The Kings New York Revocable Living Trust for House is a legal document designed to protect and manage a person's real estate assets in the event of incapacitation or death. This type of trust provides flexibility and control for homeowners in Kings County, New York, allowing them to easily transfer their property to designated beneficiaries without going through the probate process. One prominent type of Kings New York Revocable Living Trust for House is the Single Revocable Living Trust. This type of trust is created by an individual and is ideal for single homeowners who wish to ensure their property is easily transferable to their chosen beneficiaries upon their passing. It allows the granter to maintain full control over the real estate assets during their lifetime while ensuring a smooth transition after they are no longer able to manage the property themselves. Another type is the Joint Revocable Living Trust for House, specifically designed for married couples or partners who jointly own residential property in Kings County, New York. This trust enables both parties to retain complete control and ownership of the property during their lifetimes while providing guidelines on the distribution or management of the property for the surviving spouse/partner or designated beneficiaries after the first person passes away. The Kings New York Revocable Living Trust for House comes with several benefits. Firstly, it allows homeowners to avoid the expensive and time-consuming probate process that follows a person's passing. By placing the property within the trust, the property ownership transfers directly to the beneficiaries, saving time and money. Moreover, this trust ensures privacy as the trust and its contents are not part of the public record. This means that the transfer of property and the identities of the beneficiaries remain confidential, shielding the family from unnecessary attention during a sensitive time. Additionally, the Kings New York Revocable Living Trust for House allows homeowners to provide clear instructions for the management and distribution of their property after their death or incapacitation. It offers flexibility in determining how the property will be used, sold, or inherited by beneficiaries, ensuring that the granter's wishes are carried out as specified. Overall, the Kings New York Revocable Living Trust for House is a valuable estate planning tool for homeowners in Kings County, New York, seeking to safeguard their real estate assets, avoid probate, maintain privacy, and dictate the future of their property after they pass away.

Kings New York Revocable Living Trust for House

Description

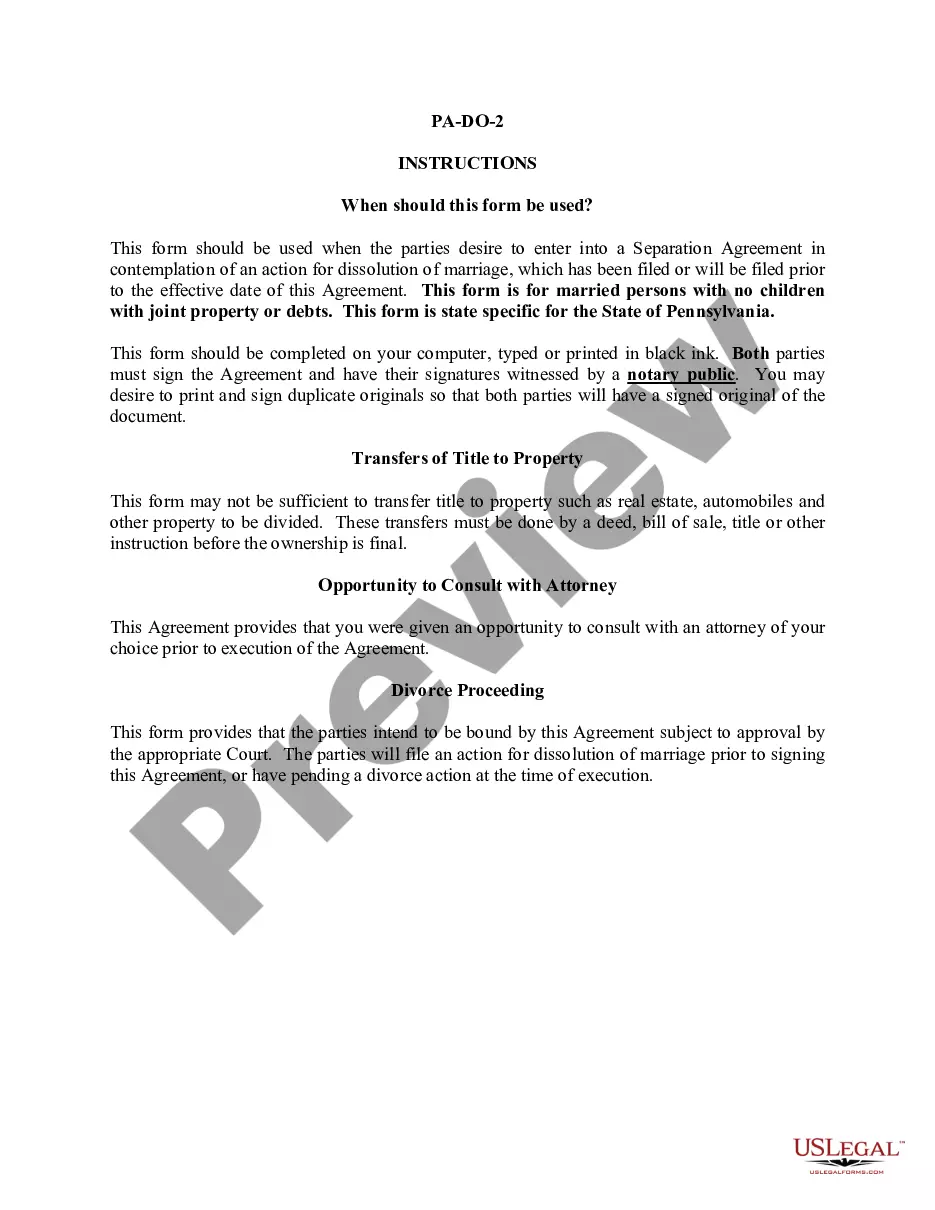

How to fill out Kings New York Revocable Living Trust For House?

Whether you plan to open your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Kings Revocable Living Trust for House is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Kings Revocable Living Trust for House. Follow the guide below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the right one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Kings Revocable Living Trust for House in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

Everyone needs a living revocable trust, says Suze Orman. In response to several emails and tweets asking why a trust is so mandatory, Orman spells it out. "A living revocable trust serves as far more than just where assets are to go upon your death and it does that in an efficient way," she said.

Drawbacks of a Living TrustPaperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

In a revocable trust, you have the right to dissolve the trust at any time. This means that although the home technically belongs to the trust, you have the ability to take back the property at any time.

While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

Moving your house or other assets into a trust (specifically an irrevocable trust) can decrease your taxable estate. For a wealthy estate that could otherwise be subject to a state or federal estate tax, putting assets into a trust can help avoid or minimize the estate taxes.

With your property in trust, you typically continue to live in your home and pay the trustees a nominal rent, until your transfer to residential care when that time comes. Placing the property in trust may also be a way of helping your surviving beneficiaries avoid inheritance tax liabilities.

Trust property refers to the assets placed into a trust, which are controlled by the trustee on behalf of the trustor's beneficiaries. Trust property removes tax liability on the assets from the trustor to the trust itself, in some cases.

The Pros and Cons of Revocable Living TrustsProbate can be avoided.Ancillary probate in another state can also be avoided.Protection in case of incapacitation.No immediate tax benefits.No asset protection.It requires some administrative work.More items...

Other Benefits of a Property Protection Trust Will For example, the surviving spouse can move house, downsize etc. The terms of the Trust will still apply to the new house. They cannot sell or spend the trust funds but the trust can be transferred to another house.

The main benefit of putting your house in a trust is that it bypasses probate when you pass away. All of your other assets, whether or not you have a will, will go through the probate process. Probate is the judicial process that your estate goes through when you die.