San Antonio Texas Revocable Living Trust for Married Couple: A Comprehensive Guide A San Antonio Texas Revocable Living Trust for Married Couple is a legal arrangement that allows a married couple to plan for the distribution of their assets, both during their lifetimes and after their passing. This trust is recognized and governed by the laws of Texas and provides several advantages, such as probate avoidance, flexibility, and control over assets. A Revocable Living Trust is a trust that can be modified or terminated by the trust creators, also known as granters or settlers, during their lifetime. It gives the couple the ability to manage their assets and affairs, both separately and jointly, as long as they are mentally competent. Moreover, it offers privacy, as the trust is not required to go through the probate process, ensuring the details of the assets and beneficiaries remain confidential. The San Antonio Texas Revocable Living Trust for Married Couple comes in different types, tailored to meet individual needs and preferences. These include: 1. Joint Revocable Living Trust: This type of trust is created jointly by the married couple, and all assets held within the trust are jointly owned. It is an ideal option for couples who desire joint management and control over their assets. 2. Individual Revocable Living Trusts with Spousal Provisions: In this case, each spouse creates their own separate trust, allowing them to have individual control over their assets. They can include provisions within their trusts to benefit the surviving spouse upon their passing. 3. A-B Trusts or Marital and Residuary Trusts: This form of trust is designed to minimize estate taxes upon the passing of the first spouse. It splits the trust into two sections: the Marital Trust (A-Trust), which benefits the surviving spouse, and the Residuary Trust (B-Trust), which holds assets for the future beneficiaries, such as children or other family members. 4. Qualified Terminable Interest Property (TIP) Trust: This trust option is particularly useful for blended families or individuals with children from previous marriages. It ensures that the surviving spouse has access to and benefits from the deceased spouse's assets while guaranteeing the assets go to the intended beneficiaries upon the surviving spouse's passing. Creating a San Antonio Texas Revocable Living Trust for Married Couple requires the assistance of an experienced estate planning attorney well-versed in Texas laws. They will guide you through the process of creating and funding the trust, ensuring all necessary documents are properly drafted, signed, and notarized. In summary, a San Antonio Texas Revocable Living Trust for Married Couple is a versatile estate planning tool that offers enhanced asset control, probate avoidance, and privacy. By utilizing various trust types, couples can effectively protect and distribute their assets according to their specific wishes.

San Antonio Texas Revocable Living Trust for Married Couple

Description

How to fill out San Antonio Texas Revocable Living Trust For Married Couple?

Preparing paperwork for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate San Antonio Revocable Living Trust for Married Couple without expert assistance.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid San Antonio Revocable Living Trust for Married Couple by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, follow the step-by-step instruction below to get the San Antonio Revocable Living Trust for Married Couple:

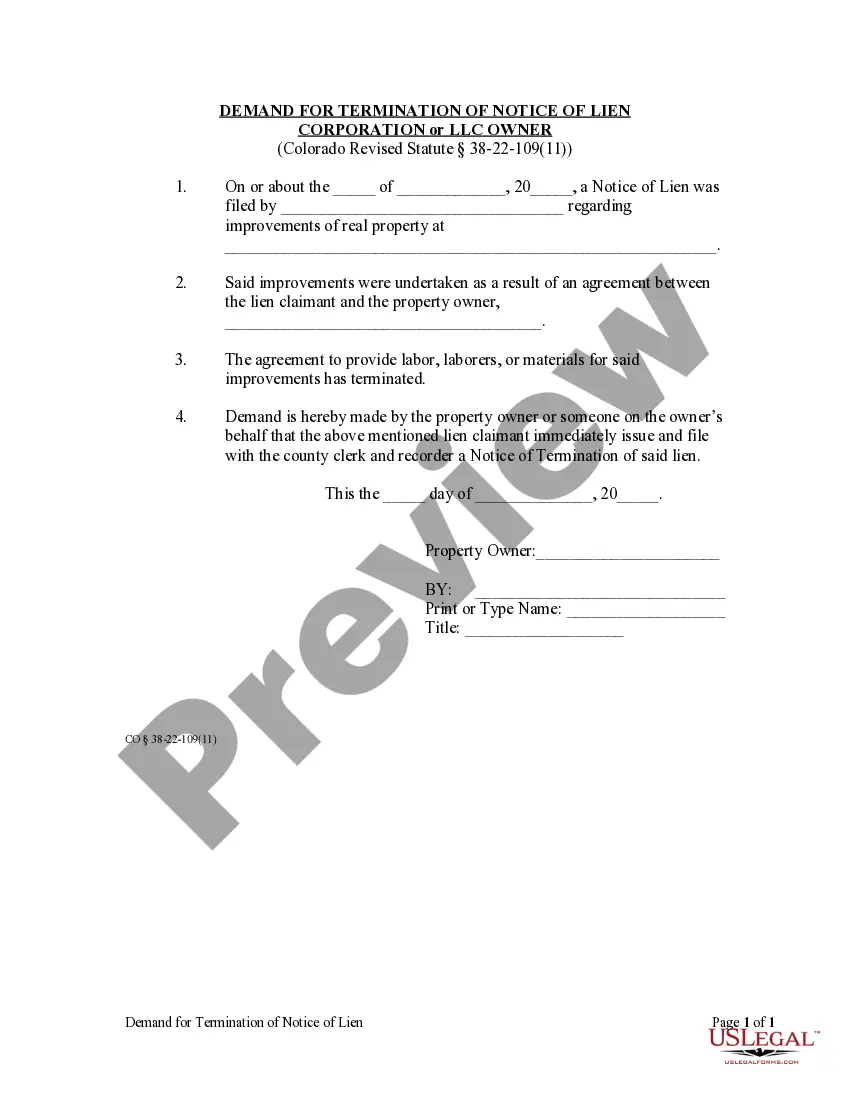

- Look through the page you've opened and check if it has the sample you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any use case with just a few clicks!