A Hennepin Minnesota Revocable Living Trust for Single Person is a legal document that allows an individual to retain control over their assets during their lifetime while providing for the management and distribution of those assets upon their death. This type of trust is often used by individuals who wish to avoid probate and maintain privacy regarding their estate matters. The Hennepin County in Minnesota offers different types of Revocable Living Trust for Single Persons. Some common ones include: 1. Basic Revocable Living Trust: This trust provides a straightforward approach to asset management and distribution, allowing the single person to maintain control over their assets throughout their lifetime and specify how they should be distributed upon their death. 2. Pour-Over Will Trust: This type of trust is often used in conjunction with a will. It allows for assets not previously transferred into the trust to "pour-over" into the trust upon the individual's death, where they will be managed and distributed according to the trust's instructions. 3. Special Needs Trust: This trust is designed to provide financial support and protection for a disabled beneficiary. It allows the single person to make provisions for the care and well-being of their loved one after their death, without jeopardizing their eligibility for government benefits. 4. Charitable Remainder Trust: This trust allows the single person to donate assets to a charitable cause while receiving income from those assets during their lifetime. It offers potential tax benefits and allows individuals to support causes close to their heart. 5. Irrevocable Life Insurance Trust: This trust is specifically designed to hold life insurance policies owned by the single person. It provides a mechanism for the tax-efficient transfer of these assets and can help preserve the value of the policy for future generations. When considering a Hennepin Minnesota Revocable Living Trust for Single Person, it is important to consult with an experienced estate planning attorney who can guide you through the process and help you determine which type of trust is most suitable for your unique circumstances. Creating a trust can provide peace of mind, protect assets, and ensure that your wishes are carried out according to your specific intentions.

Hennepin Minnesota Revocable Living Trust for Single Person

Description

How to fill out Hennepin Minnesota Revocable Living Trust For Single Person?

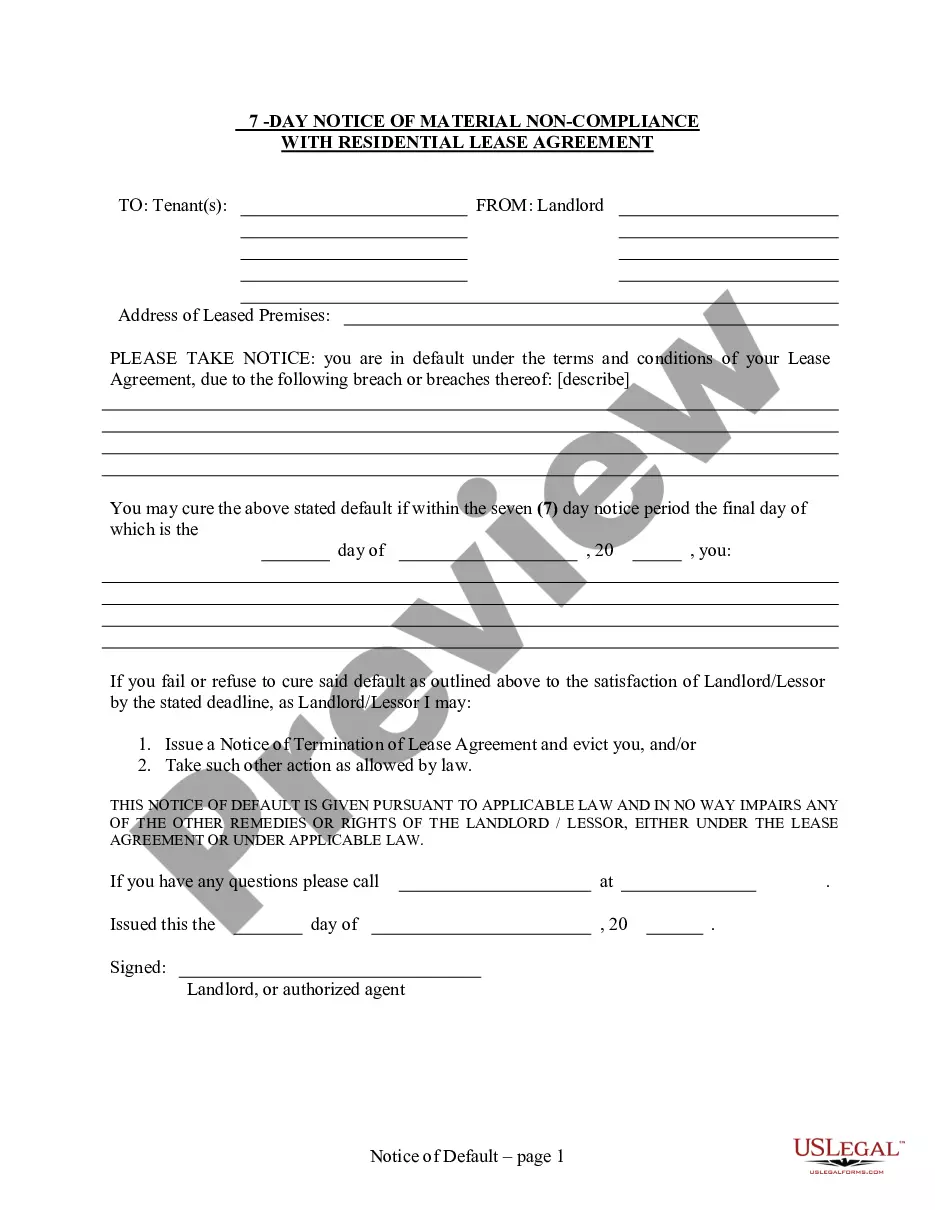

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek professional help to draft some of them from the ground up, including Hennepin Revocable Living Trust for Single Person, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in different types ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find information resources and guides on the website to make any tasks related to document execution simple.

Here's how you can find and download Hennepin Revocable Living Trust for Single Person.

- Go over the document's preview and description (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some documents.

- Check the related forms or start the search over to locate the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment method, and purchase Hennepin Revocable Living Trust for Single Person.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Hennepin Revocable Living Trust for Single Person, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional entirely. If you need to cope with an exceptionally complicated situation, we advise getting an attorney to review your form before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-specific documents with ease!