Queens New York Sample Letter for Agreement to Extend Debt Payment

Description

How to fill out Queens New York Sample Letter For Agreement To Extend Debt Payment?

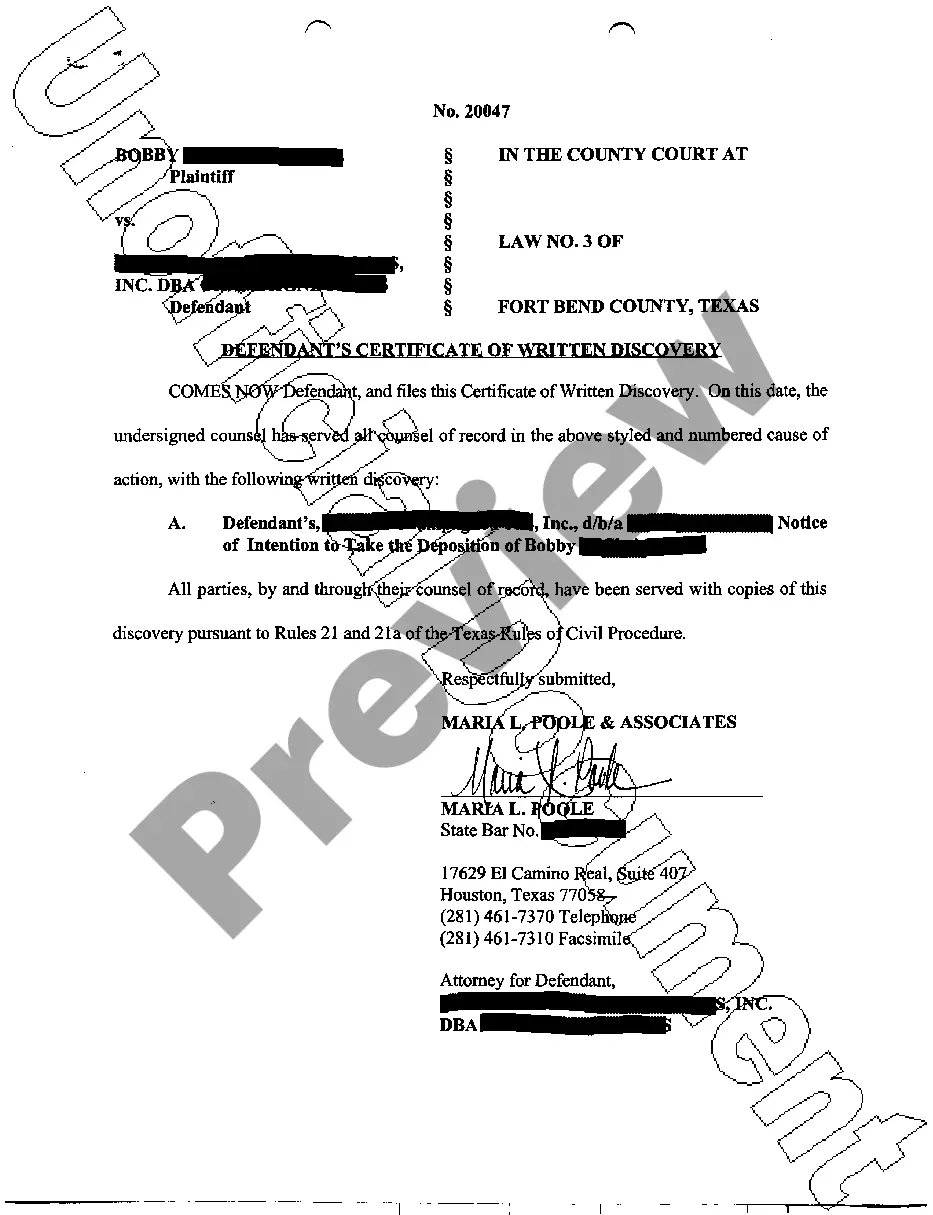

How much time does it usually take you to draw up a legal document? Considering that every state has its laws and regulations for every life situation, finding a Queens Sample Letter for Agreement to Extend Debt Payment suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. Aside from the Queens Sample Letter for Agreement to Extend Debt Payment, here you can get any specific document to run your business or individual deeds, complying with your county requirements. Experts check all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can pick the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Queens Sample Letter for Agreement to Extend Debt Payment:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Queens Sample Letter for Agreement to Extend Debt Payment.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Writing the Settlement Offer LetterInclude your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

If a debtor signs a reaffirmation agreement, the debtor agrees to pay a debt that otherwise might be discharged in his or her bankruptcy case. There may be other ways to renegotiate payments with creditors without entering into a reaffirmation agreement.

Reaffirmation is the process wherein you agree to remain responsible for a debt so that you can keep the property securing the debt (collateral). You and the lender enter into a new contractusually on the same termsand submit it to the bankruptcy court.

It must be: Signed by the bankruptcy debtor; Filed by the court; Discussed with attorney; if no attorney, a court hearing is required.

Debt settlement is a practice that allows you to pay a lump sum that's typically less than the amount you owe to resolve, or settle, your debt. It's a service that's typically offered by third-party companies that claim to reduce your debt by negotiating a settlement with your creditor.

If the debt you have is secured, meaning it uses your home or vehicle as collateral, and you want to maintain possession of that collateral, a reaffirmation agreement stops you from losing it through repossession or foreclosure. It can also help reduce the damage bankruptcy will have to your credit score.

The language can be as simple as: In order to settle this matter amicably, I offer you the sum of amount (inclusive of interests and costs) as the full and final settlement of the above claim/debt.

Reaffirmation is an agreement by a debtor, to a lender, to repay some or all of their debt. Debtors make reaffirmation agreements purely voluntarily. When a borrower reaffirms a debt, this is noted by credit reporting agencies, which then register that the person will make regular on-time payments.