Cook Illinois is a leading company in the transportation industry, providing efficient and reliable services for schools, organizations, and individuals. However, recent concerns have arisen regarding Cook Illinois' group insurance contract, leading to several complaints being raised by employees and customers. These complaints mainly revolve around issues related to coverage, benefits, and communication gaps. One common type of Cook Illinois complaint regarding the group insurance contract is the lack of comprehensive coverage. Employees and customers have expressed their dissatisfaction with the limited range of services covered, particularly regarding specific medical treatments, therapies, or specialized care. These complaints highlight the need for a more inclusive insurance plan that addresses diverse healthcare needs and offers a wider array of coverage options. Another type of Cook Illinois complaint related to the group insurance contract is the inadequate benefits provided. Both employees and customers have voiced their concerns over the insufficient financial assistance offered by the insurance plan. This includes complaints about high deductibles, co-payments, and out-of-pocket expenses, making it challenging for individuals to afford necessary medical services. The desire for improved benefits highlights the importance of a more affordable and supportive insurance plan. Additionally, communication gaps have emerged as a significant complaint regarding Cook Illinois' group insurance contract. Employees and customers have expressed frustration with the lack of clarity and transparency when it comes to understanding the insurance policy terms, eligibility criteria, and claim procedures. These complaints call for better communication channels, comprehensive documentation, and accessible customer support to help address questions and concerns effectively. To address these complaints, Cook Illinois needs to focus on reassessing and renegotiating their group insurance contract. It is crucial for the company to collaborate closely with insurance providers to develop a more holistic and adaptable insurance plan that fulfills the diverse needs of employees and customers. This includes exploring options for additional coverage, lowering deductibles and co-payments, and enhancing benefits. Furthermore, Cook Illinois should enhance their communication strategies to ensure that employees and customers can easily access and understand the group insurance contract. Clear and concise documentation, user-friendly online platforms, and timely updates are essential to bridge the existing gaps. Additionally, providing knowledgeable and responsive customer support will help address questions, concerns, and clarify any uncertainties related to the insurance policy. Overall, Cook Illinois must actively address the various complaints and concerns regarding their group insurance contract. By undertaking comprehensive reforms and implementing customer-centric policies, the company can ensure that employees and customers have access to a fair, inclusive, and reliable insurance plan.

Cook Illinois Complaint regarding Group Insurance Contract

Description

How to fill out Cook Illinois Complaint Regarding Group Insurance Contract?

Whether you intend to start your company, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Cook Complaint regarding Group Insurance Contract is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to obtain the Cook Complaint regarding Group Insurance Contract. Adhere to the guide below:

