A Houston Texas Revocable Living Trust for Unmarried Couples is a legal arrangement designed to protect the assets and interests of unmarried couples in the event of incapacity, death, or the termination of the relationship. It allows couples to establish clear guidelines for managing their finances, property, and healthcare decisions while providing flexibility and control over their estate. This type of trust is particularly beneficial for unmarried couples as they do not have the same legal protections and default rights as married couples. By creating a Revocable Living Trust, unmarried couples can ensure their wishes are honored and their assets are distributed according to their preferences, rather than default state laws. Different types of Revocable Living Trusts for Unmarried Couples in Houston, Texas may include: 1. Joint Revocable Living Trust: This type of trust allows unmarried couples to combine their assets into a single trust, effectively treating the assets as jointly owned. It provides both partners with equal control and enables them to specify how the assets should be distributed upon death or separation. 2. Separate Revocable Living Trusts: In this arrangement, each partner creates their own individual trust, maintaining ownership and control over their respective assets. This option can be useful if couples have different levels of wealth, separate businesses, or if they wish to keep their assets separate while still benefiting their partner. 3. Pour-over Will with Revocable Living Trust: This approach involves creating a revocable living trust for the unmarried couple, which acts as the primary estate planning document, while also including a pour-over will. The will serves as a backup to the trust, allowing any assets not explicitly included in the trust to be transferred to it upon death. By establishing a Houston Texas Revocable Living Trust for Unmarried Couples, partners can ensure that their wishes regarding their finances, healthcare, and estate distribution are honored. This legal instrument provides protection, privacy, and peace of mind to unmarried couples, allowing them to navigate life's uncertainties while safeguarding their assets and interests.

Houston Texas Revocable Living Trust for Unmarried Couples

Description

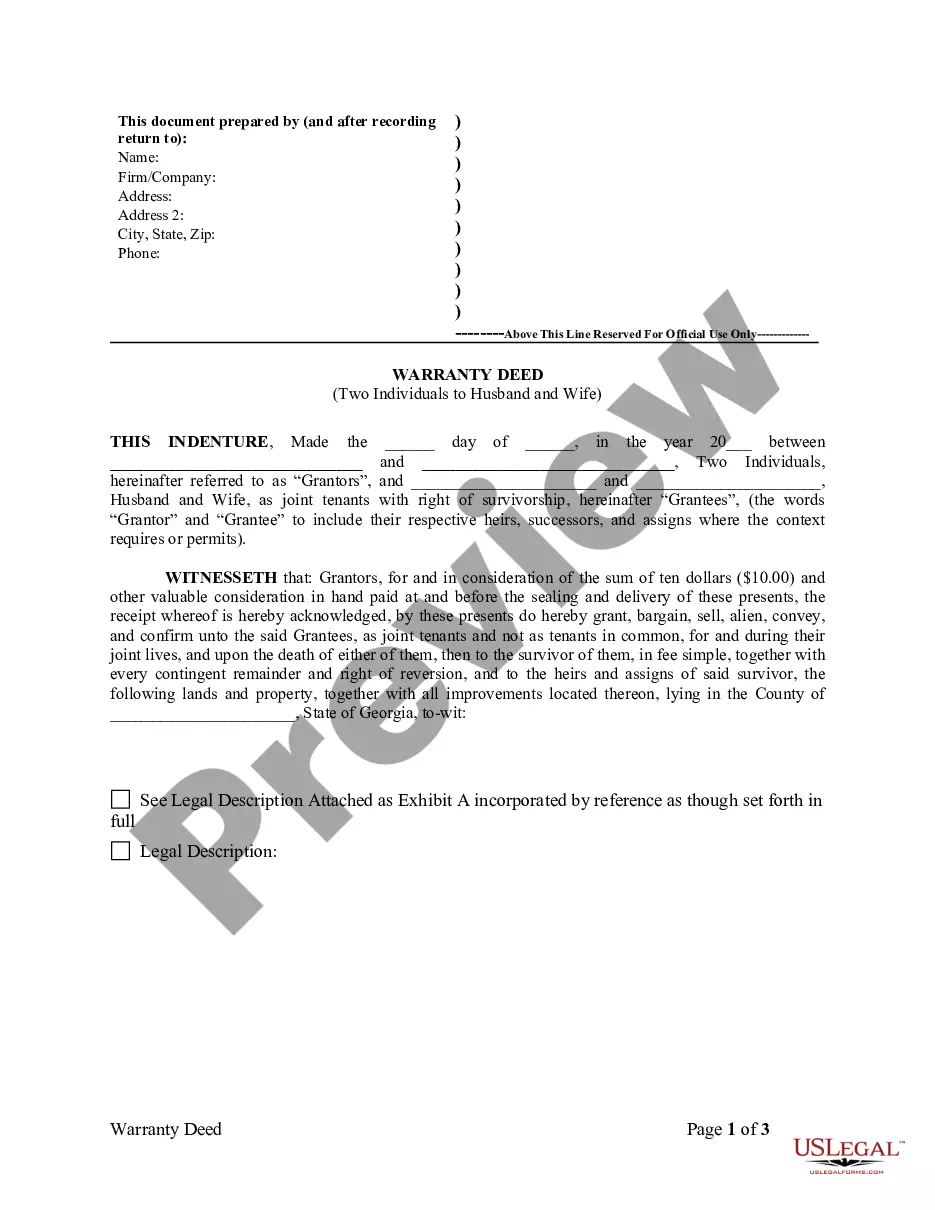

How to fill out Houston Texas Revocable Living Trust For Unmarried Couples?

Whether you intend to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occasion. All files are grouped by state and area of use, so opting for a copy like Houston Revocable Living Trust for Unmarried Couples is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Houston Revocable Living Trust for Unmarried Couples. Follow the guidelines below:

- Make sure the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Houston Revocable Living Trust for Unmarried Couples in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

People tend to think that you have to be married in order to have a trust. However, unmarried couples should also have living trusts. For married couples, a basic joint living trust is common and will meet all their needs.

No Asset Protection A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

Do I Need a Living Trust? While there's not a one-size-fits-all answer, the vast majority of people can get by without using a living trust. Dave Ramsey says, A simple will is perfect for 95% of the population. In other words, unless you have a really big estate, a simple will works just fine.

Typically, when a married couple utilizes a Revocable Living Trust based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

The family house "It would become part of the probate estate." One option is to make sure both of you are named as joint owners on the deed, "with rights of survivorship." In that case, generally speaking, you each equally own the house and are entitled to assume full ownership upon the death of the other.

Drawbacks of a Living TrustPaperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

There are a variety of assets that you cannot or should not place in a living trust. These include: Retirement Accounts: Accounts such as a 401(k), IRA, 403(b) and certain qualified annuities should not be transferred into your living trust. Doing so would require a withdrawal and likely trigger income tax.

A revocable trust can be especially important for unmarried couples. It permits the person or people you name to manage your financial affairs for you as well as to avoid probate. You can name one or more people to serve as co-trustee with you so that you can work together on your finances.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.