When it comes to financial transactions and loans, a Guaranty of Promissory Note is a common legal document that offers protection to lenders. In Santa Clara, California, this type of guaranty agreement is crucial for securing loans between an individual and a corporate borrower. It ensures that the lender can recover their funds in case the borrower defaults on the promissory note. Here is a detailed description of what the Santa Clara California Guaranty of Promissory Note by Individual — Corporate Borrower entails: The Santa Clara California Guaranty of Promissory Note by Individual — Corporate Borrower is a legally binding agreement executed between a lender, typically a financial institution, and a corporate borrower, which can be a business entity or corporation. In this arrangement, an individual acts as a guarantor, assuming responsibility for the borrower's obligations in case of default. Keywords: Santa Clara California, Guaranty of Promissory Note, Individual, Corporate Borrower, loan, financial transactions, legal document, protection, lenders, default, promissory note, agreement, corporation, business entity, responsibility. Types of Santa Clara California Guaranty of Promissory Note by Individual — Corporate Borrower may include: 1) Limited Guaranty of Promissory Note: This type of guaranty places restrictions on the guarantor's liability, often limiting it to a specific amount or time frame. It provides partial protection to the lender and may have conditions or qualifications attached. 2) Unconditional Guaranty of Promissory Note: In an unconditional guaranty, the individual guarantor accepts full liability for the borrower's obligations without any restrictions or limitations. This type offers maximum protection to lenders as the guarantor is obligated to fulfill the borrower's obligations entirely. 3) Continuing Guaranty of Promissory Note: A continuing guaranty remains valid even if the borrower takes out multiple promissory notes over time. It extends the guarantor's liability beyond the initial loan and covers subsequent financial transactions, providing ongoing protection to the lender. 4) Limited Recourse Guaranty of Promissory Note: This type of guaranty limits the lender's recourse to specific assets or collateral offered by the borrower. The guarantor's liability is restricted to the value of the designated assets, reducing their overall exposure. 5) Joint and Several Guaranty of Promissory Note: In a joint and several guaranties, multiple individuals or entities act as guarantors, collectively assuming responsibility for the borrower's obligations. Each guarantor can be held individually liable for the entire debt amount, giving the lender more flexibility in pursuing repayment. Santa Clara California Guaranty of Promissory Note by Individual — Corporate Borrower plays a significant role in securing loans and protecting lenders' interests. It establishes a legal framework that ensures the guarantor's commitment to fulfilling the borrower's obligations if default occurs. Lenders in Santa Clara, California, value this important document for managing financial risks associated with corporate borrowing from individuals.

Santa Clara California Guaranty of Promissory Note by Individual - Corporate Borrower

Description

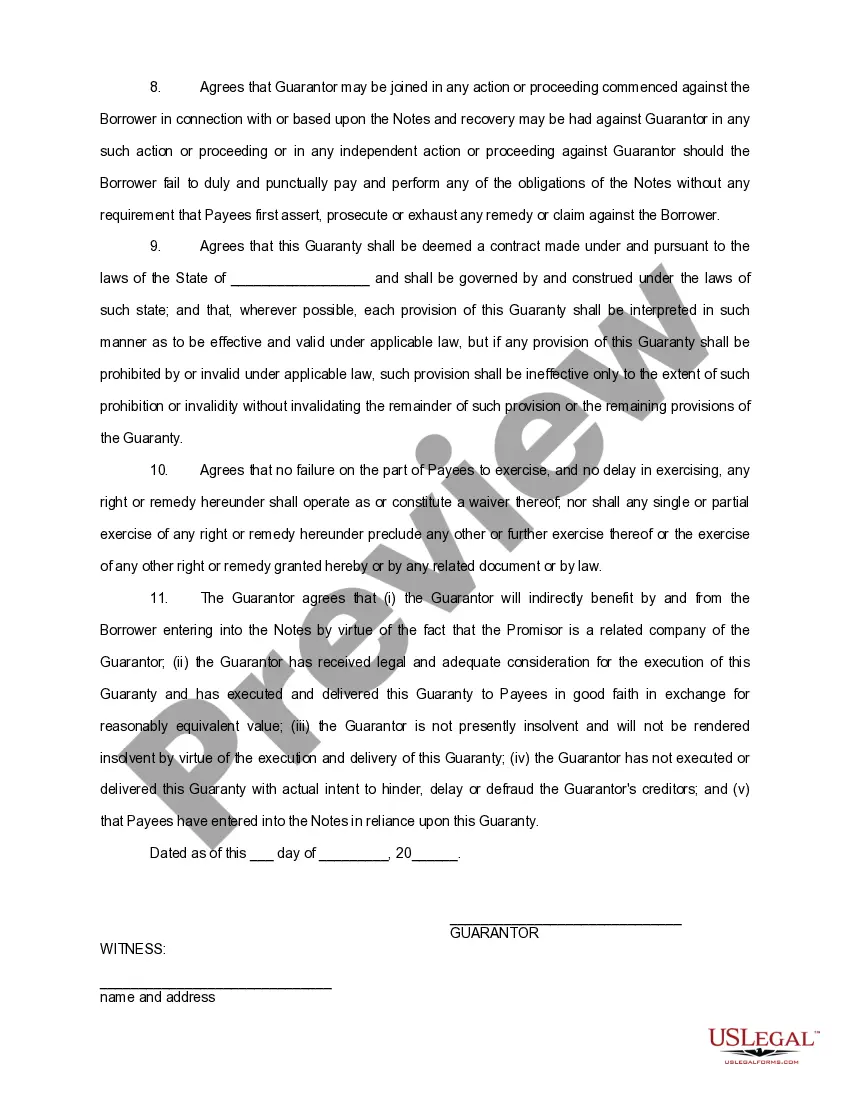

How to fill out Santa Clara California Guaranty Of Promissory Note By Individual - Corporate Borrower?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Santa Clara Guaranty of Promissory Note by Individual - Corporate Borrower is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to get the Santa Clara Guaranty of Promissory Note by Individual - Corporate Borrower. Follow the guidelines below:

- Make sure the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample when you find the right one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Santa Clara Guaranty of Promissory Note by Individual - Corporate Borrower in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!