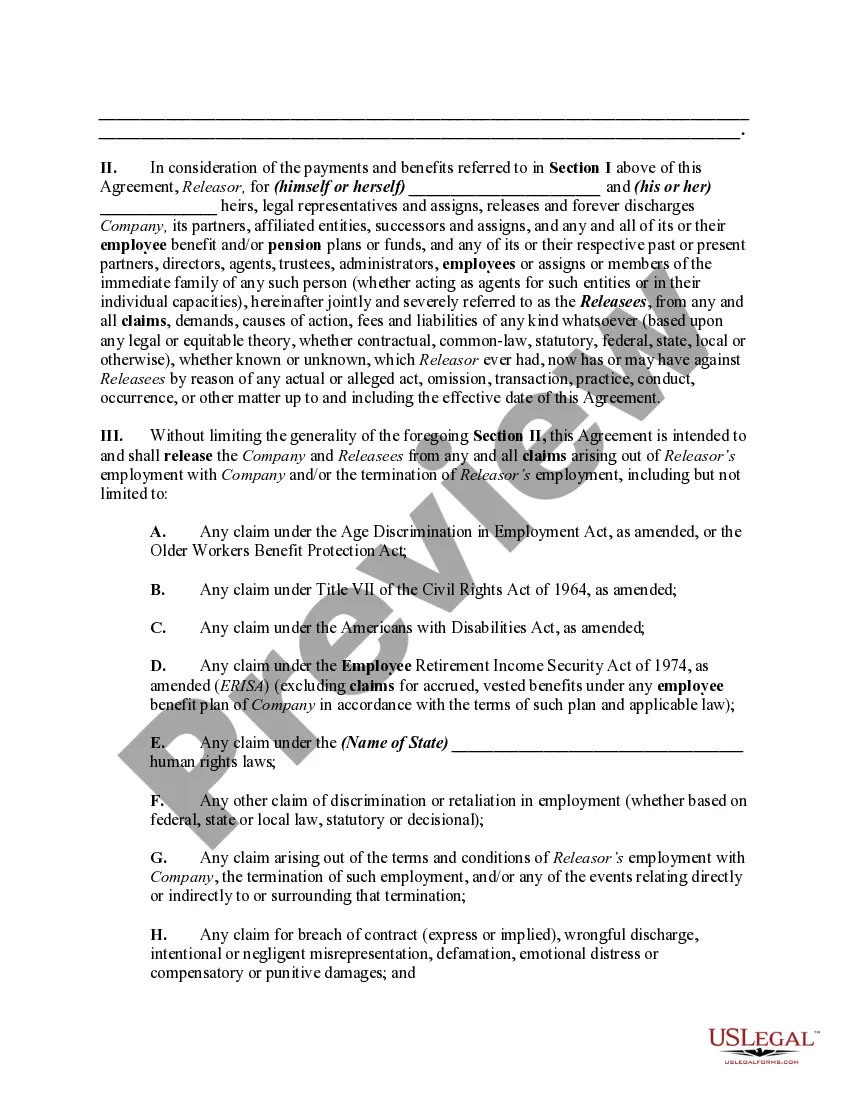

In this form, as a result of a lump sum settlement, a former employee is releasing a former employer from any and all claims for breach of contract or wrongful termination as well as any claim under the Employee Retirement Income Security Act of 1974, as amended (ERISA); any claim under the Age Discrimination in Employment Act, as amended, or the Older Workers Benefit Protection Act; any claim under Title VII of the Civil Rights Act of 1964, as amended; any claim under the Americans with Disabilities Act, as amended; and any other claim of discrimination or retaliation in employment (whether based on federal, state or local law, statutory or decisional);

