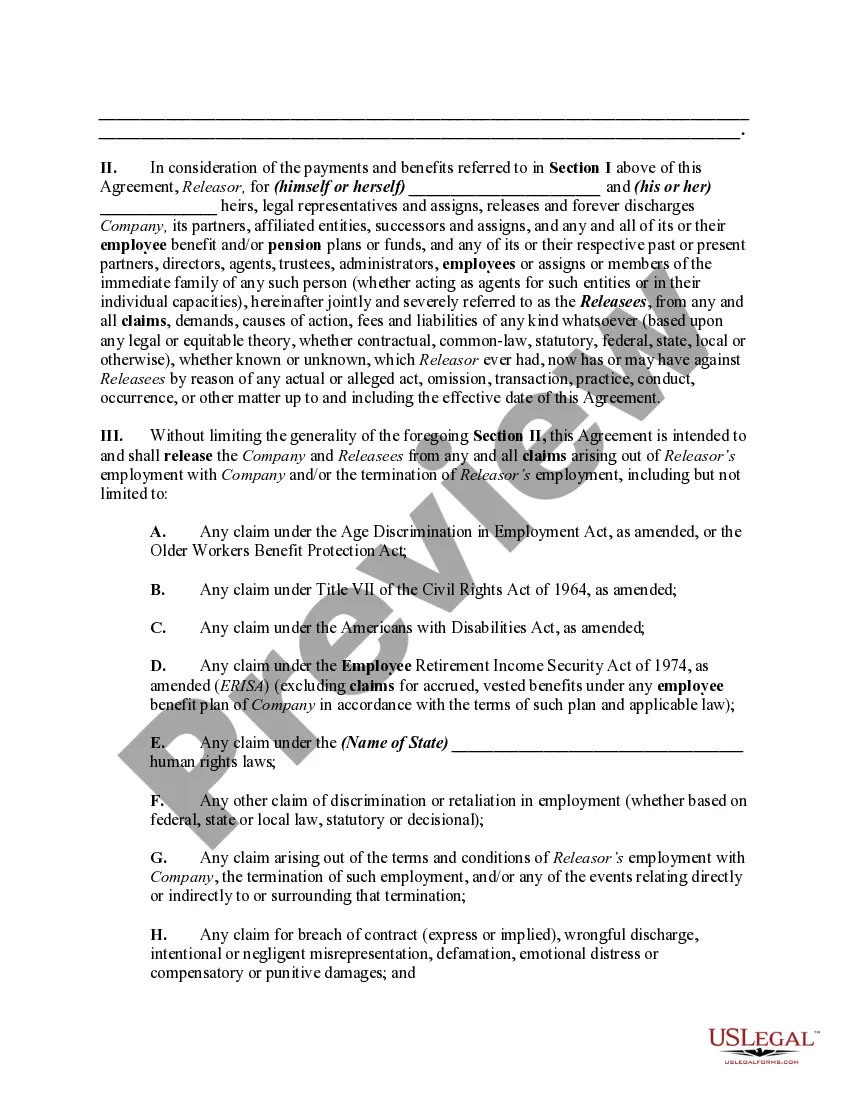

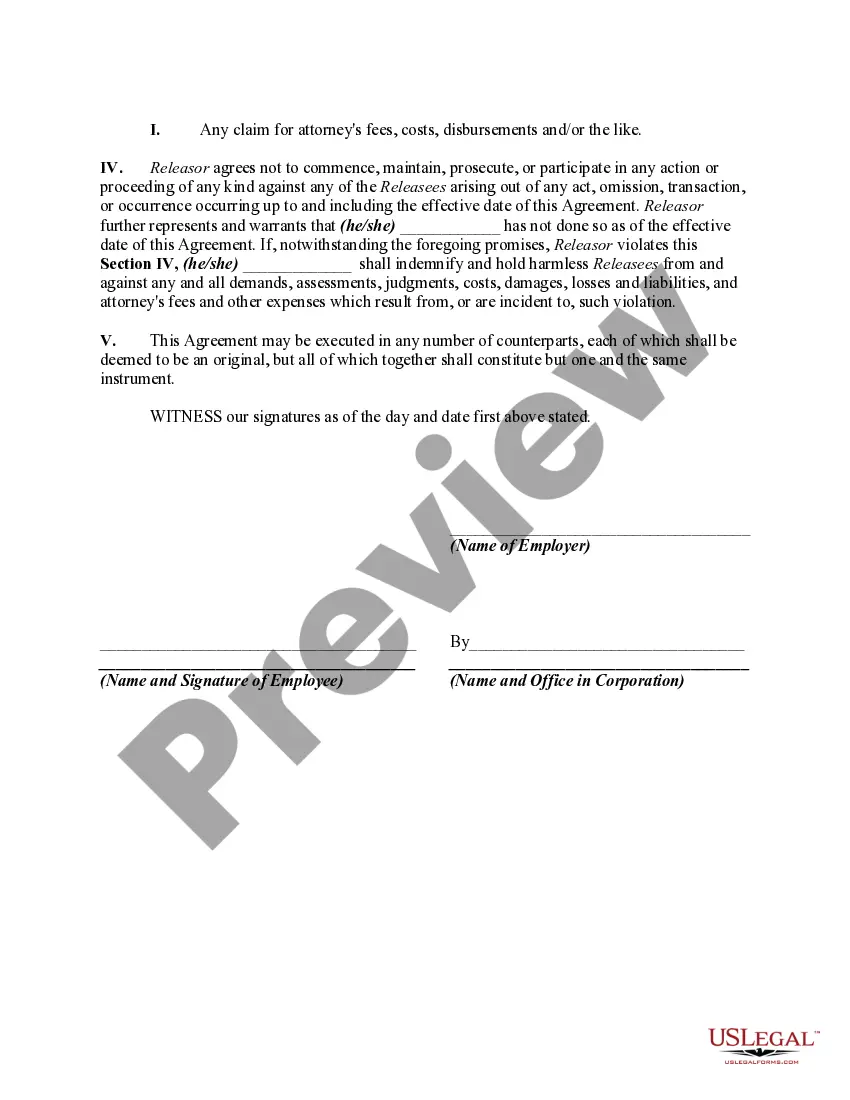

In this form, as a result of a lump sum settlement, a former employee is releasing a former employer from any and all claims for breach of contract or wrongful termination as well as any claim under the Employee Retirement Income Security Act of 1974, as amended (ERISA); any claim under the Age Discrimination in Employment Act, as amended, or the Older Workers Benefit Protection Act; any claim under Title VII of the Civil Rights Act of 1964, as amended; any claim under the Americans with Disabilities Act, as amended; and any other claim of discrimination or retaliation in employment (whether based on federal, state or local law, statutory or decisional);

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Harris Texas Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds Introduction: The Harris Texas Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds refers to a legal agreement executed between an employee and an employer in Harris County, Texas. This agreement is designed to resolve any disputes or claims arising from terminated employment, including the release of claims related to employee benefits and pension plans. Detailed Description: 1. Purpose and Scope of the Harris Texas Release: The Harris Texas Release is a crucial document that establishes a legally binding settlement between an employee and their former employer. It encompasses all claims and disputes arising from the employment termination and specifically addresses the release of claims related to employee benefit and pension plans. 2. Employee Benefit Plans and Funds: Under the Harris Texas Release, the employee agrees to release any claims or grievances pertaining to employee benefit plans. This includes but is not limited to health insurance, life insurance, retirement plans, stock options, profit-sharing plans, and any other employee welfare or compensation plans offered by the employer. 3. Pension Plans and Funds: The Harris Texas Release also covers the release of claims associated with employee pension plans. This encompasses defined benefit plans, defined contribution plans, individual retirement accounts (IRAs), and other retirement-related funds. The employee agrees to waive any potential claims against the employer regarding these plans and funds. 4. Different Types of Harris Texas Releases: a. Full and Final Release: This type of release completely absolves the employer from any claims arising from the terminated employment, including employee benefits and pension plans. b. Limited Release: In certain cases, the employee may agree to release specific claims related to employee benefits or pension plans, while retaining the right to pursue other types of claims against the employer. c. Partial Release: Similar to a limited release, this type of agreement releases certain claims associated with employee benefits or pension plans, while still allowing the employee to pursue other claims arising from terminated employment. 