Cuyahoga Ohio Guaranty of Promissory Note by Individual — Corporate Borrower is a legal document that outlines the terms and conditions of a guarantee made by an individual for a promissory note held by a corporate borrower in Cuyahoga County, Ohio. This guarantee serves as a form of security or assurance that the individual guarantor will be responsible for fulfilling the obligations of the promissory note if the corporate borrower fails to do so. The Cuyahoga Ohio Guaranty of Promissory Note by Individual — Corporate Borrower is designed to protect the lender's interests and provide an additional layer of financial security. By having an individual guarantor involved, the lender can seek compensation from the guarantor in case of default by the corporate borrower. The specific terms and conditions included in the Cuyahoga Ohio Guaranty of Promissory Note by Individual — Corporate Borrower may vary depending on the requirements of the parties involved. However, some common provisions that may be included are: 1. Identification: The document typically includes the names and contact information of the individual guarantor, the corporate borrower, and the lender. 2. Obligations: It outlines the specific obligations of the individual guarantor, emphasizing their responsibility to pay and perform the obligations of the promissory note if the corporate borrower defaults. 3. Guarantor's Representations and Warranties: The guarantor may make certain representations and warranties, stating that they have the legal authority to guarantee the promissory note and that their guarantee will not conflict with any existing obligations. 4. Principal and Interest: The document may specify the principal amount of the promissory note, the applicable interest rate, and the repayment terms. 5. Collateral: In some cases, the individual guarantor may provide collateral to secure the guarantee. 6. Default and Remedies: The Cuyahoga Ohio Guaranty of Promissory Note by Individual — Corporate Borrower should address the consequences of default, including the lender's rights to demand immediate payment, initiate legal action, or seek other remedies. 7. Jurisdiction and Governing Law: The document typically stipulates that any disputes will be resolved in the courts of Cuyahoga County, Ohio, and be governed by the laws of the state. Different types or variations of Cuyahoga Ohio Guaranty of Promissory Note by Individual — Corporate Borrower may exist based on specific circumstances or additional provisions required by the lender or the guarantor. However, the primary purpose of such a guarantee document remains consistent — to ensure that a responsible individual is willing to assume liability for a corporate borrower's obligations, providing security for the lender in case of default.

Cuyahoga Ohio Guaranty of Promissory Note by Individual - Corporate Borrower

Description

How to fill out Cuyahoga Ohio Guaranty Of Promissory Note By Individual - Corporate Borrower?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including Cuyahoga Guaranty of Promissory Note by Individual - Corporate Borrower, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different types ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find information resources and guides on the website to make any tasks related to paperwork completion straightforward.

Here's how to locate and download Cuyahoga Guaranty of Promissory Note by Individual - Corporate Borrower.

