Nassau New York Revocable Living Trust for House

Description

How to fill out Revocable Living Trust For House?

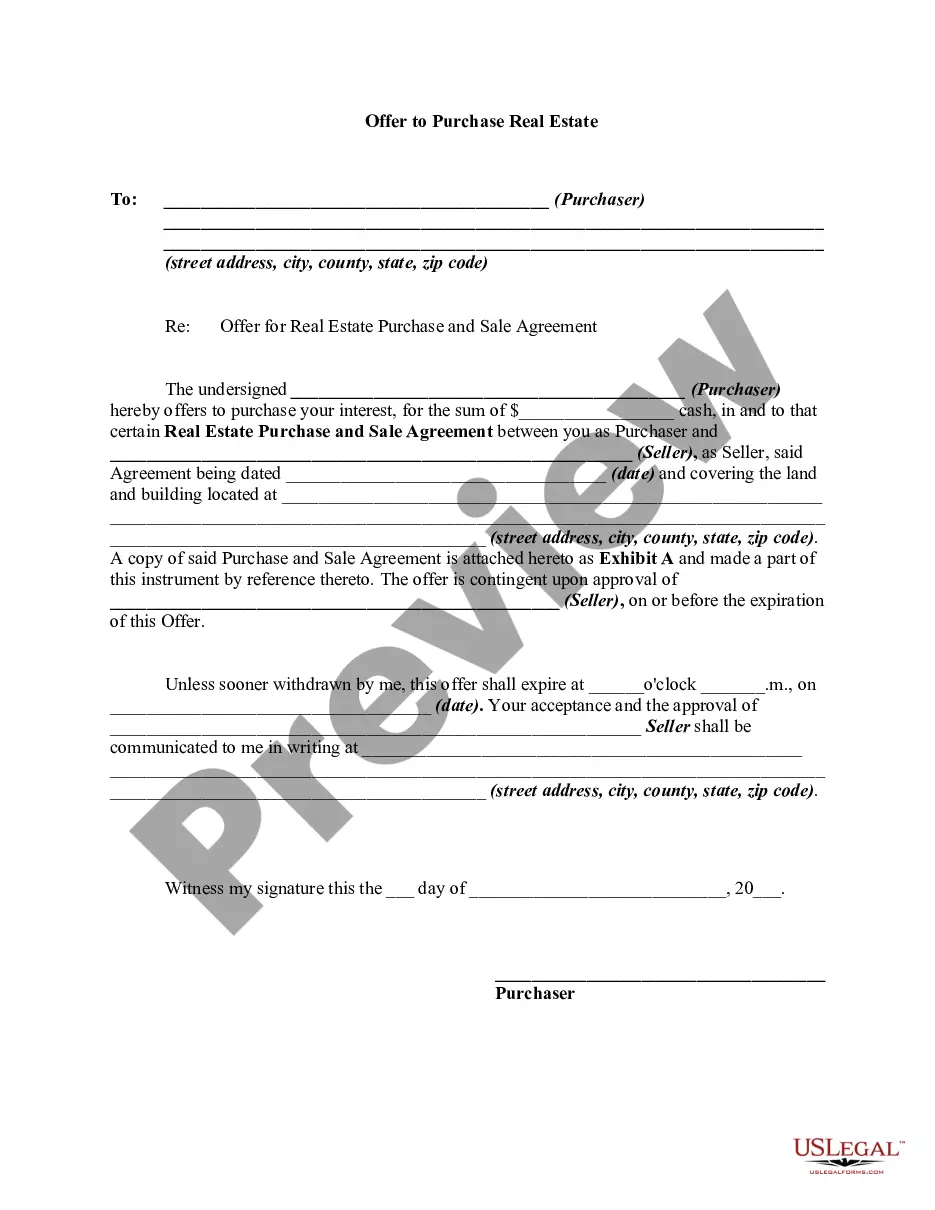

Do you require a swift creation of a legally-binding Nassau Revocable Living Trust for your residence or perhaps another document to manage your personal or professional matters? You have two alternatives: engage a legal professional to prepare a legal document for you or do it completely on your own. Fortunately, there’s a third option - US Legal Forms. It will assist you in obtaining well-crafted legal documents without incurring excessive costs for legal assistance.

US Legal Forms provides an extensive assortment of over 85,000 state-compliant document templates, including the Nassau Revocable Living Trust for House and complete form packages. We supply documents for a wide range of life situations: from divorce filings to real estate form templates. We have been in business for over 25 years and have established a solid reputation among our clients. Here is how you can join them and obtain the essential document without complications.

If you have already created an account, you can conveniently Log In to it, find the Nassau Revocable Living Trust for House template, and download it. To re-download the form, simply navigate to the My documents tab.

Acquiring and downloading legal forms is effortless when utilizing our catalog. Additionally, the templates we provide are regularly updated by industry professionals, which enhances your confidence when organizing legal matters. Experience US Legal Forms today and witness the difference!

- First, thoroughly check if the Nassau Revocable Living Trust for House complies with your state’s or county’s laws.

- If the document has a description, ensure to confirm its intended purpose.

- Return to your search if the document doesn’t meet your requirements by utilizing the search bar located in the header.

- Select the plan that accommodates your needs best and move on to the payment process.

- Decide the format in which you wish to receive your document and proceed to download it.

- Print it, complete it, and affix your signature on the designated line.

Form popularity

FAQ

What are the Disadvantages of a Trust?Costs. When a decedent passes with only a will in place, the decedent's estate is subject to probate.Record Keeping. It is essential to maintain detailed records of property transferred into and out of a trust.No Protection from Creditors.

Another potential advantage is that a trust is a way of keeping control and asset protection for the beneficiary. A trust avoids handing over valuable property, cash or investment while the beneficiaries are relatively young or vulnerable.

While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

With your property in trust, you typically continue to live in your home and pay the trustees a nominal rent, until your transfer to residential care when that time comes. Placing the property in trust may also be a way of helping your surviving beneficiaries avoid inheritance tax liabilities.

On the death of the first partner, the deceased partner's share of the house is left to chosen beneficiaries (e.g. children) in a Trust. This trust is effectively created when the first partner dies, by the Will. The surviving partner is allowed to continue living in the house for the rest of their life.

In a revocable trust, you have the right to dissolve the trust at any time. This means that although the home technically belongs to the trust, you have the ability to take back the property at any time.

Putting a house into a trust is actually quite simple and your living trust attorney or financial planner can help. Since your house has a title, you need to change the title to show that the property is now owned by the trust.

A trust, unlike a will, can help you pass on assets even before you die. Placing a house in an irrevocable trust can help you qualify for Medicaid by decreasing your taxable estate. With an irrevocable trust you can get asset protection from creditors, including nursing homes.

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork. Take a look at the pros and cons of creating a trust before you put your house into it.

Rental Properties and TrustsYou can place rental properties into a trust whether they are new acquisitions or you have owned them for some time. It is best to set up a trust before buying the property and take out the mortgage through your trust.