King Washington Guaranty of Promissory Note by Individual — Corporate Borrower is a legal agreement that ensures the repayment of a promissory note issued by a corporate borrower. This document serves as a binding contract between an individual guarantor and the lending institution. The guarantor, who may be an officer, director, or shareholder of the corporate borrower, guarantees to honor and fulfill all obligations outlined in the promissory note in the event of default by the corporation. This agreement is designed to provide further security to the lender by holding the guarantor personally responsible for the repayment of the promissory note. It acts as a financial safeguard, assuring the lender that even if the corporate borrower fails to fulfill its repayment obligations, they can seek recourse from the guarantor's personal assets. Thus, the guarantor assumes the risk and liability associated with the potential default of the borrower. Typically, King Washington Guaranty of Promissory Note by Individual — Corporate Borrower encompasses various provisions. These may include the specifics of the promissory note, such as the principal amount, interest rate, repayment terms, and any applicable fees. Additionally, it outlines the guarantor's acknowledgment of their personal liability, their commitment to honor the terms of the promissory note, and their responsibility to repay the outstanding balance in the event of default by the corporate borrower. Different types or variations of King Washington Guaranty of Promissory Note by Individual — Corporate Borrower may include specific provisions tailored to unique circumstances. For example, there might be variations for loans granted to different sectors like real estate, healthcare, or technology. Additional variations could address specific aspects such as collateral provisions, acceleration clauses, or provisions for legal costs in case of default. In summary, King Washington Guaranty of Promissory Note by Individual — Corporate Borrower serves as a legal protection that ensures lenders receive their due payments in case of default by a corporate borrower. It provides an extra layer of security and reinforces the commitment of both the borrower and the guarantor to fulfill their financial obligations. This agreement, formulated using legal expertise, offers a safety net for lenders and enhances the possibility of successful financial transactions.