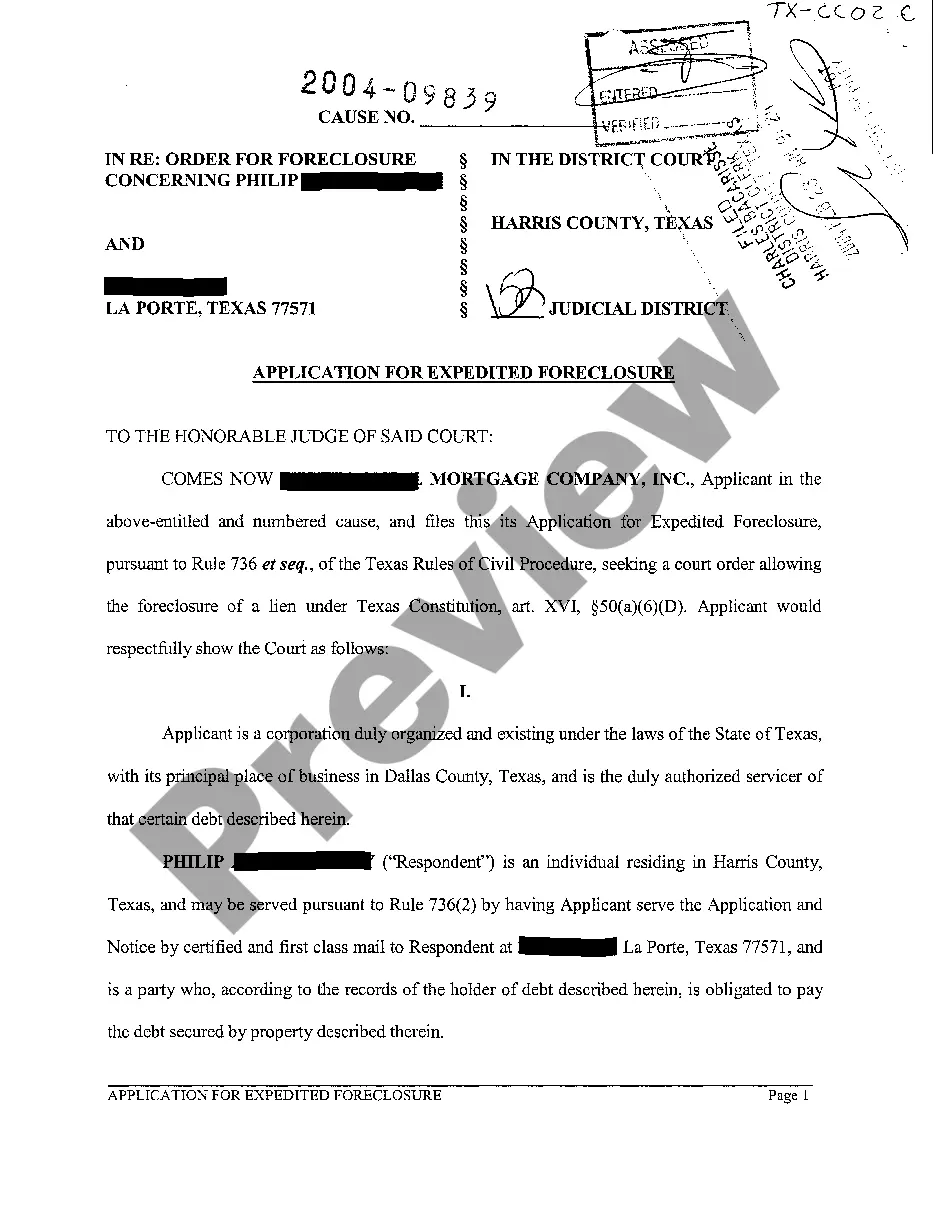

- Make certain the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the file once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Cook Complaint regarding Group Insurance Contract in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

How Do I...Statewide Toll-Free: 1-877-MY-FL-CFO (1-877-693-5236)Out of State Callers: (850) 413-3089.TDD Line: 1-800-640-0886.Email Address: Consumer.Services@myfloridacfo.com.

Insurance is regulated by the states. This system of regulation stems from the McCarran-Ferguson Act of 1945, which describes state regulation and taxation of the industry as being in the public interest and clearly gives it preeminence over federal law. Each state has its own set of statutes and rules.

1. Insurance Regulatory and Development Authority of India (IRDAI), is a statutory body formed under an Act of Parliament, i.e., Insurance Regulatory and Development Authority Act, 1999 (IRDAI Act 1999) for overall supervision and development of the Insurance sector in India.

New York State Insurance Department.

UAE Insurance AuthorityHead Office: Aldar HQ,Al Raha Beach,Abu Dhabi.Tel: 00971 24990111.Fax: 00971 24990111.Email: contactus@ia.gov.ae.Website: .

DIFS regulates the business of insurance transacted in Michigan. Our authority pertains to contracts issued in Michigan.

Contact infoAddress: 200 E. Gaines Street. Tallahassee, FL 32399.Phone: (850) 413-3140.E-mail: InsuranceCommissioner@floir.com.

The Office of Insurance Regulation regulates and provides oversight for all insurance companies and insurance-related entities licensed to do business in Florida as described above.

The NYS Department of Financial Services supervises and regulates all insurance business in NY State and investigates complaints about insurance company problems including violations of the NYS Prompt Pay Law (which requires health insurers & HMOs to pay undisputed health insurance claims within 45 days of receipt and

Insurance companies are regulated by the states. Each state has a regulatory body that oversees insurance matters. This body is often called the Department of Insurance, but some states use other names. Examples are the Office of the Insurance Commissioner (Washington) and the Division of Financial Regulation (Oregon).