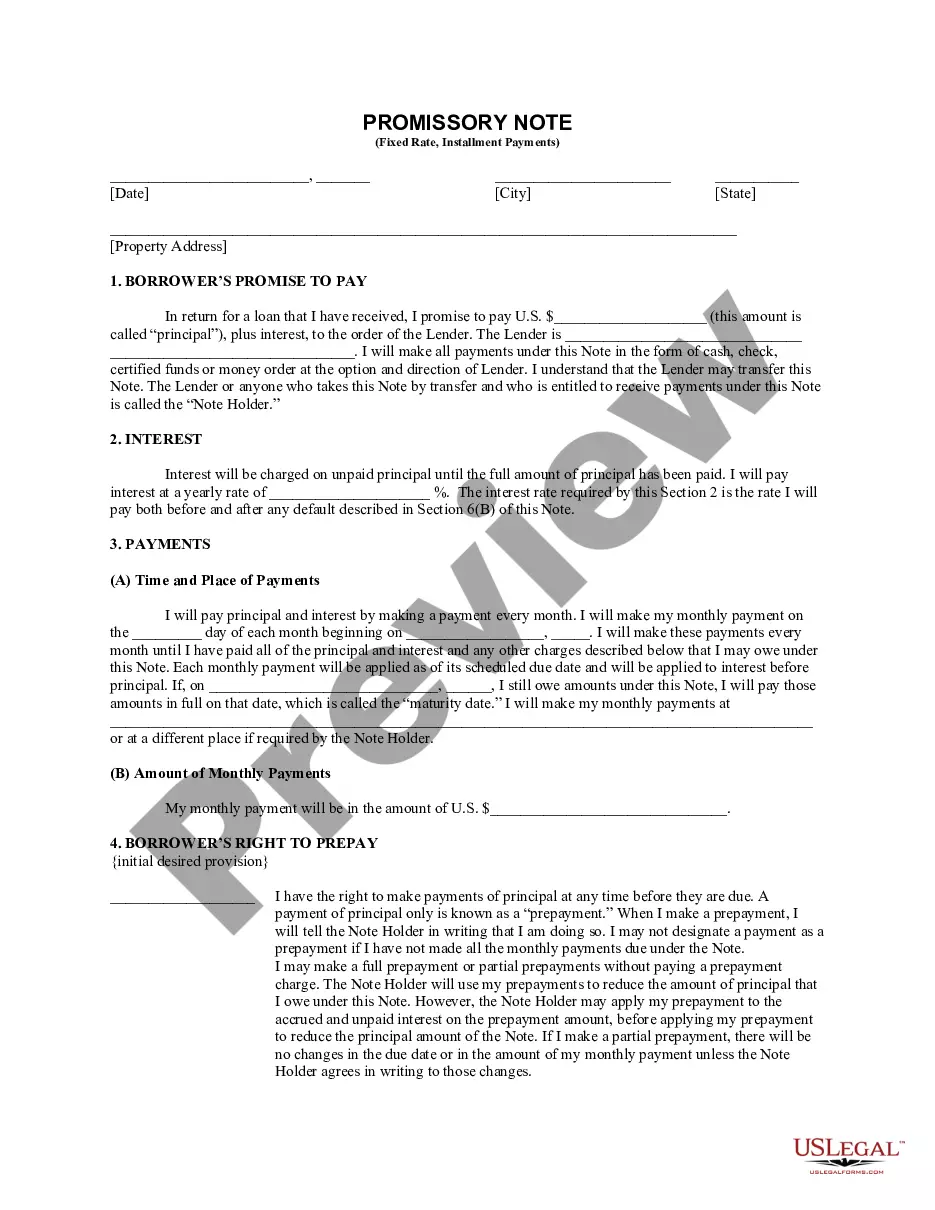

The Wake North Carolina Guaranty of Promissory Note by Corporation — Individual Borrower is a legal document that outlines the terms and conditions of a promissory note guarantee provided by a corporation on behalf of an individual borrower. This type of guarantee agreement is commonly used in financial transactions where a corporation agrees to back the borrower's financial obligations. The Wake North Carolina Guaranty of Promissory Note offers protection to a lender by ensuring that the corporation will fulfill the obligations of the individual borrower if they default on the loan. It provides an additional level of assurance to the lender, mitigating the risk involved in extending credit to an individual borrower. The terms and conditions outlined in this guaranty document include details such as the amount of the promissory note, the repayment schedule, the interest rate, and any penalties for default. It may also specify any collateral that secures the loan. There may be different types of Wake North Carolina Guaranty of Promissory Note by Corporation — Individual Borrower agreements tailored to specific situations, such as: 1. Limited Guaranty: This type of guaranty covers only a portion of the borrower's obligations, limiting the corporation's liability to a specific amount or duration. 2. Absolute Guaranty: In an absolute guaranty, the corporation assumes full responsibility for the borrower's obligations, ensuring complete payment in case of default. 3. Continuing Guaranty: This type of guaranty remains in effect for future transactions between the borrower and the lender. It covers not only the existing promissory note but also any future borrowings. These types of guaranty agreements are essential for both lenders and borrowers to establish a clear understanding of the responsibilities and liabilities involved in a financial transaction. It is crucial for all parties involved to carefully review and understand the terms and conditions before signing the Wake North Carolina Guaranty of Promissory Note by Corporation — Individual Borrower. Seeking legal advice is strongly recommended ensuring compliance with North Carolina state laws and regulations.

Wake North Carolina Guaranty of Promissory Note by Corporation - Individual Borrower

Description

How to fill out Wake North Carolina Guaranty Of Promissory Note By Corporation - Individual Borrower?