King Washington Guaranty of Promissory Note by Individual - Corporate Borrower

Description

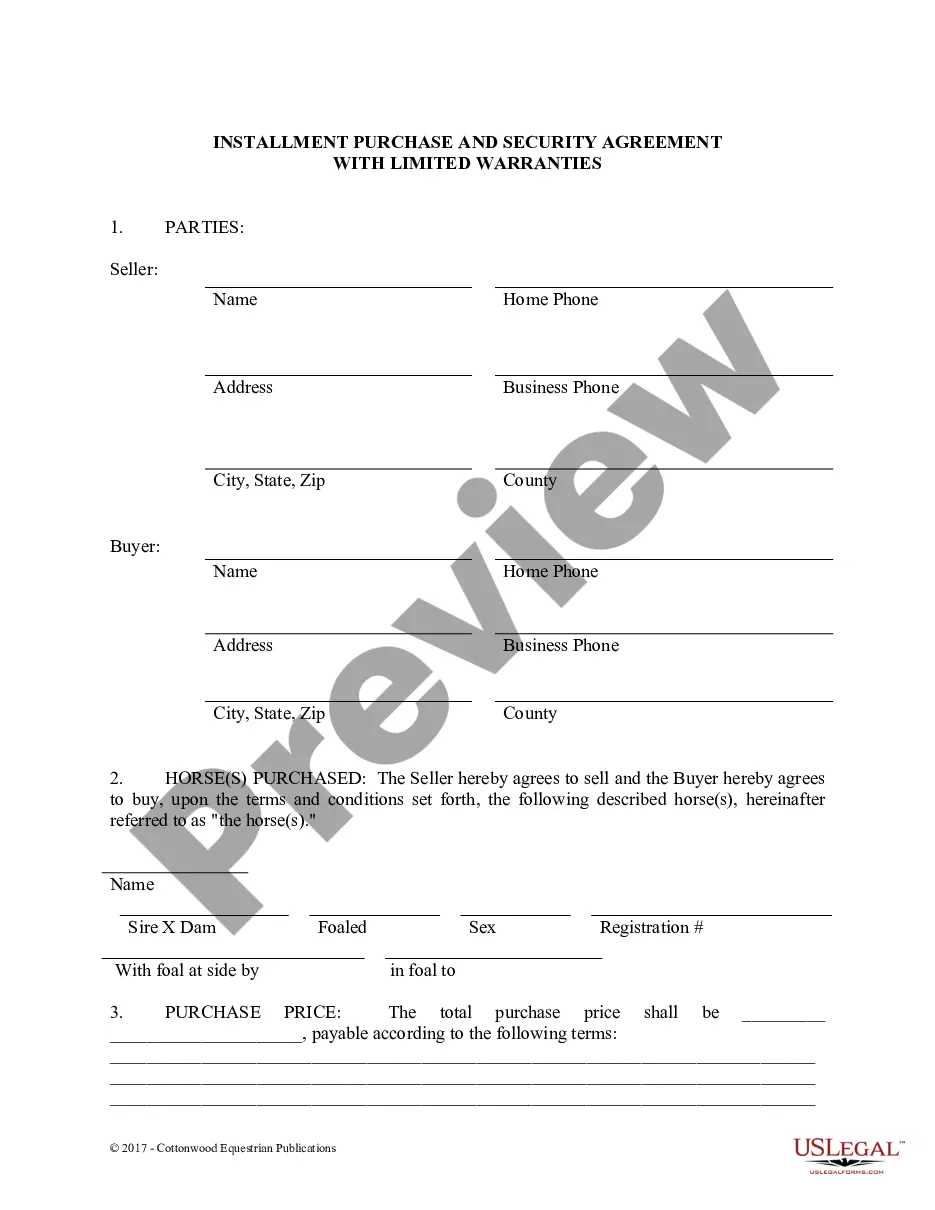

How to fill out King Washington Guaranty Of Promissory Note By Individual - Corporate Borrower?

If you need to get a reliable legal form provider to obtain the King Guaranty of Promissory Note by Individual - Corporate Borrower, consider US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can search from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of supporting resources, and dedicated support team make it simple to locate and complete various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply select to search or browse King Guaranty of Promissory Note by Individual - Corporate Borrower, either by a keyword or by the state/county the form is intended for. After locating necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the King Guaranty of Promissory Note by Individual - Corporate Borrower template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and select a subscription option. The template will be immediately ready for download as soon as the payment is completed. Now you can complete the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes this experience less expensive and more reasonably priced. Create your first business, organize your advance care planning, create a real estate agreement, or complete the King Guaranty of Promissory Note by Individual - Corporate Borrower - all from the convenience of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

The person or entity that guarantees the borrower's debt is called a guarantor. A guarantor is one whose promise 'is collateral to a primary or principal obligation on the part of another and which binds the obligor to performance in the event of nonperformance by such other, the latter being bound to perform

applicant is a person who joins in the application of a loan or other service. Having a coapplicant can make an application more attractive since it involves additional sources of income, credit, or assets. applicant has more rights and responsibilities than a cosigner or guarantor.

Promissory notes are debt instruments. They can be issued by financial institutions. The capital markets consist of two types of markets: primary and secondary.. However, they can also be issued by small companies or individuals.

With a personal guarantee, an individual agrees to be held contractually responsible if a borrower falls behind on repaying a loan. Similarly, a corporate guarantee represents an agreement where a corporate entity agrees to be held responsible.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

A cosigner agrees to take responsibility for repaying a loan if the primary borrower misses a payment. The cosigner typically has better credit or a higher income than the primary borrower, who might otherwise not get a loan application approved without the help of a cosigner.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Another important distinction to remember is that a co-borrower is primarily liable for the debt from its inception. In contrast, a guarantor is not liable unless the underlying borrower defaults and, depending on the terms of the guaranty, the lender pursues collection efforts against the borrower.

A bank can issue a promissory note, but so can an individual or a company or business. Anyone who lends money can do so. A promissory note isn't a contract, but you'll likely have to sign one before you take out a mortgage.