The Alameda California Loan Agreement — Long Form is a comprehensive legal document outlining the terms and conditions for a loan transaction specific to Alameda, California. This document is commonly used to protect the rights and responsibilities of both the lender and borrower when entering into a loan agreement. The Alameda California Loan Agreement — Long Form serves as a legally binding contract between the parties involved, ensuring that all terms are clearly defined and agreed upon. It covers vital aspects such as the loan amount, interest rates, repayment schedule, collateral requirements, and any additional provisions deemed necessary. Different types of Alameda California Loan Agreement — Long Form may include: 1. Personal Loan Agreement: This type of loan agreement is entered into between individuals, commonly friends or family members, for personal financing needs, such as education, medical expenses, or small-scale investments. 2. Business Loan Agreement: This loan agreement is specifically designed for businesses seeking financial support. It provides a framework for borrowing capital and clearly defines the terms for repayment, including interest rates, loan duration, and collateral requirements. 3. Mortgage Loan Agreement: This type of loan agreement focuses on real estate transactions, where the loan is secured by a mortgage on the property being purchased. It details the terms of repayment, interest rates, specific conditions related to the mortgage, and consequences for default or foreclosure. 4. Vehicle Loan Agreement: This loan agreement is applicable in situations where individuals or businesses are borrowing funds to purchase or lease a vehicle. It outlines the repayment terms, including interest rates, duration, and potential consequences for default. 5. Student Loan Agreement: This type of loan agreement is specific to educational purposes, typically involving a lending institution and a student seeking financing for higher education expenses. It includes details on repayment plans, interest rates, and any applicable deferment or forgiveness provisions. No matter the type, the Alameda California Loan Agreement — Long Form is a critical legal tool to safeguard both parties involved in a loan transaction. It ensures clarity, transparency, and legal protection, ultimately helping to maintain a smooth and mutually beneficial financial relationship.

Alameda California Loan Agreement - Long Form

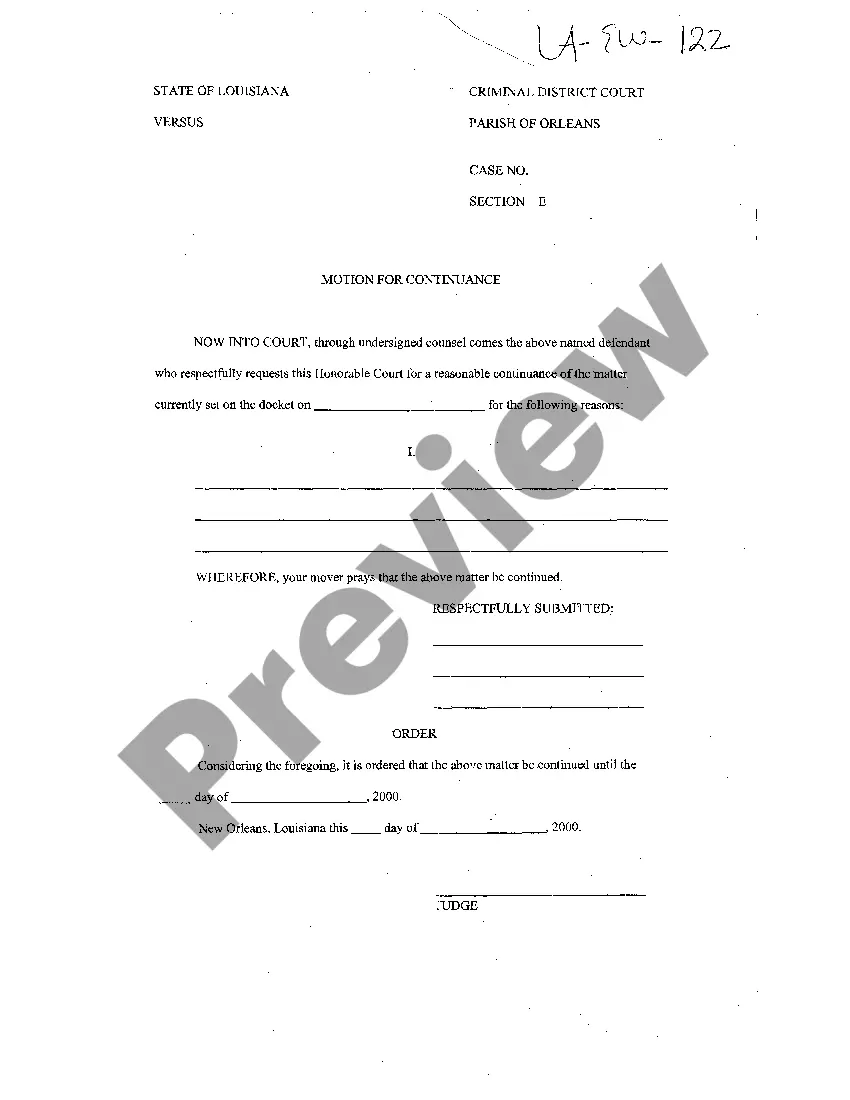

Description

How to fill out Alameda California Loan Agreement - Long Form?

Are you looking to quickly create a legally-binding Alameda Loan Agreement - Long Form or probably any other form to handle your own or business matters? You can go with two options: contact a legal advisor to draft a valid paper for you or draft it entirely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you receive neatly written legal paperwork without paying unreasonable fees for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-compliant form templates, including Alameda Loan Agreement - Long Form and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, double-check if the Alameda Loan Agreement - Long Form is tailored to your state's or county's laws.

- In case the form includes a desciption, make sure to check what it's intended for.

- Start the search over if the form isn’t what you were seeking by using the search bar in the header.

- Select the plan that is best suited for your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Alameda Loan Agreement - Long Form template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our services. In addition, the documents we provide are updated by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!