If you need to find a reliable legal document supplier to obtain the Wake Guaranty of Promissory Note by Corporation - Individual Borrower, consider US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of learning resources, and dedicated support make it simple to find and execute various documents.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Wake Guaranty of Promissory Note by Corporation - Individual Borrower, either by a keyword or by the state/county the form is created for. After finding the required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Wake Guaranty of Promissory Note by Corporation - Individual Borrower template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be instantly available for download once the payment is completed. Now you can execute the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less costly and more reasonably priced. Set up your first business, organize your advance care planning, create a real estate agreement, or complete the Wake Guaranty of Promissory Note by Corporation - Individual Borrower - all from the comfort of your home.

Join US Legal Forms now!

Form popularity

FAQ

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

While a promissory note involves two parties (the payer and the payee), checks involve three parties (the payer, the payee, and the bank from which the funds are drawn).

The asset (promissory note) is protected by the collateral (the guarantor's promise to pay, and the ability to sue the guarantor personally for noncompliance with the terms of the promissory note). As with any collateral, a personal guarantee gives the asset more security.

Types of Promissory NotesSimple Promissory Note.Student Loan Promissory Note.Real Estate Promissory Note.Personal Loan Promissory Notes.Car Promissory Note.Commercial Promissory note.Investment Promissory Note.

A written promise to pay money that is often used as a means to borrow funds or take out a loan. The individual who promises to pay is the maker, and the person to whom payment is promised is called the payee or holder. If signed by the maker, a promissory note is a negotiable instrument.

4 Types of Promissory Notes.

A promissory note is a legal document signed by a debtor who promises to pay a debt in a form and manner as described in the document. A personal guaranty, as defined at businessdictionary.com, is an agreement that makes one liable for one's own or a third party's debts or obligations.

A personal guaranty is not enforceable without consideration In fact, no contract is enforceable without consideration. A personal guaranty is a type of contract. A contract is an enforceable promise. The enforceability of a contract comes from one party's giving of consideration to the other party.

In general, promissory notes are used for more informal relationships than loan agreements. A promissory note can be used for friend and family loans, or short-term, small loans. Loan agreements, on the other hand, are used for everything from vehicles to mortgages to new business ventures.

Types of Promissory NotesSimple promissory note.Demand promissory note.Secured promissory note.Unsecured promissory note.