Philadelphia Pennsylvania Revocable Living Trust for House

Description

How to fill out Revocable Living Trust For House?

How long does it usually require you to draft a legal document.

Taking into account that each state has its statutes and regulations for every area of life, locating a Philadelphia Revocable Living Trust for House that fulfills all local criteria can be demanding, and procuring it from a qualified attorney is frequently costly.

Several online platforms provide the most sought-after state-specific documents for download, but utilizing the US Legal Forms database is the most advantageous.

Once you are confident in the chosen template, click Buy Now, select the subscription plan that best fits your needs, register for an account on the platform or Log In to continue to payment options, pay through PayPal or with your credit card, modify the file format if needed, and click Download to store the Philadelphia Revocable Living Trust for House. You can print the template or utilize any preferred online editor to complete it electronically. Regardless of how many times you need to use the acquired document, all files you've ever saved can be accessed from your profile by selecting the My documents tab. Give it a try!

- US Legal Forms is the largest online repository of templates, gathered by states and fields of application.

- Besides the Philadelphia Revocable Living Trust for House, here you can find any particular document to manage your business or personal matters, adhering to your local regulations.

- Experts confirm all templates for their relevance, allowing you to ensure your documents are properly prepared.

- Using the service is quite straightforward.

- If you already have an account on the platform and your subscription is current, you just need to Log In, select the desired template, and download it.

- You can retrieve the document in your profile at any point later.

- If you are unfamiliar with the website, there will be some additional procedures to finish before acquiring your Philadelphia Revocable Living Trust for House.

- Review the page content you're currently on.

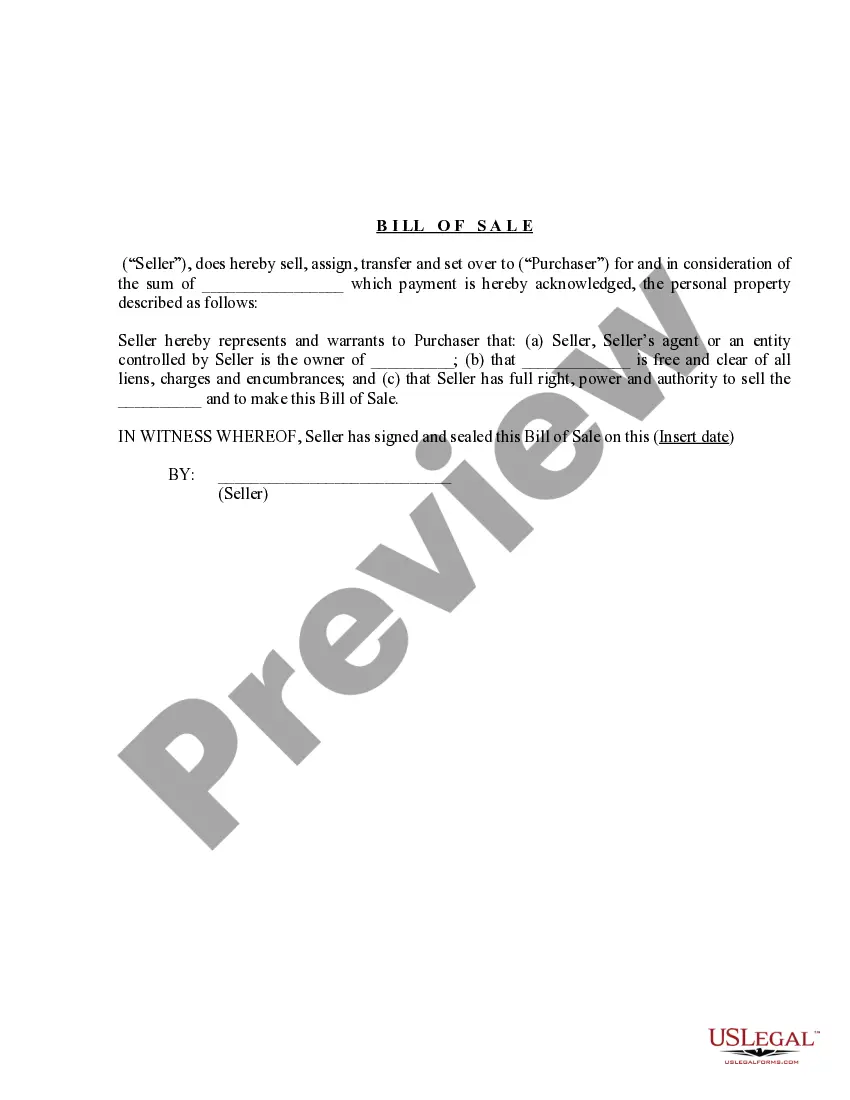

- Examine the description of the template or Preview it (if accessible).

- Search for another document using the relevant option in the header.

Form popularity

FAQ

Establishing a trust requires serious legal help, which is not cheap. A typical living trust can cost $2,000 or more, while a basic last will and testament can be drawn up for about $150 or so.

Here's a good rule of thumb: If you have a net worth of at least $100,000 and have a substantial amount of assets in real estate, or have very specific instructions on how and when you want your estate to be distributed among your heirs after you die, then a trust could be for you.

Some of the Cons of a Revocable TrustShifting assets into a revocable trust won't save income or estate taxes. No asset protection. Although assets held in an irrevocable trust are generally beyond the reach of creditors, that's not true with a revocable trust.

To make a living trust in Pennsylvania, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...

On the death of the first partner, the deceased partner's share of the house is left to chosen beneficiaries (e.g. children) in a Trust. This trust is effectively created when the first partner dies, by the Will. The surviving partner is allowed to continue living in the house for the rest of their life.

In a revocable trust, you have the right to dissolve the trust at any time. This means that although the home technically belongs to the trust, you have the ability to take back the property at any time.

Rental Properties and TrustsYou can place rental properties into a trust whether they are new acquisitions or you have owned them for some time. It is best to set up a trust before buying the property and take out the mortgage through your trust.

The primary benefit of creating a revocable trust is that it provides a prearranged mechanism that will ensure the continued management and preservation of your assets, should you become disabled. It can also set forth all of the dispositive provisions of your estate plan.

Putting a house into a trust is actually quite simple and your living trust attorney or financial planner can help. Since your house has a title, you need to change the title to show that the property is now owned by the trust.

With your property in trust, you typically continue to live in your home and pay the trustees a nominal rent, until your transfer to residential care when that time comes. Placing the property in trust may also be a way of helping your surviving beneficiaries avoid inheritance tax liabilities.