Dear [Employer], I am writing to request an Application for Employer Identification Number (EIN) for my business in Phoenix, Arizona. As an employer operating in this thriving city, obtaining an EIN is crucial to comply with federal tax regulations and establishing a solid foundation for my business. A Phoenix Arizona Sample Letter regarding Application for Employer Identification Number consists of several key components to ensure a successful application process. Firstly, it is essential to include accurate and up-to-date information about your business, including its legal name, address, and contact details. This information will help the Internal Revenue Service (IRS) to identify and allocate the EIN correctly. Furthermore, it is important to outline the type of entity your business operates as, such as sole proprietorship, partnership, corporation, Limited Liability Company (LLC), or nonprofit organization. This classification will determine the appropriate tax form and requirements for your business. For instance, a sole proprietorship may only require the use of the owner's Social Security Number, while other entities typically need an EIN. To successfully apply for an EIN, you will need to provide your business's principal activity or product/service, the date you acquired or started the business, and the reason for requesting an EIN. The reason for your request will most likely be "starting a new business," but for other situations such as opening a new bank account, acquiring employees, or changing the business structure, an EIN may also be required. Additionally, when applying for an EIN, you must designate a responsible party for your business. This person will be the main contact regarding the EIN application and will act as the primary point of contact with the IRS. Include their full legal name, Social Security Number, and contact information. Finally, sign and date the letter to show its authenticity and ensure compliance with the IRS requirements. Remember to keep a copy of the application for your records. In conclusion, a Phoenix Arizona Sample Letter regarding Application for Employer Identification Number is a formal request for an EIN for your business operating in Phoenix, Arizona. Including accurate and comprehensive information about your business, its entity type, principal activities, and the reason for application is vital. Furthermore, designating a responsible party and signing the letter certifies its authenticity. By meticulously addressing these details, your EIN application process is more likely to proceed smoothly. Sincerely, [Your Name] [Your Business Name] [Contact Information]

Phoenix Arizona Sample Letter regarding Application for Employer Identification Number

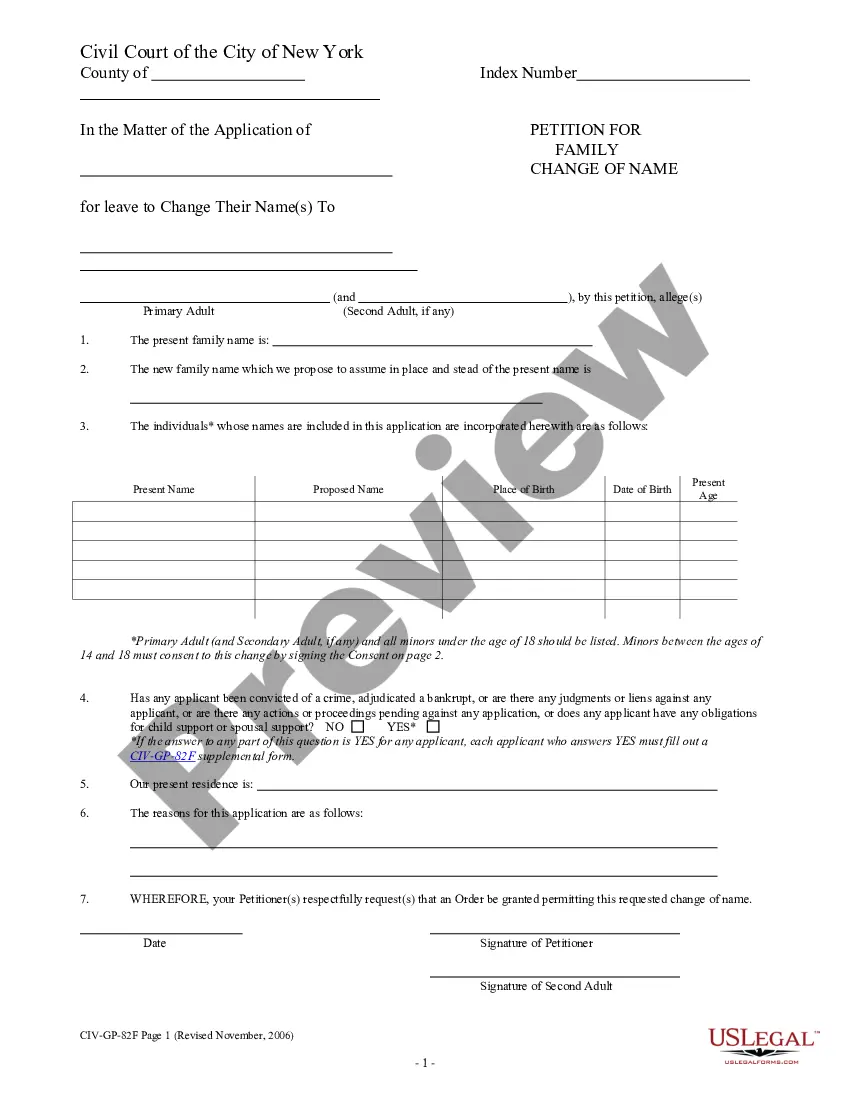

Description

How to fill out Phoenix Arizona Sample Letter Regarding Application For Employer Identification Number?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official paperwork that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Phoenix Sample Letter regarding Application for Employer Identification Number.

Locating templates on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Phoenix Sample Letter regarding Application for Employer Identification Number will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to get the Phoenix Sample Letter regarding Application for Employer Identification Number:

- Ensure you have opened the correct page with your local form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Phoenix Sample Letter regarding Application for Employer Identification Number on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!