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

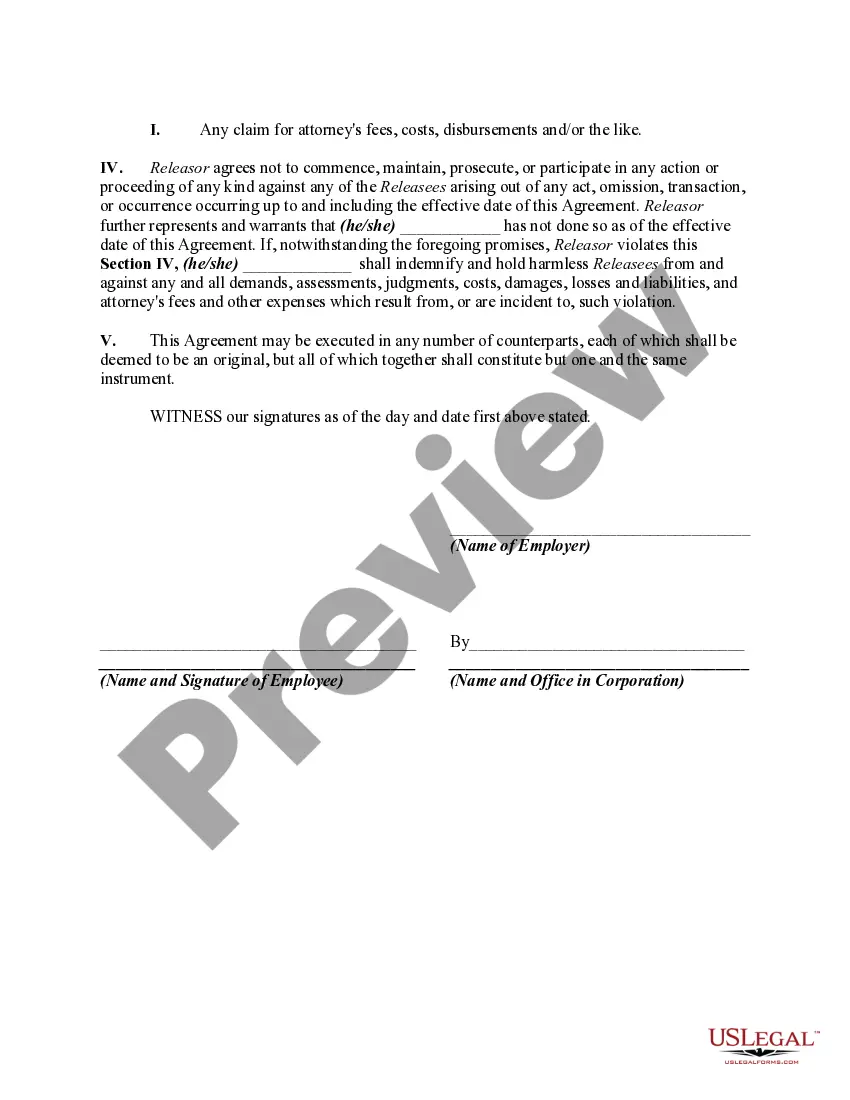

Cuyahoga Ohio Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds A Cuyahoga Ohio Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds refers to a legal agreement between an employee and their employer in Cuyahoga, Ohio, specifically addressing the termination of employment. This comprehensive release is designed to protect the interests of both parties, ensuring a transparent and mutually agreed termination process. Employee Benefit and Pension Plans and Funds, being an integral part of an employee's compensation package, often require specific attention when terminating employment. Within this release, various types of benefits and funds related to employee retirement plans are considered and addressed. The following are some different types of Cuyahoga Ohio Releases by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds: 1. Severance Release: This type of release focuses on the financial compensation an employee may receive upon termination. It involves the relinquishment of any legal claims the employee may have against the employer in exchange for a severance package. 2. Pension Release: If the terminated employee had been part of a pension plan, this release specifies the terms and conditions for the release of pension funds, including any vested or accrued benefits. It ensures that the employee fully understands the implications of terminating their rights to future pension benefits. 3. Healthcare Benefit Release: In this release, the employee agrees to waive any claims against the employer concerning healthcare benefits. It clarifies the employer's responsibilities regarding the continuation of coverage or the provision of COBRA (Consolidated Omnibus Budget Reconciliation Act) benefits after termination. 4. Retirement Plan Release: This release specifically addresses retirement plans such as 401(k) or IRA accounts. It outlines the terms and conditions regarding the distribution or rollover of the employee's retirement funds and any additional stock options or bonuses gained through these plans. 5. Non-Disclosure Agreement and Confidentiality Release: This type of release ensures the employee's confidentiality regarding company information and trade secrets. It prohibits the employee from disclosing any confidential information to third parties or using it to their advantage, further protecting the employer's interests. Overall, the Cuyahoga Ohio Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a detailed and legally binding agreement that safeguards the rights and obligations of both parties upon termination. It is crucial for both employer and employee to thoroughly review, understand, and consult legal counsel before entering into such agreements to ensure the protection of their respective interests.Cuyahoga Ohio Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds A Cuyahoga Ohio Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds refers to a legal agreement between an employee and their employer in Cuyahoga, Ohio, specifically addressing the termination of employment. This comprehensive release is designed to protect the interests of both parties, ensuring a transparent and mutually agreed termination process. Employee Benefit and Pension Plans and Funds, being an integral part of an employee's compensation package, often require specific attention when terminating employment. Within this release, various types of benefits and funds related to employee retirement plans are considered and addressed. The following are some different types of Cuyahoga Ohio Releases by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds: 1. Severance Release: This type of release focuses on the financial compensation an employee may receive upon termination. It involves the relinquishment of any legal claims the employee may have against the employer in exchange for a severance package. 2. Pension Release: If the terminated employee had been part of a pension plan, this release specifies the terms and conditions for the release of pension funds, including any vested or accrued benefits. It ensures that the employee fully understands the implications of terminating their rights to future pension benefits. 3. Healthcare Benefit Release: In this release, the employee agrees to waive any claims against the employer concerning healthcare benefits. It clarifies the employer's responsibilities regarding the continuation of coverage or the provision of COBRA (Consolidated Omnibus Budget Reconciliation Act) benefits after termination. 4. Retirement Plan Release: This release specifically addresses retirement plans such as 401(k) or IRA accounts. It outlines the terms and conditions regarding the distribution or rollover of the employee's retirement funds and any additional stock options or bonuses gained through these plans. 5. Non-Disclosure Agreement and Confidentiality Release: This type of release ensures the employee's confidentiality regarding company information and trade secrets. It prohibits the employee from disclosing any confidential information to third parties or using it to their advantage, further protecting the employer's interests. Overall, the Cuyahoga Ohio Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a detailed and legally binding agreement that safeguards the rights and obligations of both parties upon termination. It is crucial for both employer and employee to thoroughly review, understand, and consult legal counsel before entering into such agreements to ensure the protection of their respective interests.