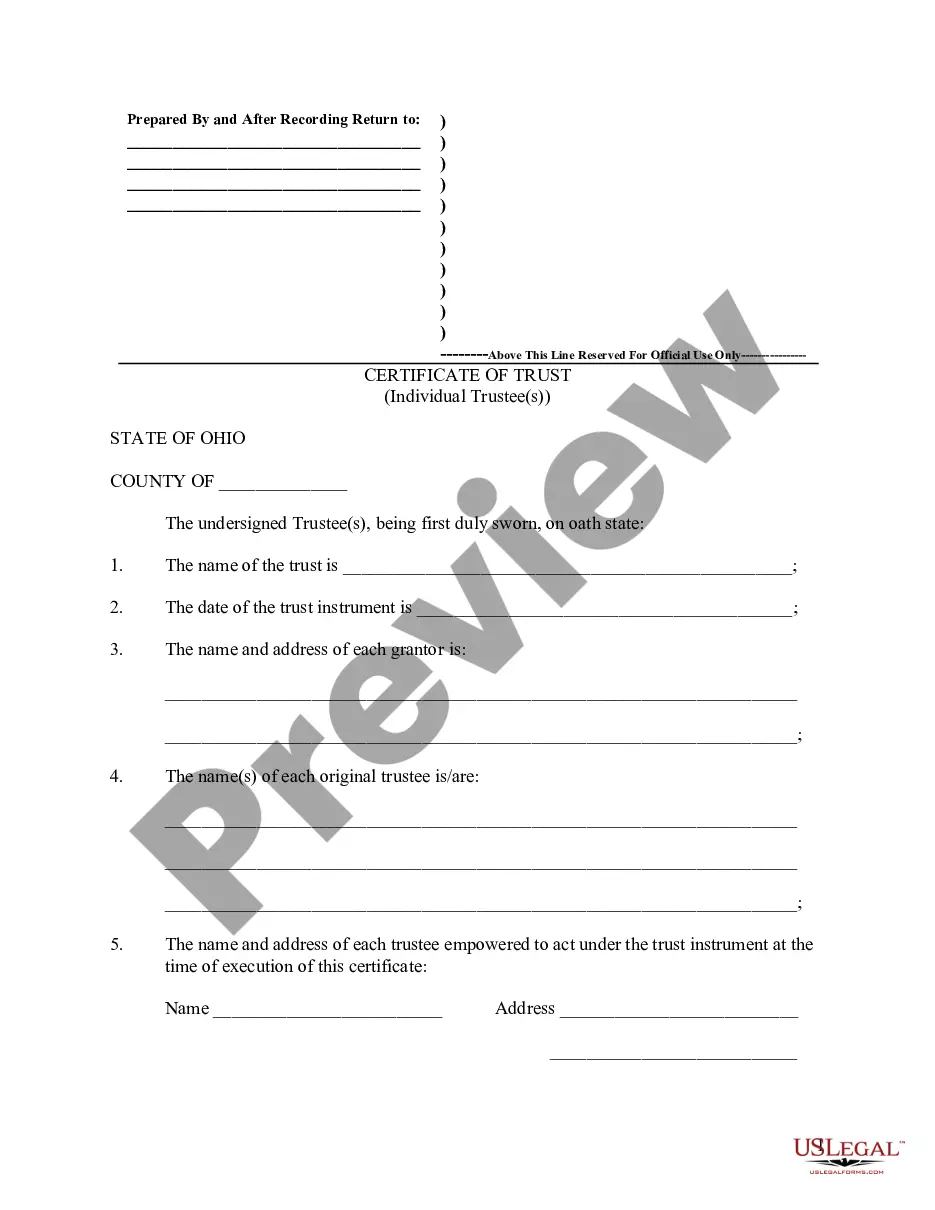

Allegheny Pennsylvania Revocable Living Trust for Real Estate is a legal arrangement that allows individuals in Allegheny County, Pennsylvania, to protect and manage their real estate assets during their lifetime and ensure a smooth transfer of these assets upon their passing. This type of trust is created by a granter, who is the owner of the real estate, and can be modified or revoked at any time during their lifetime. One of the main benefits of establishing an Allegheny Pennsylvania Revocable Living Trust for Real Estate is that it avoids the need for probate, offering privacy and saving time and money for the beneficiaries. Additionally, it provides a comprehensive plan for the management and distribution of real estate assets, ensuring that they are handled according to the granter's wishes. Different types of Allegheny Pennsylvania Revocable Living Trust for Real Estate include: 1. Individual Revocable Living Trust: This is the most common type of revocable living trust, wherein a single individual creates and manages the trust solely for their real estate assets. 2. Spousal Revocable Living Trust: This type of trust is created by a married couple together, with both spouses serving as contractors and co-trustees. It enables them to protect and manage their joint real estate assets for the benefit of each other and future beneficiaries. 3. Family Revocable Living Trust: This trust is designed to protect and manage real estate assets for the benefit of the entire family. It allows the granter to specify how the assets should be distributed among various family members while providing provisions for the management and maintenance of the properties. 4. Charitable Revocable Living Trust: This type of trust allows the granter to contribute real estate assets to charitable organizations or causes while ensuring continued enjoyment and control during their lifetime. It offers significant tax benefits while supporting charitable endeavors. Establishing an Allegheny Pennsylvania Revocable Living Trust for Real Estate requires proper legal guidance to ensure compliance with state laws and to address specific individual or familial needs. It is recommended to consult with an experienced estate planning attorney to create a trust that aligns with the granter's goals and provides comprehensive protection and management of real estate assets.

Allegheny Pennsylvania Revocable Living Trust for Real Estate

Description

How to fill out Allegheny Pennsylvania Revocable Living Trust For Real Estate?

