A Houston Texas Revocable Living Trust for Married Couple is a legal document that allows a couple to plan and manage their assets during their lifetime and ensures a smooth transfer of those assets to beneficiaries upon death. This trust is specifically designed for married couples residing in Houston, Texas. Here are different types of Houston Texas Revocable Living Trusts for Married Couples: 1. Joint Revocable Living Trust: This trust is created jointly by the couple and typically includes all their assets, such as real estate, investments, and personal property. Both spouses have equal control and can make changes or revoke the trust during their lifetime. 2. Separate Revocable Living Trusts: In certain circumstances, each spouse may choose to establish their own separate revocable living trusts. This can be beneficial if one spouse has substantial separate assets or if they wish to maintain separate control and administration over their assets. 3. A/B Trust: Also known as a "credit shelter trust" or "marital trust," an A/B trust is often set up by high net worth couples to minimize estate taxes upon the death of the first spouse. This trust divides the couple's assets into two parts: the A trust (survivor's trust) and the B trust (decedent's trust). 4. Qualified Terminable Interest Property (TIP) Trust: This trust allows one spouse to provide for the other while still controlling the ultimate disposition of the assets. It is commonly used in blended families or when there are concerns about protecting assets for children from a previous marriage. 5. Irrevocable Life Insurance Trust (IIT): While not strictly a revocable living trust, an IIT is often incorporated into an overall estate plan for married couples. It is created to remove life insurance proceeds from the taxable estate, providing liquidity to pay estate taxes or leaving a tax-free inheritance for beneficiaries. In summary, a Houston Texas Revocable Living Trust for Married Couple is a powerful estate planning tool that allows couples to have control over their assets during their lifetime while ensuring a seamless distribution of those assets to beneficiaries after their passing. The specific type of trust chosen will depend on the couple's unique circumstances and goals.

