Bronx New York Affidavit of Self-Employed Independent Contractor Regarding Loss of Wages as Proof of Damages in Personal Injury Suit serves as a crucial document in legal proceedings when a self-employed independent contractor from the Bronx experiences loss of wages due to personal injury. This affidavit helps contractors obtain compensation for the financial losses incurred during their recovery period. Keywords: Bronx New York, Affidavit, Self-Employed, Independent Contractor, Loss of Wages, Proof of Damages, Personal Injury Suit There are various types of Bronx New York Affidavits of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit, including: 1. Casualty Affidavit: This type of affidavit is utilized by self-employed independent contractors in the Bronx who have suffered injuries due to accidents, such as slip and falls, construction site mishaps, or motor vehicle collisions, which have led to a loss of wages. 2. Medical Malpractice Affidavit: When a self-employed independent contractor in the Bronx experiences personal injury due to medical negligence or malpractice, this type of affidavit is employed to provide evidence of the resulting loss of wages. 3. Work-related Injury Affidavit: If a self-employed independent contractor based in the Bronx sustains an injury while performing their job duties, this affidavit is used to illustrate the financial impact of the injury, including loss of wages, on their personal injury suit. 4. Professional Negligence Affidavit: In cases where a self-employed independent contractor from the Bronx suffers personal injury due to another party's professional negligence, such as a faulty repair or incorrect advice, this type of affidavit highlights the resulting loss of wages as proof of damages. 5. Premises Liability Affidavit: Self-employed contractors in the Bronx who sustain injuries on someone else's property, such as a slip and fall in a store or a construction site accident, utilize this affidavit to demonstrate the loss of wages they have incurred as a consequence of their injuries. These different types of Bronx New York Affidavits of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit allow contractors to present concrete evidence of their financial hardships, thereby strengthening their legal case and increasing their chances of receiving appropriate compensation for their injuries.

Bronx New York Affidavit of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit

Description

How to fill out Bronx New York Affidavit Of Self-Employed Independent Contractor Regarding Loss Of Wages As Proof Of Damages In Personal Injury Suit?

Drafting paperwork for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to generate Bronx Affidavit of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit without professional assistance.