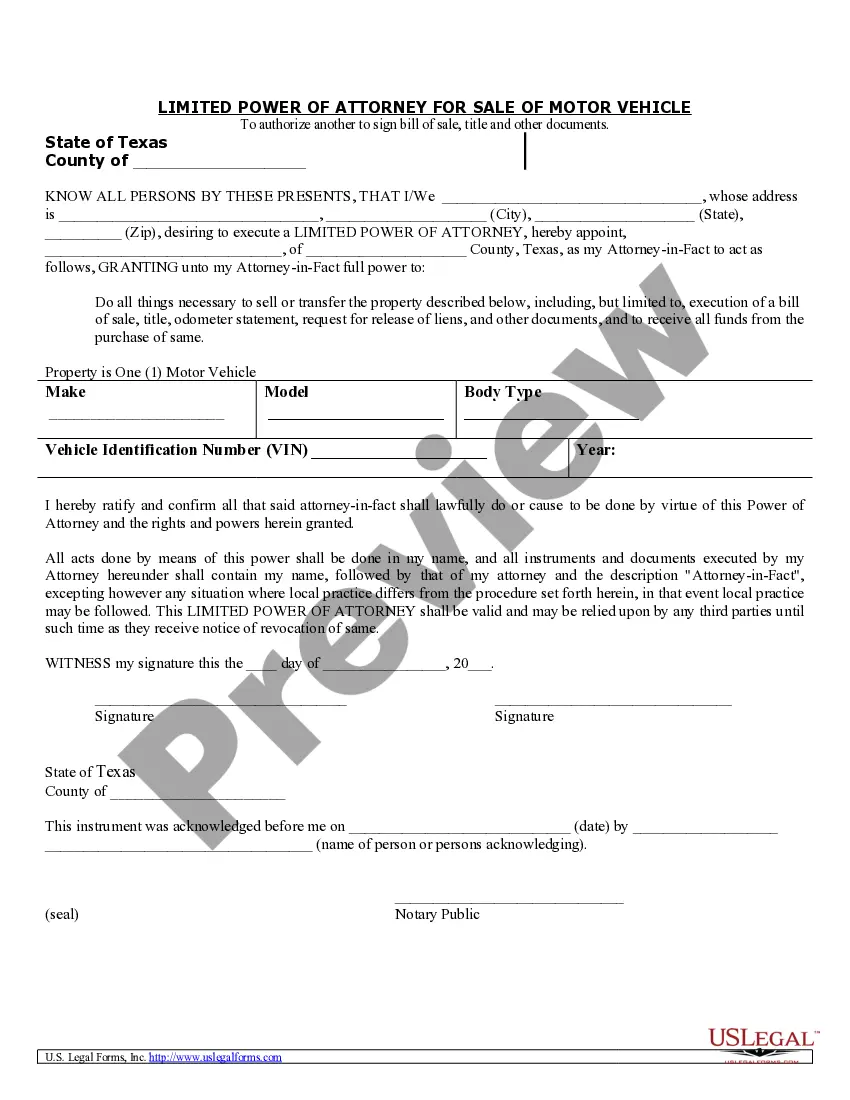

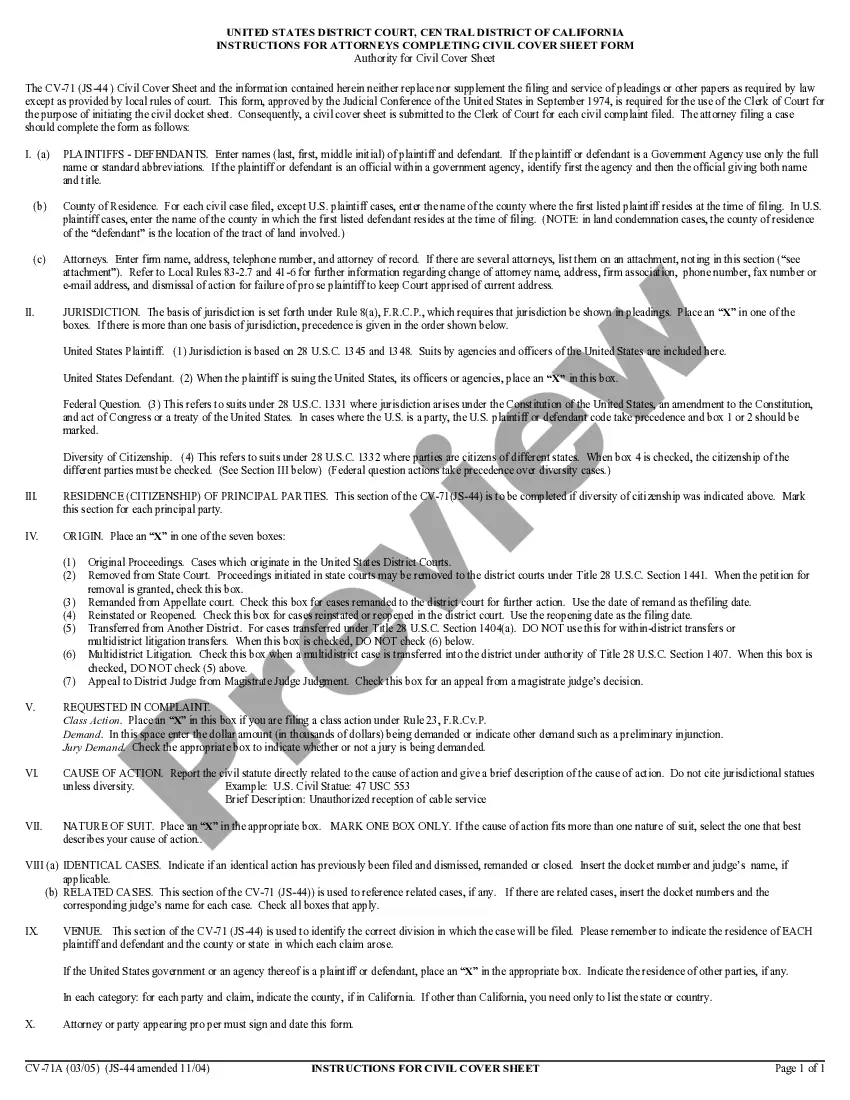

- Take a look at the document's preview and description (if available) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can impact the validity of some records.

- Examine the similar document templates or start the search over to find the right file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Cuyahoga Guaranty of Promissory Note by Individual - Corporate Borrower.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Cuyahoga Guaranty of Promissory Note by Individual - Corporate Borrower, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional completely. If you have to deal with an exceptionally complicated situation, we advise getting an attorney to examine your document before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Join them today and purchase your state-compliant paperwork with ease!

Form popularity

FAQ

A personal guarantee is an agreement between a business owner and lender, stating that the individual who signs is responsible for paying back a loan should the business ever be unable to make payments.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

If the corporate debtor refuses to pay, a personal guarantee agreement allows the bank to enforce that debt against other individuals. Often times it is the directors of the corporation that are asked to give personal guarantees, but at other times it may be an uninvolved third party, such as a spouse or a parent.

Promissory notes are debt instruments. They can be issued by financial institutions. The capital markets consist of two types of markets: primary and secondary.. However, they can also be issued by small companies or individuals.

As per section 32 of negotiable instrument act, in the absence of a contract to the contrary, the maker of a promissory note and the acceptor before the maturity of a bill of exchange are under the liability to pay the amount thereof at maturity.

A bank can issue a promissory note, but so can an individual or a company or business. Anyone who lends money can do so. A promissory note isn't a contract, but you'll likely have to sign one before you take out a mortgage.

A personal guaranty is not enforceable without consideration In fact, no contract is enforceable without consideration. A personal guaranty is a type of contract. A contract is an enforceable promise. The enforceability of a contract comes from one party's giving of consideration to the other party.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.