A Montgomery Maryland Guaranty of Promissory Note by Individual — Corporate Borrower is a legally binding agreement in which an individual agrees to be personally responsible for repaying a promissory note on behalf of a corporate borrower in Montgomery County, Maryland. This guarantees that if the corporate borrower defaults on their loan obligations, the individual guarantor will fulfill those financial obligations. In Montgomery County, Maryland, there are various types of Guaranty of Promissory Note by Individual — Corporate Borrower agreements. These may include: 1. Unconditional Guaranty: This type of guaranty holds the individual guarantor fully accountable for the debts and obligations of the corporate borrower, regardless of any conditions or circumstances. It provides the lender with an added layer of security, ensuring that the debt will be paid back. 2. Limited Guaranty: Unlike an unconditional guaranty, a limited guaranty imposes certain restrictions or limitations on the individual guarantor's obligations. It may define specific circumstances or limits under which the guarantor becomes responsible for the promissory note, such as a certain dollar amount or timeframe. 3. Continuing Guaranty: A continuing guaranty remains in effect until the promissory note is fully repaid, even if there are modifications or amendments made to the loan agreement. This ensures the individual guarantor's liability extends to any changes in the terms of the promissory note without requiring the agreement to be renegotiated. 4. Demand Guaranty: A demand guaranty allows the lender to request immediate payment from the individual guarantor as soon as the corporate borrower fails to make the required payments or breaches the terms of the promissory note. It provides the lender with the flexibility to enforce the guaranty upon demand, without waiting for the entire loan term to expire. 5. Limited Liability Guaranty: A limited liability guaranty restricts the individual guarantor's liability to a specific amount or percentage of the outstanding balance of the promissory note. This limits the guarantor's exposure to a predetermined sum without requiring them to be fully responsible for the entire debt of the corporate borrower. In Montgomery, Maryland, the Guaranty of Promissory Note by Individual — Corporate Borrower plays a crucial role in securing loans and mitigating risks for lenders. It ensures that in case of default or non-payment by the corporate borrower, the individual guarantor will be held accountable and will have to fulfill the loan obligations.

Montgomery Maryland Guaranty of Promissory Note by Individual - Corporate Borrower