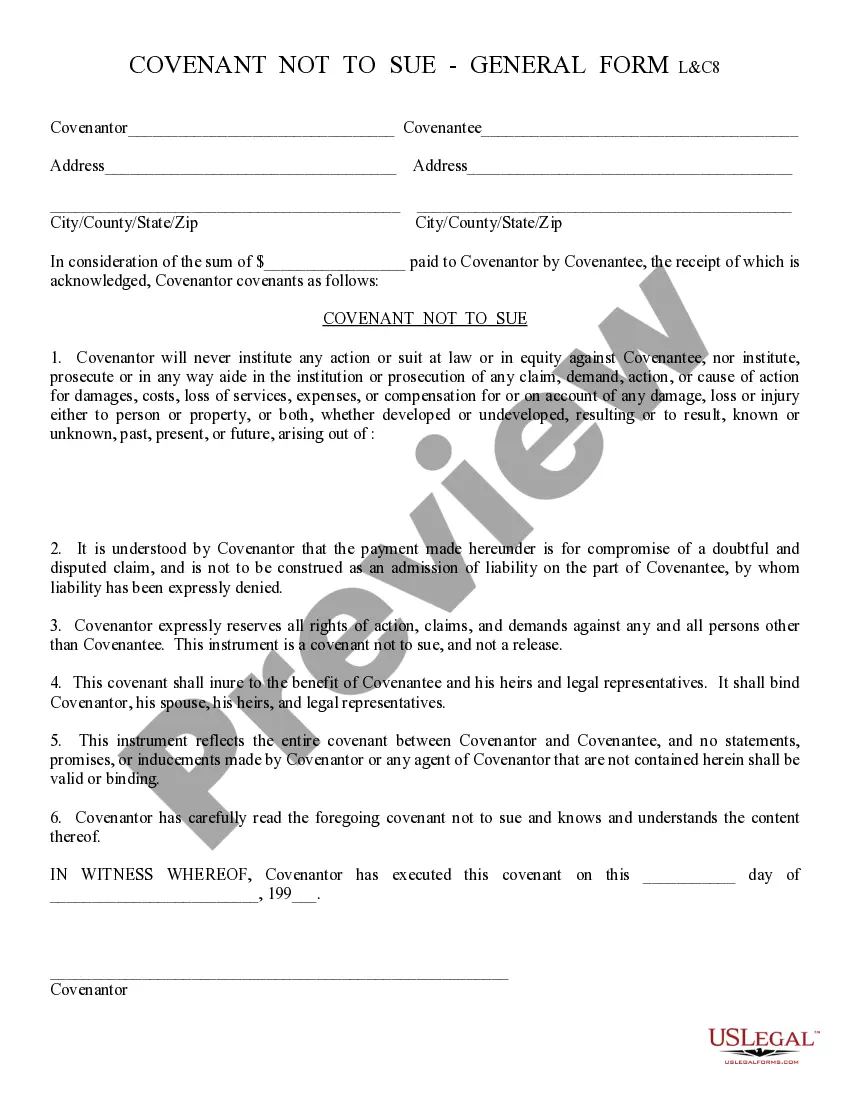

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Bronx Affidavit of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit by yourself, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Bronx Affidavit of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit:

- Look through the page you've opened and check if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a couple of clicks!

Form popularity

FAQ

I, , do hereby certify that I am self-employed and that for the most current tax year, my net earnings were $. I hereby attach a copy of my individual federal income tax return for the prior calendar year.

If an independent contractor can show that his employer's negligence caused his injuries, he would be entitled to the same compensation as an employee working for the non-subscriber employer. This includes damages for his medical bills, lost wages, and pain and suffering.

Some ways to prove self-employment income include:Annual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS.1099 Forms.Bank Statements.Profit/Loss Statements.Self-Employed Pay Stubs.

As in all personal injury claims damages for loss of earnings are awarded on the basis of evidence. You ('the Claimant') will need to prove your loss....Such evidence could include:Tax returns.Accounts (profit and loss)Invoices and receipts.16 Sept 2020

6 steps to writing an affidavitTitle the affidavit. First, you'll need to title your affidavit.Craft a statement of identity. The very next section of your affidavit is what's known as a statement of identity.Write a statement of truth.State the facts.Reiterate your statement of truth.Sign and notarize.

California Department of Public Health. Self-Employment Affidavit. This form is to be completed by self-employed individuals who have not filed taxes and who cannot provide paystubs to establish annual household income (e.g., an individual who works for cash or contracts with organizations but does not have an employer

How to Write an Income Verification Letter for Self-Employed?Introduce yourself and indicate the purpose of this statement.Confirm you are self-employed.Provide a breakdown of your income.Add your contact details - the recipient may want to verify certain information you have shared.More items...

Loss of income is relatively simply to prove. This is because determining the amount simply requires examining the plaintiff's work attendance record and their pay stubs....Potential evidence of loss of income could include:Bills;Invoices; of.Documentation of missed meetings or conferences.

If you're wondering how to claim for loss of earnings compensation in the UK, you will need to be able to prove how much income you have lost, including your loss of projected future income. To prove this, you will need to be able to provide a loss of earnings claims letter, with a detailed Schedule of Loss.

More info

State schools are not included due to limited size and expense. 2. To be considered “good” (the average income per pupil is adequate to support a “good school district in general”) by the Board of Education. 3. To be entitled to use (via school financing) the tax base of a school district of 3,000 or fewer households or 2,000 households of moderate incomes or less. 4. To be entitled to use (via school financing) any other tax base it establishes. To allow an outside agency (such as an outside consulting firm) to conduct a study that would compare all the above schools that receive the same funding from the state (with some caveats). 1. The state charter (if any) and the agreement on the basis for determining the charter's existence. 2. Charter schools and the board of education, or the governing body if they are both incorporated into a commonwealth charter school district. 3. A local school district. 4.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.