A claim may be presented to the personal representative (i.e., executor or administrator) at any time before the estate is closed if suit on the claim has not been barred by the general statute of limitations or a statutory notice to creditors. Claims may generally be filed against an estate on any debt or other monetary obligation that could have been brought against the decedent during his/her life.

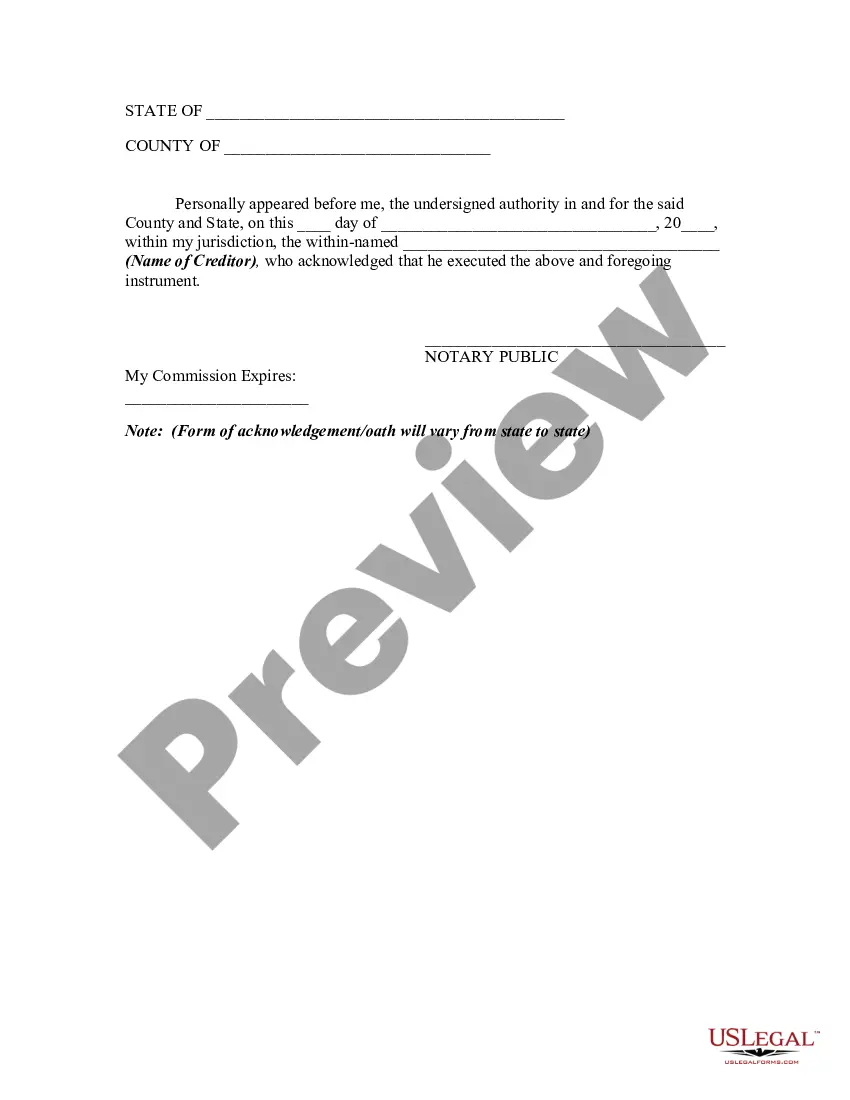

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Cook Illinois Release of Claims Against an Estate By Creditor is a legal document that outlines the process by which a creditor releases their claims against the assets of an estate. This release of claims is typically done when a debtor, who owed debts to the creditor, passes away. By signing this document, the creditor states that they no longer have any outstanding claims against the estate and will not pursue any further legal or financial action. The Cook Illinois Release of Claims Against an Estate By Creditor is used in various situations, such as: 1. Probate Cases: When a debtor dies, their estate enters the probate process, where all outstanding debts and obligations are settled. Creditors who are owed money can use this release of claims to formally state that they will not make any claims against the assets of the estate. 2. Debt Settlement: In some cases, creditors may choose to negotiate a settlement with the debtor's estate rather than pursuing the full value of the owed debts. By signing the release of claims, the creditor acknowledges the agreed-upon settlement and confirms that they will not seek further payment. 3. Insolvency or Bankruptcy Proceedings: If a debtor has filed for insolvency or bankruptcy, the Cook Illinois Release of Claims Against an Estate By Creditor may be used by creditors to discharge their claims against the estate. This document ensures that creditors are satisfied with the proceeds they can receive from the debtor's bankruptcy estate. The Cook Illinois Release of Claims Against an Estate By Creditor includes specific keywords to establish its legal nature and provide clarity regarding its purpose. Some relevant keywords for this document may include: — Estate: Referring to the total assets, debts, and obligations left by a deceased individual. — Creditor: A person or entity to whom the debtor owes money or holds an outstanding debt. — Claims: Denoting the debts owed by the debtor to the creditor. — Release: The act of relinquishing or letting go of claims. — Probate: The legal process of settling an individual's estate after their death. — Settlement: An agreement between the debtor's estate and the creditor to resolve outstanding debts. — Bankruptcy: The legal status of an individual who is unable to repay their debts. — Insolvency: The state of being unable to meet financial obligations or lacking sufficient assets to cover debts. In summary, the Cook Illinois Release of Claims Against an Estate By Creditor is a crucial legal document used in various situations to release the claims a creditor may have against the assets of a debtor's estate.Cook Illinois Release of Claims Against an Estate By Creditor is a legal document that outlines the process by which a creditor releases their claims against the assets of an estate. This release of claims is typically done when a debtor, who owed debts to the creditor, passes away. By signing this document, the creditor states that they no longer have any outstanding claims against the estate and will not pursue any further legal or financial action. The Cook Illinois Release of Claims Against an Estate By Creditor is used in various situations, such as: 1. Probate Cases: When a debtor dies, their estate enters the probate process, where all outstanding debts and obligations are settled. Creditors who are owed money can use this release of claims to formally state that they will not make any claims against the assets of the estate. 2. Debt Settlement: In some cases, creditors may choose to negotiate a settlement with the debtor's estate rather than pursuing the full value of the owed debts. By signing the release of claims, the creditor acknowledges the agreed-upon settlement and confirms that they will not seek further payment. 3. Insolvency or Bankruptcy Proceedings: If a debtor has filed for insolvency or bankruptcy, the Cook Illinois Release of Claims Against an Estate By Creditor may be used by creditors to discharge their claims against the estate. This document ensures that creditors are satisfied with the proceeds they can receive from the debtor's bankruptcy estate. The Cook Illinois Release of Claims Against an Estate By Creditor includes specific keywords to establish its legal nature and provide clarity regarding its purpose. Some relevant keywords for this document may include: — Estate: Referring to the total assets, debts, and obligations left by a deceased individual. — Creditor: A person or entity to whom the debtor owes money or holds an outstanding debt. — Claims: Denoting the debts owed by the debtor to the creditor. — Release: The act of relinquishing or letting go of claims. — Probate: The legal process of settling an individual's estate after their death. — Settlement: An agreement between the debtor's estate and the creditor to resolve outstanding debts. — Bankruptcy: The legal status of an individual who is unable to repay their debts. — Insolvency: The state of being unable to meet financial obligations or lacking sufficient assets to cover debts. In summary, the Cook Illinois Release of Claims Against an Estate By Creditor is a crucial legal document used in various situations to release the claims a creditor may have against the assets of a debtor's estate.