Los Angeles California Complaint regarding Group Insurance Contract: A Detailed Description Introduction: In the bustling city of Los Angeles, California, Group Insurance Contracts play a vital role in providing comprehensive coverage to employees and members of various organizations. However, there may arise situations where complaints against these contracts become necessary. It is important to understand the common issues people might have with Group Insurance Contracts in Los Angeles, along with their possible variations. This article aims to delve into the topic, shedding light on Los Angeles California Complaints regarding Group Insurance Contracts and providing relevant keywords to address different types of complaints. 1. Denial of Claim Complaints: One of the primary concerns individuals or organizations may have regarding Group Insurance Contracts in Los Angeles is the denial of claims. These complaints arise when policyholders believe that their insurer has incorrectly denied their claim, leaving them without the expected coverage. Keywords: denied claim, rejection, dispute, coverage denial, justified claim denial. 2. Coverage Limitations Complaints: Another common complaint revolves around coverage limitations set within a Group Insurance Contract. Individuals may find themselves dissatisfied when they realize that certain medical treatments, procedures, or services deemed necessary by healthcare providers are not covered under their policy. Keywords: limited coverage, exclusions, restricted benefits, policy limitations, denial of essential services. 3. Premium Increases Complaints: Group Insurance Contracts in Los Angeles are subject to periodic premium adjustments. However, complaints may arise when policyholders believe that the increases are unreasonable, disproportionate, or unjustified. Keywords: unfair premium hike, excessive rate adjustment, unjustifiable increase, inflated premiums, inconsistent pricing. 4. Delayed Claim Processing Complaints: Instances where insurers excessively delay the processing of claims can lead to considerable frustration and financial strain. Policyholders may file a complaint if they feel their claims are not being handled promptly and fairly according to the terms of their Group Insurance Contract. Keywords: claim processing delay, excessive wait time, unreasonably long decision period, slow response, claim mishandling. 5. Poor Customer Service Complaints: Customer service is pivotal in the insurance industry, and inadequate support can result in dissatisfaction. Policyholders might complain about unresponsive, unhelpful, or rude behavior from insurance representatives, leading to frustration and a lack of trust in the insurer. Keywords: unsatisfactory service, unprofessional behavior, lack of assistance, negligent communication, ineffective support. Conclusion: Los Angeles California Complaints regarding Group Insurance Contracts can encompass various issues, from denial of claims and coverage limitations to premium increases, claim processing delays, and poor customer service. By addressing these concerns, insurers can work towards ensuring a fair and satisfactory experience for their policyholders. It is crucial for policyholders to communicate their grievances effectively, highlighting the specific issue they are facing, to seek resolution and enhance the overall trust in Group Insurance Contracts in Los Angeles, California.

Los Angeles California Complaint regarding Group Insurance Contract

Description

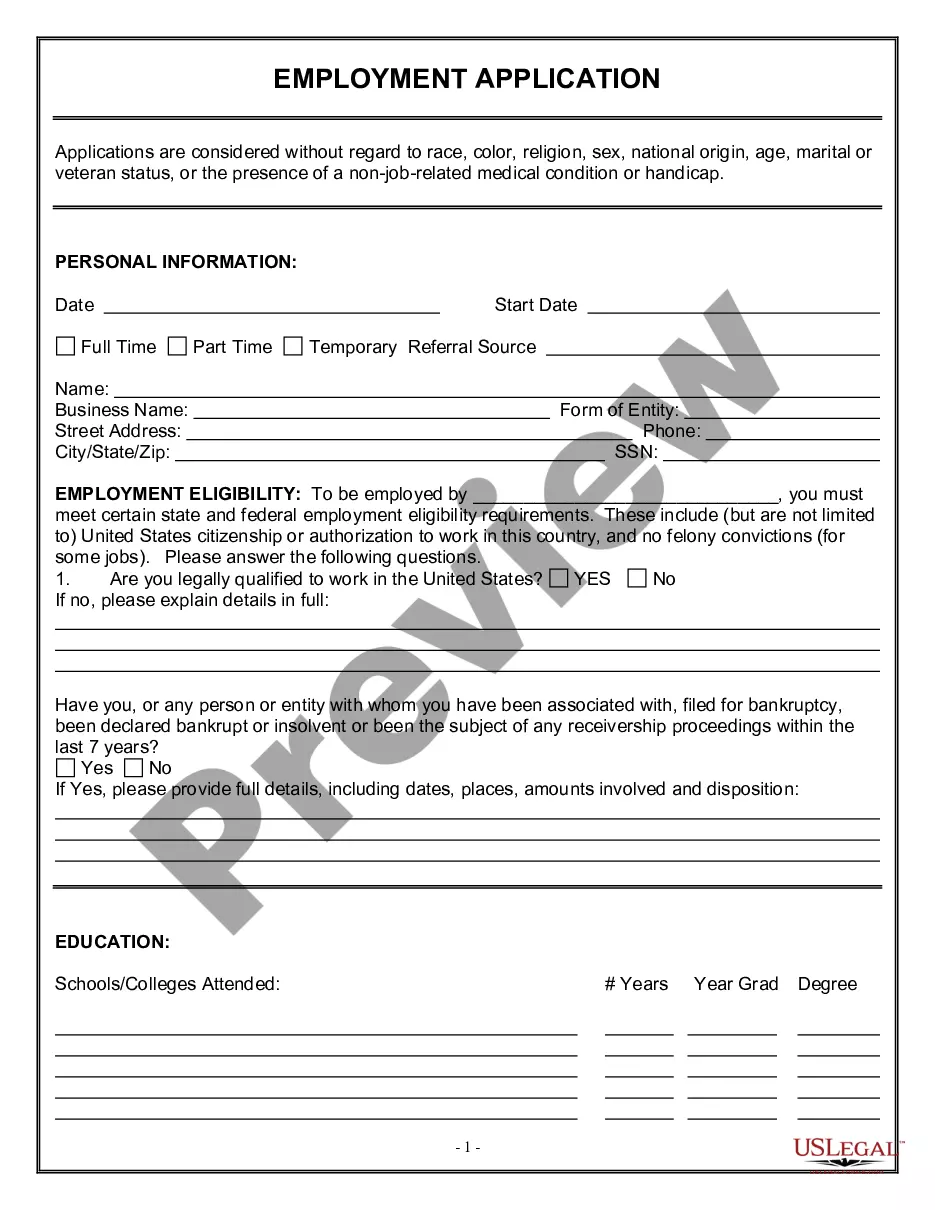

How to fill out Los Angeles California Complaint Regarding Group Insurance Contract?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Los Angeles Complaint regarding Group Insurance Contract, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different categories ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find information materials and tutorials on the website to make any tasks related to document execution simple.

Here's how you can locate and download Los Angeles Complaint regarding Group Insurance Contract.

- Go over the document's preview and description (if provided) to get a basic information on what you’ll get after getting the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can impact the validity of some records.

- Check the similar document templates or start the search over to find the appropriate file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment method, and purchase Los Angeles Complaint regarding Group Insurance Contract.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Los Angeles Complaint regarding Group Insurance Contract, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney entirely. If you need to deal with an exceptionally difficult situation, we recommend using the services of an attorney to check your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Become one of them today and get your state-compliant paperwork effortlessly!