Houston Texas Revocable Living Trust for Married Couple

Description

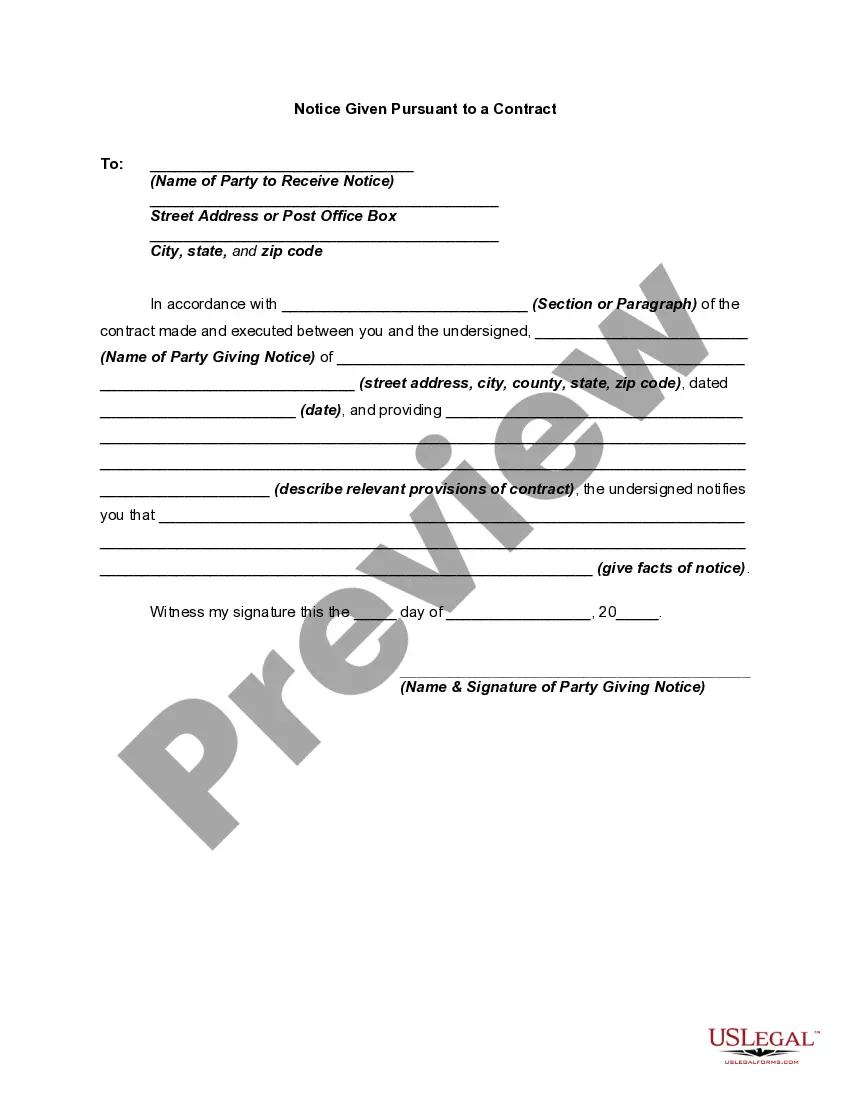

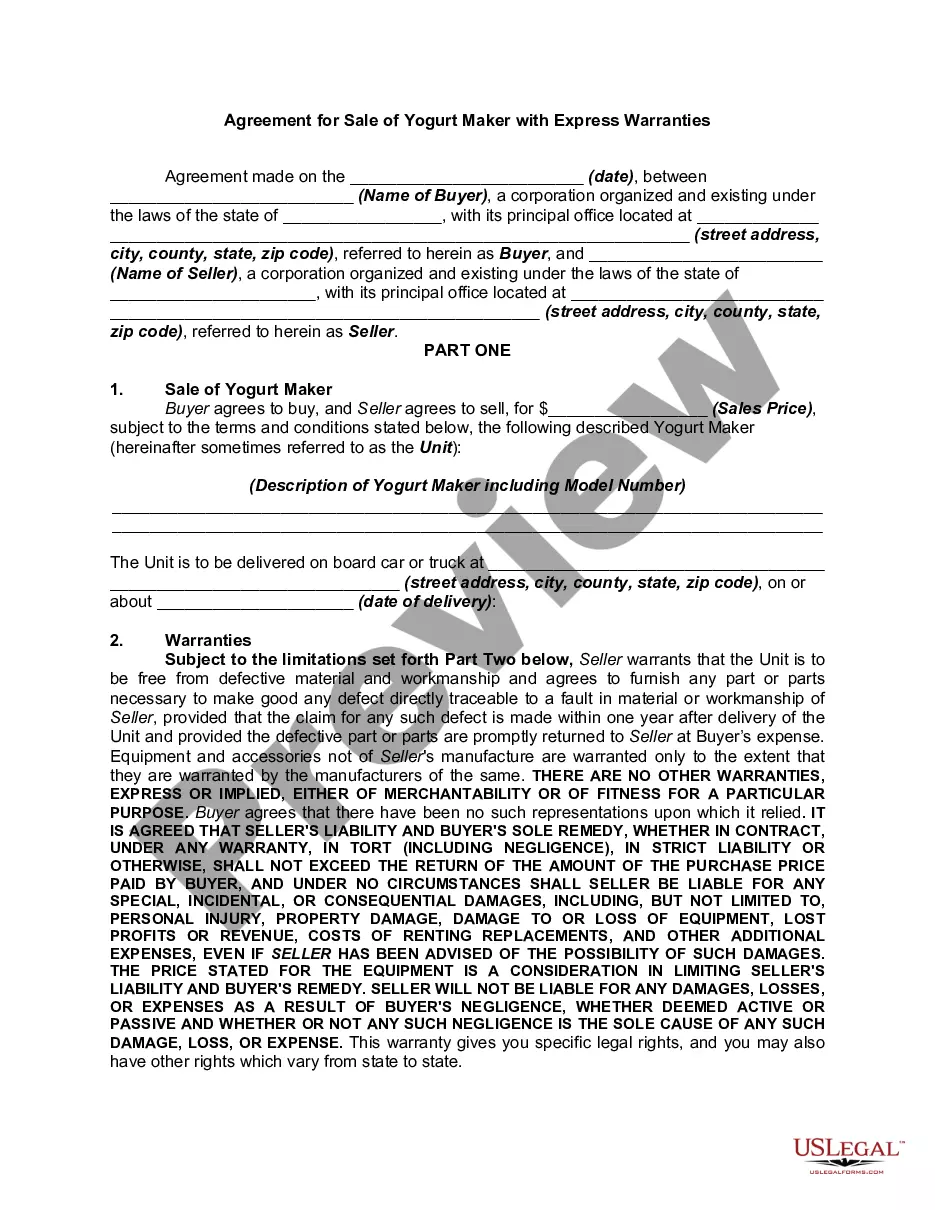

How to fill out Houston Texas Revocable Living Trust For Married Couple?

Preparing legal documentation can be burdensome. Besides, if you decide to ask an attorney to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Houston Revocable Living Trust for Married Couple, it may cost you a fortune. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Consequently, if you need the current version of the Houston Revocable Living Trust for Married Couple, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Houston Revocable Living Trust for Married Couple:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Houston Revocable Living Trust for Married Couple and save it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!