document, financial obligations, liabilities, repayment, default, debt, business transactions, lenders, financial institutions, personal guarantee, legal responsibility, financial assistance, credit. Different types of Bronx New York Guaranty of Promissory Note by Individual — Corporate Borrower may vary based on the specific terms and conditions applied or any additional clauses included. Some variations could include: 1. Limited Guaranty: This type of guaranty may limit the individual guarantor's liability, stating that their responsibility is limited to a certain maximum amount or for a specific period. 2. Continuing Guaranty: In this version, the individual guarantor's liability extends beyond the initial repayment obligations and continues until the promissory note is fully discharged. 3. Unconditional Guaranty: This type of guaranty means that the individual guarantor's commitment to repayment is not subject to any conditions or contingencies. 4. Conditional Guaranty: Unlike an unconditional guaranty, a conditional guaranty puts forth specific conditions that must be met for the individual guarantor's liability to take effect. 5. Joint and Several guaranties: This variation involves multiple individual guarantors who are collectively and independently liable for the repayment of the promissory note.

Bronx New York Guaranty of Promissory Note by Individual - Corporate Borrower

Description

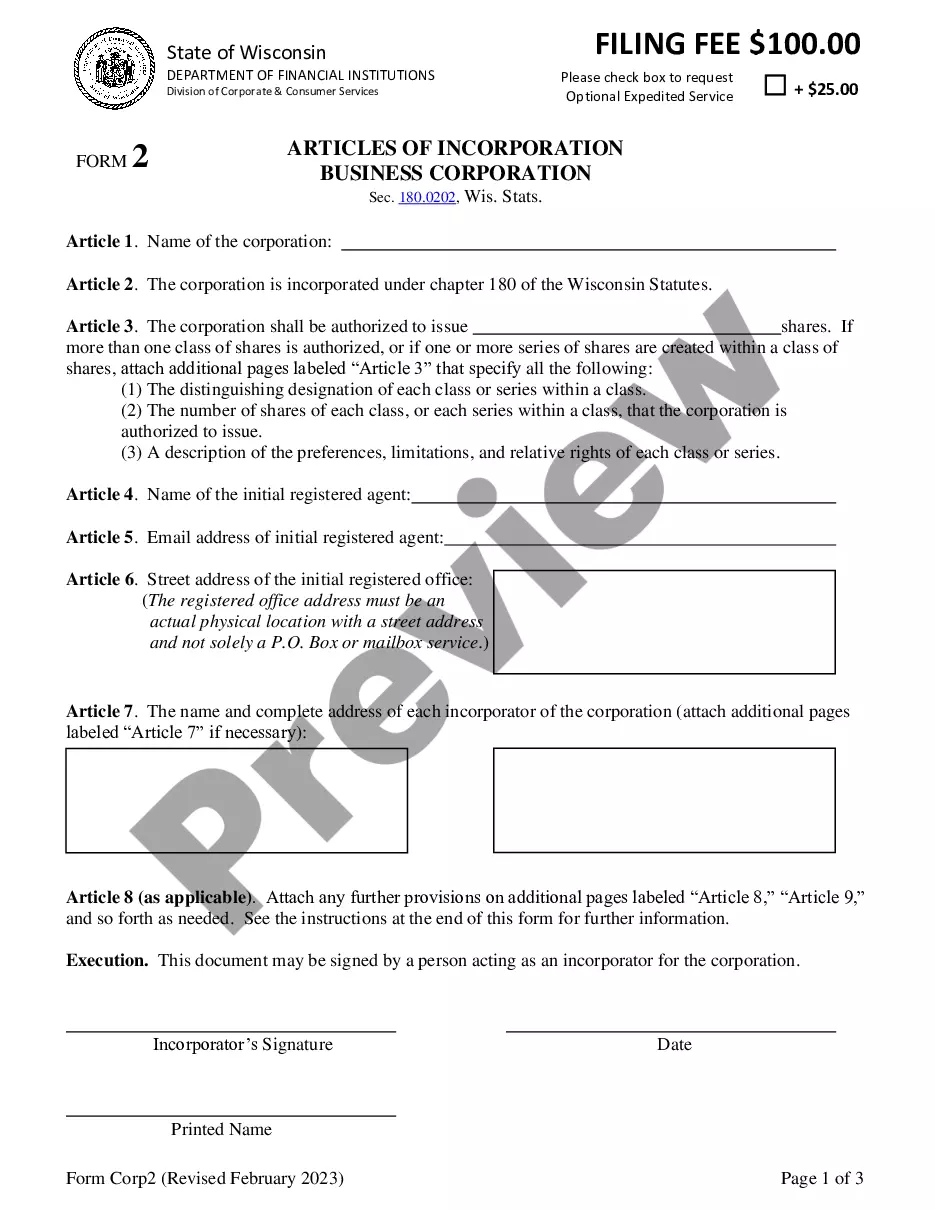

How to fill out Bronx New York Guaranty Of Promissory Note By Individual - Corporate Borrower?

Preparing legal paperwork can be difficult. In addition, if you decide to ask an attorney to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Bronx Guaranty of Promissory Note by Individual - Corporate Borrower, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case accumulated all in one place. Consequently, if you need the latest version of the Bronx Guaranty of Promissory Note by Individual - Corporate Borrower, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Bronx Guaranty of Promissory Note by Individual - Corporate Borrower:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Bronx Guaranty of Promissory Note by Individual - Corporate Borrower and download it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!