Los Angeles, California Guaranty of Promissory Note by Individual — Corporate Borrower: A Comprehensive Guide Introduction: In the dynamic financial landscape of Los Angeles, California, various types of Guaranty of Promissory Notes are utilized to secure loans between individuals and corporate borrowers. This detailed description aims to shed light on the importance, functions, and types of Guaranty of Promissory Notes prevalent in Los Angeles, California. 1. What is a Guaranty of Promissory Note by Individual — Corporate Borrower? A Guaranty of Promissory Note is a legal agreement through which an individual (guarantor) assumes responsibility for the repayment of a promissory note if the corporate borrower fails to fulfill their financial obligations. This crucial document protects lenders and provides an additional layer of security when extending credit in Los Angeles, California. 2. Key Components: — Parties Involved: This documentation involves at least two parties—the individual guarantor promising to repay the debt and the corporate borrower receiving the loan. — Terms and Conditions: The Guaranty of Promissory Note outlines specific terms, such as the loan amount, interest rate, repayment period, and consequences of default. — Liability Limitations: The agreement might define the guarantor's liability limits, such as capping the maximum amount they are responsible for or specifying their obligations in case of default or bankruptcy. 3. Types of Los Angeles California Guaranty of Promissory Note by Individual — Corporate Borrower: a. Unlimited Guaranty: An unlimited Guaranty of Promissory Note holds the individual guarantor fully responsible for all aspects of the loan, including the principal amount, accrued interest, and any associated costs. In case of default, the lender has the right to pursue all available assets of the guarantor to recover the outstanding balance. b. Limited Guaranty: Alternatively, a limited Guaranty of Promissory Note by an individual might impose restrictions on the guarantor's liability. For instance, the guarantor might be responsible only for a portion of the loan or face limited liability if certain predefined conditions are met. This type of guaranty mitigates the potential risks for the individual, offering more protection against financial liability. 4. Importance of Guaranty of Promissory Note: — Enhanced Lending Confidence: Lenders in Los Angeles, California relies on Guaranty of Promissory Notes to minimize risks and instill confidence in borrowers wishing to obtain credit. — Asset Protection: For lenders, an individual guarantor improves the chances of loan recovery by providing additional sources of repayment in case of borrower default. — Legal Standing: A properly executed Guaranty of Promissory Note ensures compliance with Californian legal requirements, allowing lenders to pursue legal remedies if needed. Conclusion: The Guaranty of Promissory Note by Individual — Corporate Borrower holds significant importance in the Los Angeles, California financial landscape. By providing an additional layer of security, it safeguards lenders from potential loan defaults and facilitates the lending process. Whether in the form of an unlimited or limited guaranty, this legal document plays a critical role in protecting the interests of all parties involved in financial transactions in Los Angeles, California.

Los Angeles California Guaranty of Promissory Note by Individual - Corporate Borrower

Description

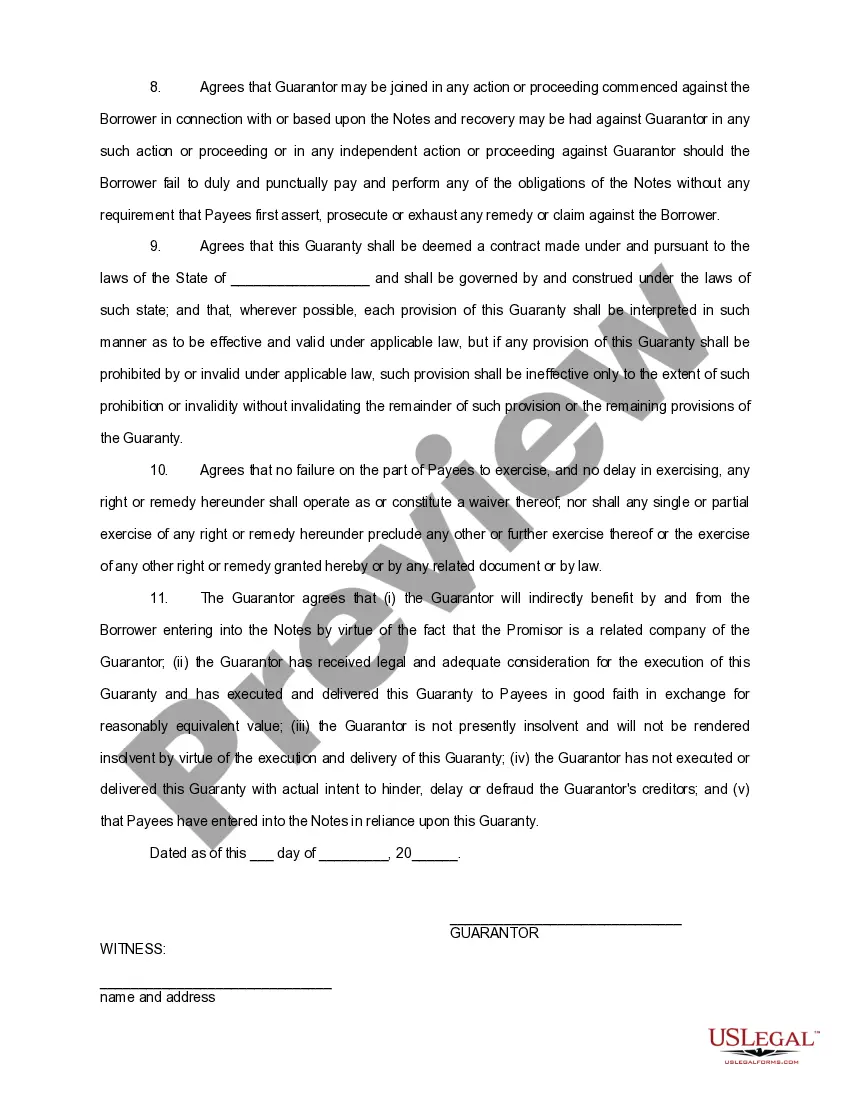

How to fill out Los Angeles California Guaranty Of Promissory Note By Individual - Corporate Borrower?

Dealing with legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including Los Angeles Guaranty of Promissory Note by Individual - Corporate Borrower, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various categories varying from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching process less challenging. You can also find detailed resources and guides on the website to make any activities related to document execution simple.

Here's how to purchase and download Los Angeles Guaranty of Promissory Note by Individual - Corporate Borrower.

- Take a look at the document's preview and description (if available) to get a general information on what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the validity of some records.

- Examine the similar document templates or start the search over to find the correct document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Los Angeles Guaranty of Promissory Note by Individual - Corporate Borrower.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Los Angeles Guaranty of Promissory Note by Individual - Corporate Borrower, log in to your account, and download it. Needless to say, our platform can’t take the place of a legal professional entirely. If you need to deal with an extremely complicated case, we advise getting a lawyer to review your form before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork with ease!