Description

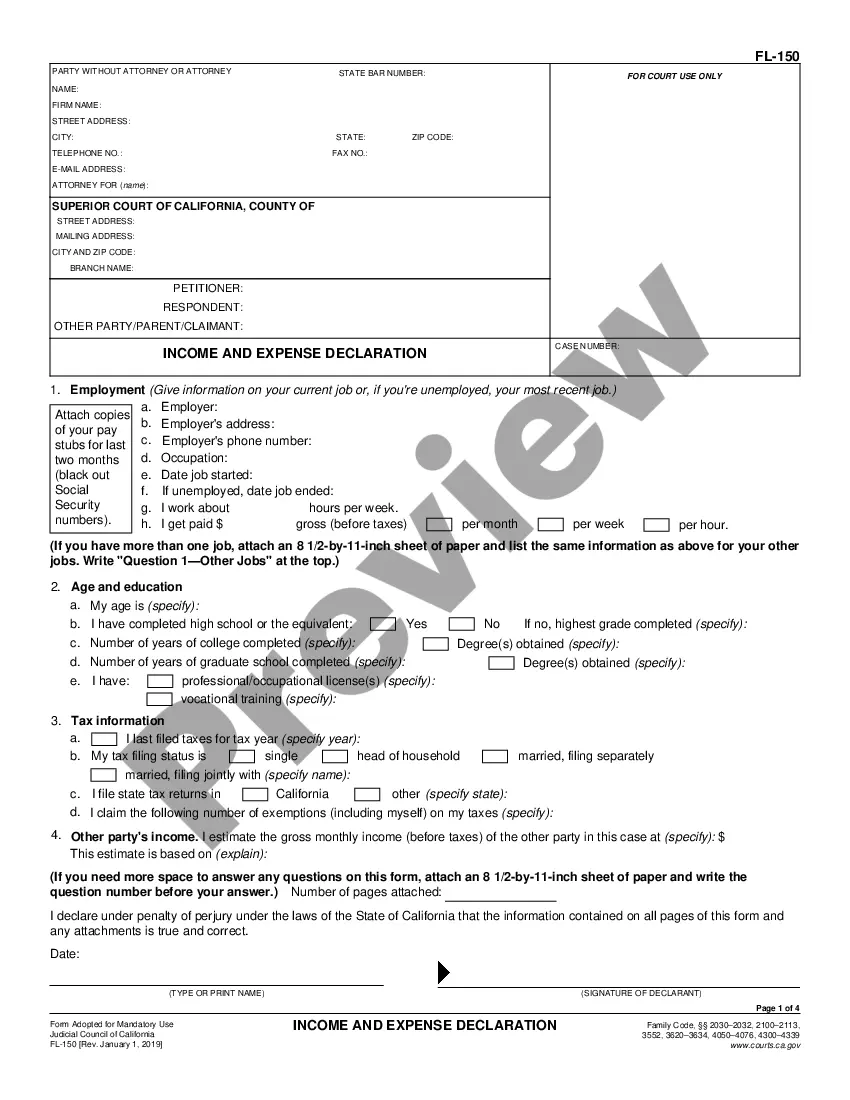

How to fill out Montgomery Maryland Guaranty Of Promissory Note By Individual - Corporate Borrower?

Creating documents, like Montgomery Guaranty of Promissory Note by Individual - Corporate Borrower, to take care of your legal affairs is a tough and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can take your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents crafted for a variety of cases and life situations. We make sure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Montgomery Guaranty of Promissory Note by Individual - Corporate Borrower template. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as straightforward! Here’s what you need to do before getting Montgomery Guaranty of Promissory Note by Individual - Corporate Borrower:

- Make sure that your form is compliant with your state/county since the rules for creating legal papers may differ from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Montgomery Guaranty of Promissory Note by Individual - Corporate Borrower isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start utilizing our service and get the form.

- Everything looks good on your end? Click the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is all set. You can go ahead and download it.

It’s an easy task to locate and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

The most important difference between a cosigner and a guarantor is that a cosigner is immediately responsible for paying rent, just as the tenant is. A guarantor is only responsible for paying rent when the tenant fails to do so themselves.

Guaranteed promissory note means a written contract obligating a recipient to repay the funds received if the recipient does not fulfill the service obligation, which was a condition of the recipient's scholarship, or grant award.

Promissory note and a bond is twofold : - (i) a promissory note contains a promise to pay a certain sum of money to another, whereas a bond contains a promise to pay simple money. In the case of a bond the promised sum need not be a certain sum.

If a guarantor is forced to settle a borrower's debt, they might seek to recover their loss, directly from the borrower. A guarantor can do this by 'subrogation', which means stepping into the shoes of the lender and taking direct action.

A cosigner agrees to take responsibility for repaying a loan if the primary borrower misses a payment. The cosigner typically has better credit or a higher income than the primary borrower, who might otherwise not get a loan application approved without the help of a cosigner.

Co-Borrower Meaning A co-borrower is a person who applies for and shares liability of a loan with another borrower. Under these circumstances, both borrowers are responsible for repayment. Generally, they also share title in the home or other asset that the loan is for.

A promissory note is a legal document signed by a debtor who promises to pay a debt in a form and manner as described in the document. A personal guaranty, as defined at businessdictionary.com, is an agreement that makes one liable for one's own or a third party's debts or obligations.

Another important distinction to remember is that a co-borrower is primarily liable for the debt from its inception. In contrast, a guarantor is not liable unless the underlying borrower defaults and, depending on the terms of the guaranty, the lender pursues collection efforts against the borrower.

applicant is a person who joins in the application of a loan or other service. Having a coapplicant can make an application more attractive since it involves additional sources of income, credit, or assets. applicant has more rights and responsibilities than a cosigner or guarantor.

A promissory note is not the same as a contract. A contract details all the terms of a legal agreement. A promissory note covers only the following: The date by when someone needs to be paid.