5. Legal Implications: By signing the Harris Texas Release, the employee acknowledges that they have received adequate consideration, typically in the form of a severance package or other benefits. They also agree not to pursue any further legal action against the employer regarding the terminated employment, including claims related to employee benefits and pension plans. Conclusion: The Harris Texas Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a crucial legal document that facilitates the resolution of disputes arising from terminated employment. It covers the release of claims related to employee benefit and pension plans, ensuring a comprehensive settlement between the employee and employer.Harris Texas Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds Introduction: The Harris Texas Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds refers to a legal agreement executed between an employee and an employer in Harris County, Texas. This agreement is designed to resolve any disputes or claims arising from terminated employment, including the release of claims related to employee benefits and pension plans. Detailed Description: 1. Purpose and Scope of the Harris Texas Release: The Harris Texas Release is a crucial document that establishes a legally binding settlement between an employee and their former employer. It encompasses all claims and disputes arising from the employment termination and specifically addresses the release of claims related to employee benefit and pension plans. 2. Employee Benefit Plans and Funds: Under the Harris Texas Release, the employee agrees to release any claims or grievances pertaining to employee benefit plans. This includes but is not limited to health insurance, life insurance, retirement plans, stock options, profit-sharing plans, and any other employee welfare or compensation plans offered by the employer. 3. Pension Plans and Funds: The Harris Texas Release also covers the release of claims associated with employee pension plans. This encompasses defined benefit plans, defined contribution plans, individual retirement accounts (IRAs), and other retirement-related funds. The employee agrees to waive any potential claims against the employer regarding these plans and funds. 4. Different Types of Harris Texas Releases: a. Full and Final Release: This type of release completely absolves the employer from any claims arising from the terminated employment, including employee benefits and pension plans. b. Limited Release: In certain cases, the employee may agree to release specific claims related to employee benefits or pension plans, while retaining the right to pursue other types of claims against the employer. c. Partial Release: Similar to a limited release, this type of agreement releases certain claims associated with employee benefits or pension plans, while still allowing the employee to pursue other claims arising from terminated employment. 5. Legal Implications: By signing the Harris Texas Release, the employee acknowledges that they have received adequate consideration, typically in the form of a severance package or other benefits. They also agree not to pursue any further legal action against the employer regarding the terminated employment, including claims related to employee benefits and pension plans. Conclusion: The Harris Texas Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a crucial legal document that facilitates the resolution of disputes arising from terminated employment. It covers the release of claims related to employee benefit and pension plans, ensuring a comprehensive settlement between the employee and employer.