Preparing paperwork for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Allegheny Revocable Living Trust for Real Estate without professional help.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Allegheny Revocable Living Trust for Real Estate by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Allegheny Revocable Living Trust for Real Estate:

- Examine the page you've opened and check if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To find the one that suits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any use case with just a couple of clicks!

Form popularity

FAQ

We recommend living trusts to our clients because of the tremendous benefits they offer over wills, the more traditional estate planning tool. The biggest benefit of using a living trust instead of a will is that living trusts avoid probate. Probate is the court process by which wills are executed.

You'll likely spend a few hundred dollars at most. Additionally, this method is less expensive than hiring an attorney, but DIY estate planning also presents some risks. If you'd rather hire a lawyer, you'll likely spend at least $1,000. This could be a less risky approach than DIY planning, but it'll cost you more.

Discretionary trusts, however, generally do not have to pay income tax. Instead, the beneficiaries pay tax on their share of the trust's net income. In a family trust, this means that the trustee can distribute assets to reduce the overall tax paid by the family.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?

Which Trust Is Best For You: Top 4Revocable Trusts. One of the two main types of trust is a revocable trust.Irrevocable Trusts. The other main type of trust is a irrevocable trust.Credit Shelter Trusts.Irrevocable Life Insurance Trust.

A professionally managed property trust provides investors with an opportunity to invest in or hold part ownership of property that may not necessarily be available as an individual. Property trusts are also commonly known as property funds or property syndicates.

How to Create a Living Trust in PennsylvaniaSelect the trust that best fits your financial situation.Determine which property and assets you want to include in the trust.Select a trustee to manage your living trust.Create the trust document.Sign the trust while a notary public is present.More items...?

Drawbacks of a Living TrustPaperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

Additionally, in Pennsylvania, a revocable living trust does not help reduce taxes. The Pennsylvania Inheritance Tax and Federal Estate Tax are identical, regardless of whether assets are managed through a revocable living trust or under a will.

To make a living trust in Pennsylvania, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...